Pennywise Study Tools for Finance Students

As a finance student, it’s important to make the most of your resources and find budget-friendly study tools that can help you succeed in your academic journey. With the rising costs of tuition and textbooks, it’s essential to find affordable alternatives that still provide value and assistance in your studies. This list of pennywise study tools is tailored specifically for finance students looking to save money while excelling in their coursework.

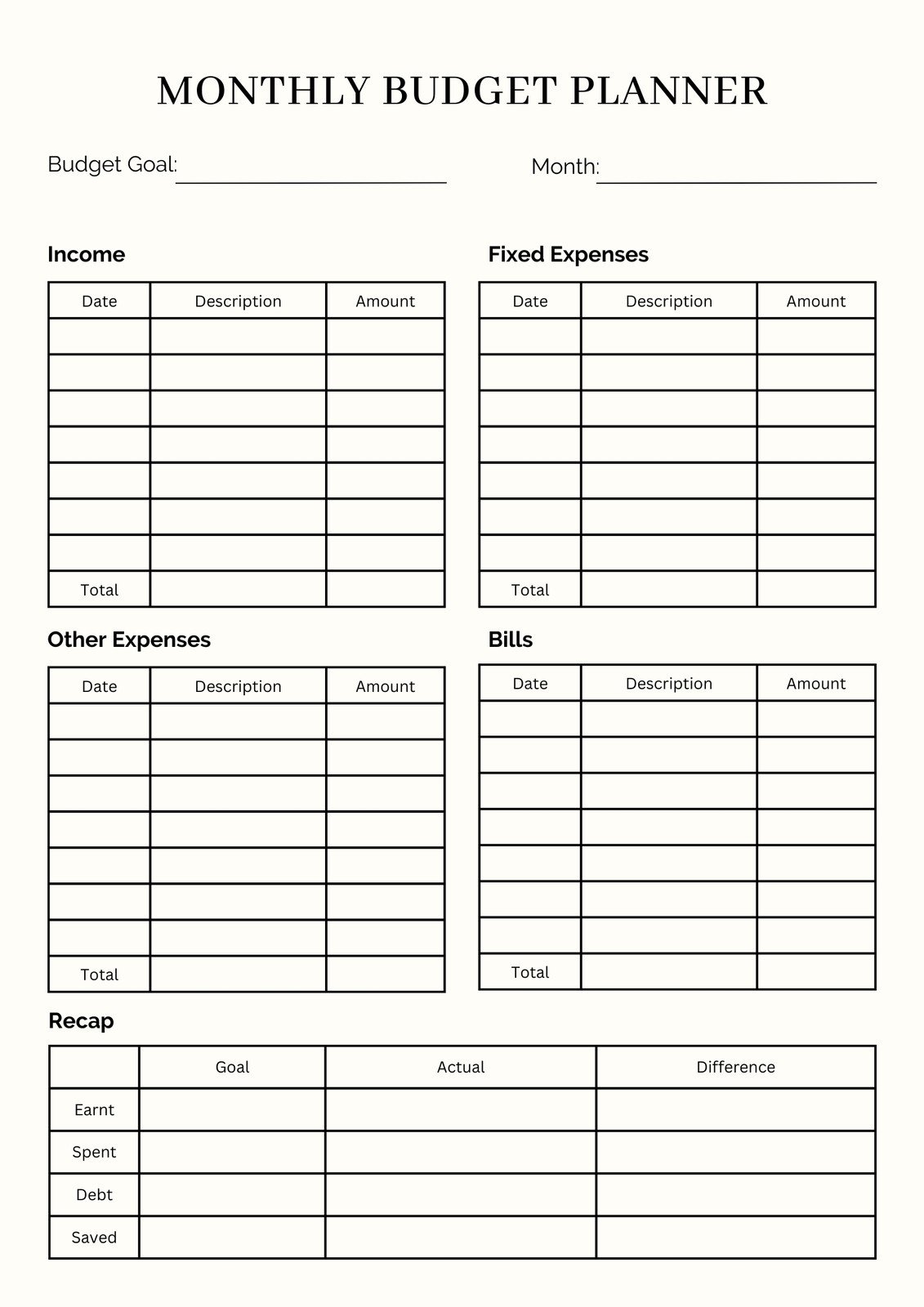

1. Budgeting Apps

Budgeting is a crucial skill for finance students, and there are plenty of budgeting apps available for free or at a low cost that can help you track your expenses, set financial goals, and manage your money effectively. Apps like Mint, PocketGuard, and YNAB (You Need a Budget) are popular choices that offer useful features for students on a budget.

Image Source: thesavvymama.com

2. Online Financial Calculators

Financial calculations are a big part of finance coursework, and having access to online financial calculators can save you time and make complex calculations easier. Websites like Calculators.org and Calculator.net offer a wide range of financial calculators for free, including ones for loan payments, investment returns, and budget planning.

3. E-Books and Open Educational Resources

Textbooks can be a major expense for students, but there are many free e-books and open educational resources available online that cover a wide range of finance topics. Websites like OpenStax, Project Gutenberg, and BookBoon offer free e-books on finance, economics, and business that can supplement your coursework without breaking the bank.

4. Financial News Apps

Staying informed about the latest developments in the financial world is essential for finance students, and there are many free financial news apps that can help you stay up to date on market trends, economic indicators, and industry news. Apps like Bloomberg, CNBC, and Reuters offer real-time updates and analysis that can enhance your understanding of finance concepts.

Image Source: collegeinfogeek.com

5. Virtual Stock Market Simulators

Practicing your investment skills is important for finance students, and virtual stock market simulators provide a risk-free way to learn about investing and trading. Websites like Investopedia’s Stock Simulator, Wall Street Survivor, and MarketWatch Virtual Stock Exchange allow you to create a virtual portfolio, track your investments, and test different strategies without risking real money.

6. Online Tutoring Services

If you need extra help with your finance coursework, online tutoring services can be a cost-effective way to get personalized assistance from experienced tutors. Websites like Chegg Tutors, Tutor.com, and Khan Academy offer affordable tutoring options for finance students, allowing you to get the help you need without spending a fortune.

7. Study Groups and Forums

Joining study groups and online forums can be a valuable resource for finance students looking to collaborate with peers, ask questions, and share study materials. Platforms like Reddit, Quora, and StudyBlue offer community-driven spaces where you can connect with other students, exchange ideas, and get support in your academic journey.

:max_bytes(150000):strip_icc()/GettyImages-1291288780-c6231347b6424143b9427a4a98c635a0.jpg)

Image Source: investopedia.com

8. Personal Finance Blogs and Podcasts

Learning about personal finance is an important aspect of finance education, and there are many free blogs and podcasts that cover topics like budgeting, investing, and saving money. Personal finance experts like Dave Ramsey, Suze Orman, and Ramit Sethi offer valuable insights and advice that can help you build financial literacy and make smart money decisions.

9. Online Courses and Webinars

Taking online courses and webinars can supplement your finance education and provide valuable insights into specific topics or skills. Platforms like Coursera, edX, and Udemy offer a wide range of free and low-cost courses in finance, accounting, and economics that can enhance your learning experience and give you a competitive edge in the job market.

10. Library Resources

Don’t forget about the resources available at your school or local library, which can provide access to books, journals, databases, and research materials that can support your finance studies. Many libraries also offer workshops, study spaces, and academic support services that can help you succeed in your coursework without spending a lot of money.

Image Source: cnet.com

In conclusion, being a finance student doesn’t have to mean breaking the bank on expensive study tools and resources. By taking advantage of the pennywise study tools listed above, you can save money, enhance your learning experience, and excel in your finance studies without sacrificing quality or value. So, make use of these budget-friendly tools and watch your academic success soar!

10 Budget-Friendly Must-Haves for Studying Finance

When it comes to studying finance, having the right tools at your disposal can make all the difference in your academic success. However, as a student, you may not always have the budget to splurge on expensive study aids. That’s why we’ve compiled a list of 10 budget-friendly must-haves for studying finance that every student should consider investing in.

1. Financial Calculator

A financial calculator is an essential tool for any finance student. It can help you quickly and accurately calculate complex financial equations, saving you time and reducing the risk of errors in your calculations. While some financial calculators can be quite expensive, there are budget-friendly options available that still offer all the key functions you need for your studies.

:max_bytes(150000):strip_icc()/student_desk_laptop_notebook_AdobeStock_187280034-ecc982cbb4084a2b8a8e251b28c59fef.jpeg)

Image Source: investopedia.com

2. Excel Spreadsheet Software

Excel is a powerful tool for organizing and analyzing financial data. As a finance student, you’ll likely be working with large datasets and complex calculations, making Excel an invaluable resource. Many universities offer discounted or free access to Excel for students, so be sure to take advantage of this cost-effective option.

3. Finance Textbooks

While textbooks can be a significant expense for students, there are ways to minimize the cost. Consider purchasing used textbooks, renting them, or borrowing them from the library. You can also look for digital versions of textbooks, which are often more affordable than physical copies.

4. Online Financial Resources

The internet is a treasure trove of free financial resources that can supplement your studies. Websites like Investopedia, Khan Academy, and Coursera offer a wealth of information on various financial topics, including tutorials, articles, and courses. Take advantage of these resources to enhance your understanding of key concepts.

Image Source: canva.com

5. Notebooks and Stationery

While it may seem simple, having a good quality notebook and stationery can make a big difference in your studying experience. Invest in notebooks that are durable and easy to organize, as well as pens and highlighters that make note-taking a breeze. Keeping your notes neat and organized will help you study more effectively.

6. Study Guides

Study guides can be a helpful supplement to your course materials, providing concise summaries of key concepts and equations. Look for budget-friendly study guides that cover the topics you’re studying to help reinforce your understanding of the material.

7. Budgeting Apps

Managing your finances is an important skill for finance students to develop, and budgeting apps can help you stay on top of your expenses. Look for free or low-cost budgeting apps that allow you to track your income and spending, set financial goals, and create budgets that align with your financial priorities.

8. Online Courses

In addition to traditional coursework, online courses can be a valuable resource for finance students looking to expand their knowledge. Many platforms offer low-cost or free courses on a wide range of financial topics, allowing you to supplement your studies and gain additional skills.

9. Study Groups

Joining a study group can be a cost-effective way to enhance your learning experience. Working with peers allows you to benefit from different perspectives, share study materials, and quiz each other on key concepts. Plus, study groups can provide emotional support and motivation during challenging times.

10. Financial Planning Software

As a finance student, you’ll likely be learning about financial planning and analysis. Investing in budget-friendly financial planning software can help you apply the concepts you’re studying in real-world scenarios. Look for software that offers features like budgeting tools, investment tracking, and retirement planning to enhance your financial knowledge and skills.

In conclusion, studying finance doesn’t have to break the bank. By investing in these budget-friendly must-haves, you can set yourself up for academic success without overspending. So, stock up on these essential tools and get ready to ace your finance courses!

Best Budget-Friendly Study Tools for Finance Students