Bolster Your Savings: Rainy Day Fund Essentials

When it comes to preparing for the unexpected, having a rainy day fund is essential. Whether it’s a sudden car repair, a medical emergency, or unexpected unemployment, having savings set aside can provide peace of mind and financial security. But how much should you save in your rainy day fund? And what are the essentials for building and maintaining it? Let’s dive into the key components of a successful rainy day fund.

First and foremost, determining how much to save in your rainy day fund depends on your individual circumstances. Financial experts typically recommend saving three to six months’ worth of living expenses. This cushion can help cover essential costs like rent or mortgage, utilities, groceries, and transportation in the event of a financial setback. However, if you have dependents or unstable income, you may want to aim for a larger emergency fund.

Image Source: kosterfinance.com

To build your rainy day fund, start by setting a savings goal based on your monthly expenses. Track your spending for a few months to get an accurate picture of your financial obligations. Once you have a target amount in mind, set up automatic transfers from your checking account to your savings account each month. This will help you stay disciplined and consistent in growing your emergency fund.

In addition to saving a specific amount each month, it’s important to keep your rainy day fund separate from your regular savings or checking accounts. Consider opening a high-yield savings account or a money market account to earn a higher interest rate on your emergency fund. This will allow your savings to grow over time and provide a buffer against inflation.

Another essential component of a rainy day fund is accessibility. While it’s important to keep your emergency savings separate from your day-to-day spending, you also want to be able to access the funds quickly and easily when needed. Look for accounts that offer online or mobile banking options, so you can transfer money to your checking account in case of an emergency.

Image Source: amazonaws.com

In addition to saving a specific amount each month and keeping your emergency fund separate and accessible, it’s also important to regularly reassess and adjust your savings goals. As your financial situation changes, such as a pay raise or a new expense, you may need to increase or decrease the amount you’re saving each month. By staying flexible and proactive, you can ensure that your rainy day fund remains sufficient to cover unexpected expenses.

Lastly, don’t forget to replenish your rainy day fund after you’ve had to use it. Treat your emergency savings like a revolving door, where you withdraw money when needed and replenish it as soon as possible. This will help you maintain a healthy financial cushion and be prepared for whatever life throws your way.

In conclusion, building and maintaining a rainy day fund is an essential part of financial planning. By saving a specific amount each month, keeping your emergency fund separate and accessible, and regularly reassessing your savings goals, you can ensure that you have a financial safety net in place for life’s unexpected challenges. So start bolstering your savings today and rest easy knowing that you’re prepared for whatever storms may come your way.

Weathering Life’s Storms: Saving Tips and Tricks

Image Source: coopteachers.com

As we navigate through the ups and downs of life, one thing is for certain – unexpected expenses can arise at any moment. From a sudden car repair to a medical emergency, having a rainy day fund in place can provide peace of mind and financial security. But how much should you save for those rainy days? Here are some saving tips and tricks to help you build your rainy day fund.

1. Set a Savings Goal: The first step in building a rainy day fund is to set a savings goal. Consider your monthly expenses, as well as any potential emergency costs that could arise. Aim to save at least three to six months’ worth of expenses to cover any unexpected financial setbacks.

2. Automate Your Savings: One of the easiest ways to save money is to automate your savings. Set up automatic transfers from your checking account to your savings account on a regular basis. This way, you can save money without even thinking about it.

Image Source: feea.org

3. Cut Back on Expenses: Take a close look at your monthly expenses and identify areas where you can cut back. Do you really need that daily latte or monthly subscription service? By trimming unnecessary expenses, you can free up more money to put towards your rainy day fund.

4. Create a Budget: Creating a budget is essential for saving money. Track your income and expenses to see where your money is going each month. By sticking to a budget, you can identify areas where you can save more money and reach your savings goals faster.

5. Start an Emergency Fund: In addition to your rainy day fund, consider starting an emergency fund for unexpected expenses that may be larger in scale. Aim to save at least $1,000 in your emergency fund to cover any major financial emergencies that may arise.

Image Source: dcfpi.org

6. Shop Smart: When it comes to saving money, shopping smart is key. Look for sales, discounts, and coupons when making purchases. Consider buying in bulk or shopping at thrift stores to save money on everyday items.

7. Increase Your Income: If you’re looking to boost your savings, consider finding ways to increase your income. Whether it’s taking on a side hustle, freelancing, or asking for a raise at work, finding additional sources of income can help you reach your savings goals faster.

8. Avoid Impulse Spending: Impulse spending can quickly derail your savings goals. Before making a purchase, ask yourself if it’s something you really need or if it’s just a want. By avoiding impulse spending, you can save more money for your rainy day fund.

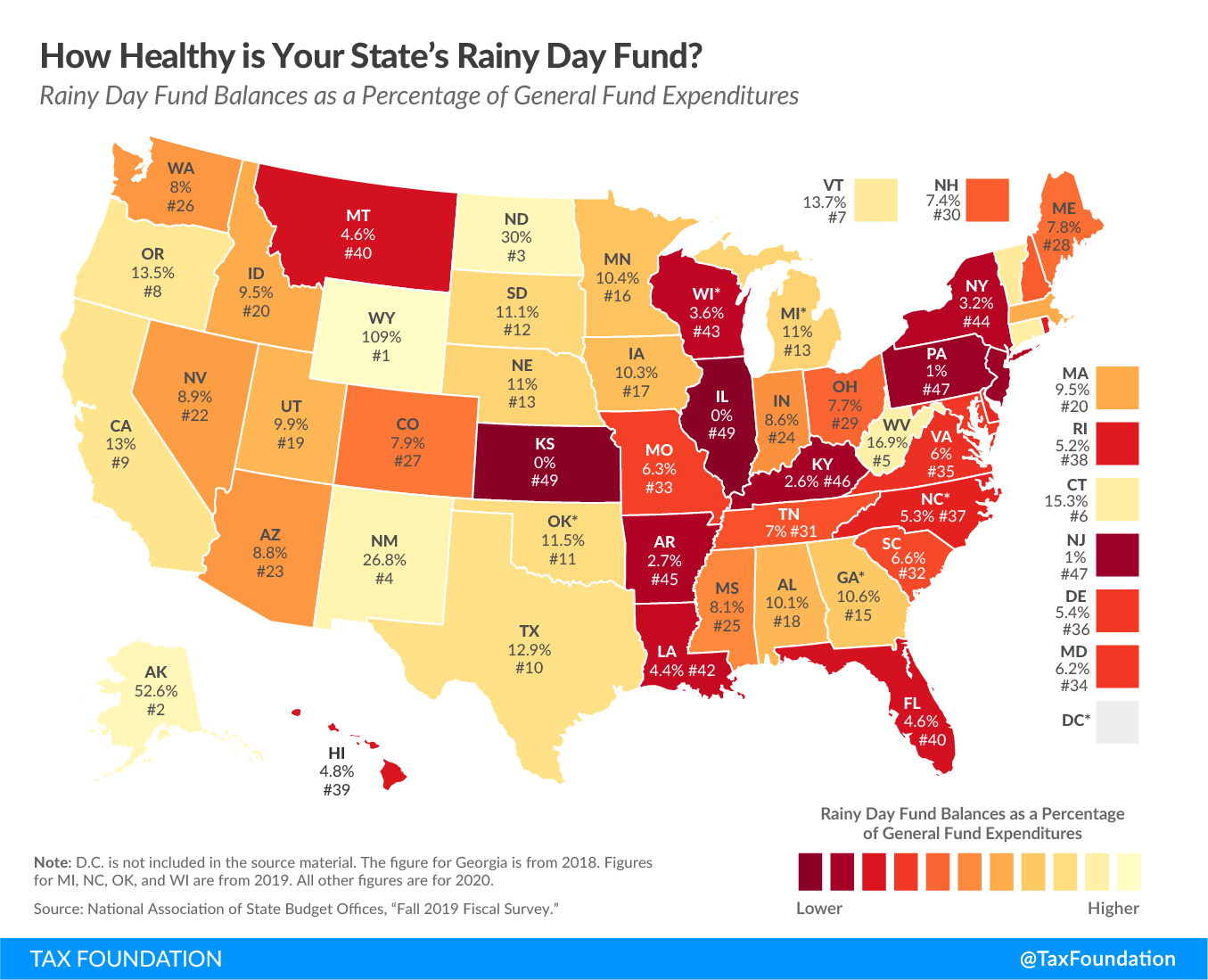

Image Source: taxfoundation.org

9. Stay Motivated: Saving money can be challenging, but staying motivated is key to reaching your savings goals. Set milestones for yourself and celebrate your progress along the way. Keep your eyes on the prize and remember the importance of having a financial safety net.

10. Review and Adjust: As your financial situation changes, it’s important to review and adjust your savings goals accordingly. Revisit your budget regularly and make adjustments as needed to ensure you’re on track to meet your savings goals.

By following these saving tips and tricks, you can build a solid rainy day fund to weather life’s storms. Remember, it’s never too late to start saving for a rainy day. Start small and gradually increase your savings over time. Your future self will thank you for being financially prepared for whatever may come your way.

Image Source: ethanonatangent.com

What Is a Rainy Day Fund & How Much Should You Save?