Freelance Financial Content Writing: Your Key to Success

In today’s digital age, the world of freelance writing has opened up a plethora of opportunities for individuals looking to work from the comfort of their own homes. One such lucrative avenue is freelance financial content writing, which can serve as your key to success in the ever-evolving landscape of the gig economy.

As a freelance financial content writer, you have the opportunity to delve into the world of finance and economics, creating engaging and informative content for a variety of clients. Whether you are writing blog posts, articles, whitepapers, or social media content, there is no shortage of demand for your skills in this niche.

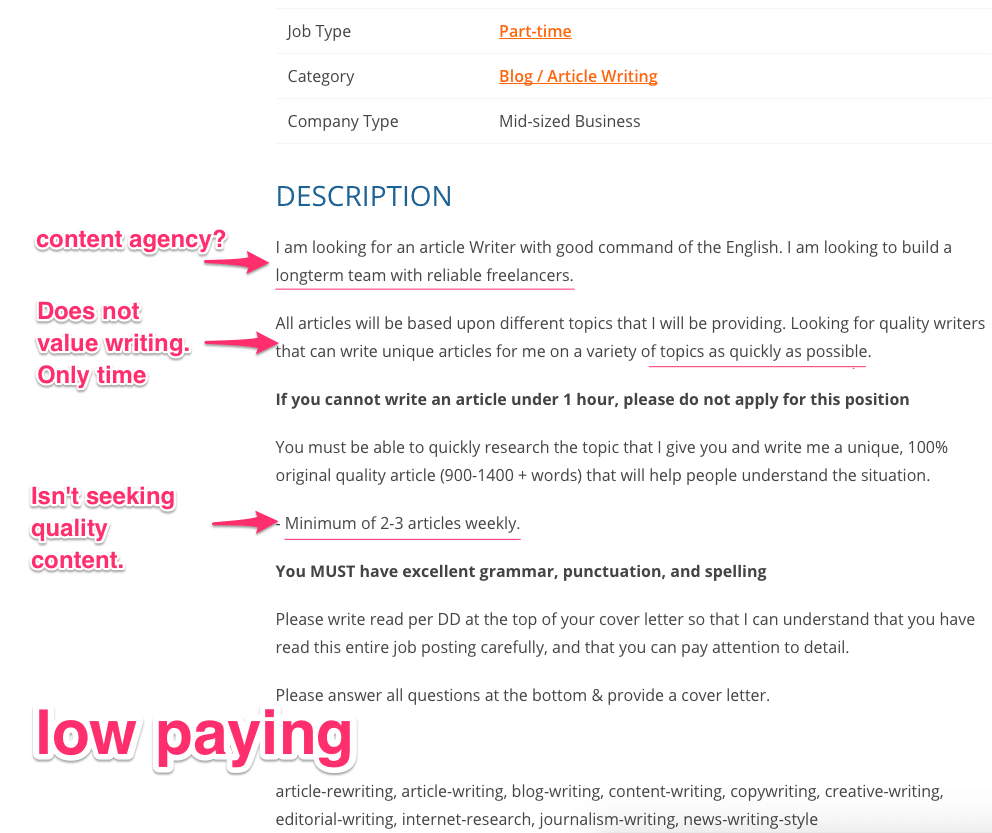

Image Source: elnacain.com

One of the great things about freelance financial content writing is the flexibility it offers. You have the freedom to choose the projects you work on, set your own schedule, and work from anywhere in the world. This flexibility allows you to tailor your workload to fit your lifestyle and personal commitments, making it an ideal career choice for those looking to achieve a better work-life balance.

Furthermore, freelance financial content writing can be a highly lucrative career path. With the demand for quality financial content on the rise, there are plenty of opportunities to earn a competitive income in this field. Whether you are writing for financial institutions, investment firms, or personal finance blogs, your expertise and writing skills are in high demand.

In addition to the financial rewards, freelance financial content writing also offers the opportunity to expand your knowledge and skills in the field of finance. As you research and write about a variety of financial topics, you will deepen your understanding of complex financial concepts and stay up-to-date on the latest trends in the industry. This continuous learning process can help you grow professionally and become an expert in your niche.

Image Source: clevergirlauthor.com

Another benefit of freelance financial content writing is the opportunity to build a diverse portfolio of work. By working with a range of clients and tackling different types of projects, you can showcase your versatility as a writer and expand your reach in the industry. A strong portfolio can help you attract new clients and secure higher-paying projects in the future.

Moreover, freelance financial content writing allows you to network with professionals in the finance industry and establish valuable connections that can lead to future opportunities. By collaborating with experts in the field, you can gain insights into the industry, build credibility as a financial writer, and potentially land long-term partnerships with reputable clients.

Overall, freelance financial content writing is a rewarding and fulfilling career choice that offers endless opportunities for growth and success. Whether you are a seasoned writer looking to break into the finance niche or a finance professional with a knack for writing, this field has something to offer for everyone. So, unlock the door to success in freelance financial content writing and start exploring the possibilities that await you in the world of financial writing jobs.

Open the Door to Endless Opportunities in Freelance Writing

Image Source: clevergirlauthor.com

Are you looking for a way to unleash your creativity and earn money at the same time? Have you ever considered delving into the world of freelance financial content writing? If not, now is the perfect time to open the door to endless opportunities in this exciting field.

Freelance financial content writing offers a myriad of possibilities for writers of all backgrounds and experience levels. Whether you are a seasoned professional looking to diversify your portfolio or a newcomer eager to break into the industry, there is a place for you in the world of freelance financial content writing.

One of the greatest advantages of freelance financial content writing is the flexibility it offers. As a freelance writer, you have the freedom to choose your own schedule, work from anywhere in the world, and take on projects that align with your interests and expertise. This flexibility allows you to pursue other passions, spend more time with your loved ones, and create a work-life balance that suits your needs.

Image Source: elnacain.com

Additionally, freelance financial content writing provides a wealth of opportunities for personal and professional growth. By taking on a variety of projects, you can expand your knowledge of different financial topics, hone your writing skills, and build a diverse portfolio that showcases your talents to potential clients. As you gain experience and establish a reputation in the industry, you may even have the opportunity to command higher rates and attract more lucrative projects.

Furthermore, freelance financial content writing allows you to work with a diverse range of clients from around the world. This global reach opens the door to new perspectives, ideas, and collaborations that can enrich your writing and broaden your horizons. By building relationships with clients and fellow writers, you can create a supportive network that empowers you to succeed in the competitive world of freelance financial content writing.

In addition to the intrinsic rewards of freelance financial content writing, there are also practical benefits to consider. As a freelance writer, you have the opportunity to earn a stable income, build a sustainable career, and take control of your financial future. With the growing demand for high-quality financial content in today’s digital age, there is no shortage of opportunities for freelance writers to thrive and prosper.

Image Source: surferseo.art

So, if you are ready to unlock the door to endless opportunities in freelance writing, take the first step today. Explore different platforms, connect with potential clients, and start pitching your ideas to showcase your skills and expertise. With dedication, persistence, and a passion for writing, you can carve out a successful career in freelance financial content writing and embark on a rewarding journey filled with creativity, growth, and prosperity.

Freelance Financial Content Writing Jobs