Financial Freedom: Unlocking the Secrets of Successful Freelancers

As a freelancer, achieving financial freedom can sometimes feel like an elusive goal. With fluctuating income, unpredictable expenses, and the constant pressure to find new clients, it’s easy to feel overwhelmed and unsure of how to take control of your finances. However, successful freelancers have unlocked the secrets to achieving financial freedom, and with a few key strategies, you too can master your money and create a more secure financial future.

One of the first steps to achieving financial freedom as a freelancer is to establish a solid foundation of financial stability. This means creating a budget that accurately reflects your income, expenses, and savings goals. By tracking your income and expenses, you can better understand where your money is going and make informed decisions about how to allocate it. Setting aside a portion of your income for savings and emergencies is also crucial for building a financial safety net and protecting yourself against unexpected expenses.

Image Source: skydo.com

Successful freelancers also understand the importance of diversifying their income streams. Relying solely on one client or source of income can leave you vulnerable to financial instability if that client or income stream dries up. By diversifying your income through multiple clients, projects, or passive income streams, you can create a more stable financial foundation and protect yourself against unforeseen financial challenges.

In addition to diversifying income, successful freelancers also prioritize building long-term wealth through strategic investments. Whether it’s investing in stocks, real estate, or retirement accounts, investing your money wisely can help you build wealth over time and secure your financial future. By educating yourself about different investment options and working with a financial advisor, you can create a personalized investment strategy that aligns with your financial goals and risk tolerance.

Another key strategy for achieving financial freedom as a freelancer is to prioritize debt repayment. High-interest debt can quickly spiral out of control and drain your financial resources, making it difficult to achieve your long-term financial goals. By prioritizing debt repayment and creating a plan to pay off your debts, you can free up more of your income for savings, investments, and other financial goals.

Image Source: presspage.com

Successful freelancers also understand the importance of setting clear financial goals and creating a roadmap for achieving them. Whether your goal is to buy a home, travel the world, or retire early, having a clear vision of what you want to achieve and a plan for how to get there can help you stay motivated and on track. By breaking your financial goals down into smaller, manageable steps and tracking your progress along the way, you can create a sense of momentum and confidence in your ability to achieve financial freedom.

Achieving financial freedom as a freelancer is not always easy, but with the right strategies and mindset, it is possible to take control of your finances and create a more secure financial future. By establishing a solid foundation of financial stability, diversifying your income, prioritizing investments and debt repayment, setting clear financial goals, and creating a roadmap for achieving them, you can unlock the secrets of successful freelancers and master your money for a brighter financial future.

Budget Like a Boss: Strategies for Thriving as a Freelancer

As a freelancer, one of the most important skills you can master is budgeting. It’s not enough to simply earn money – you need to know how to manage it effectively in order to thrive in your freelance career. In this article, we’ll explore some key strategies for budgeting like a boss and setting yourself up for financial success.

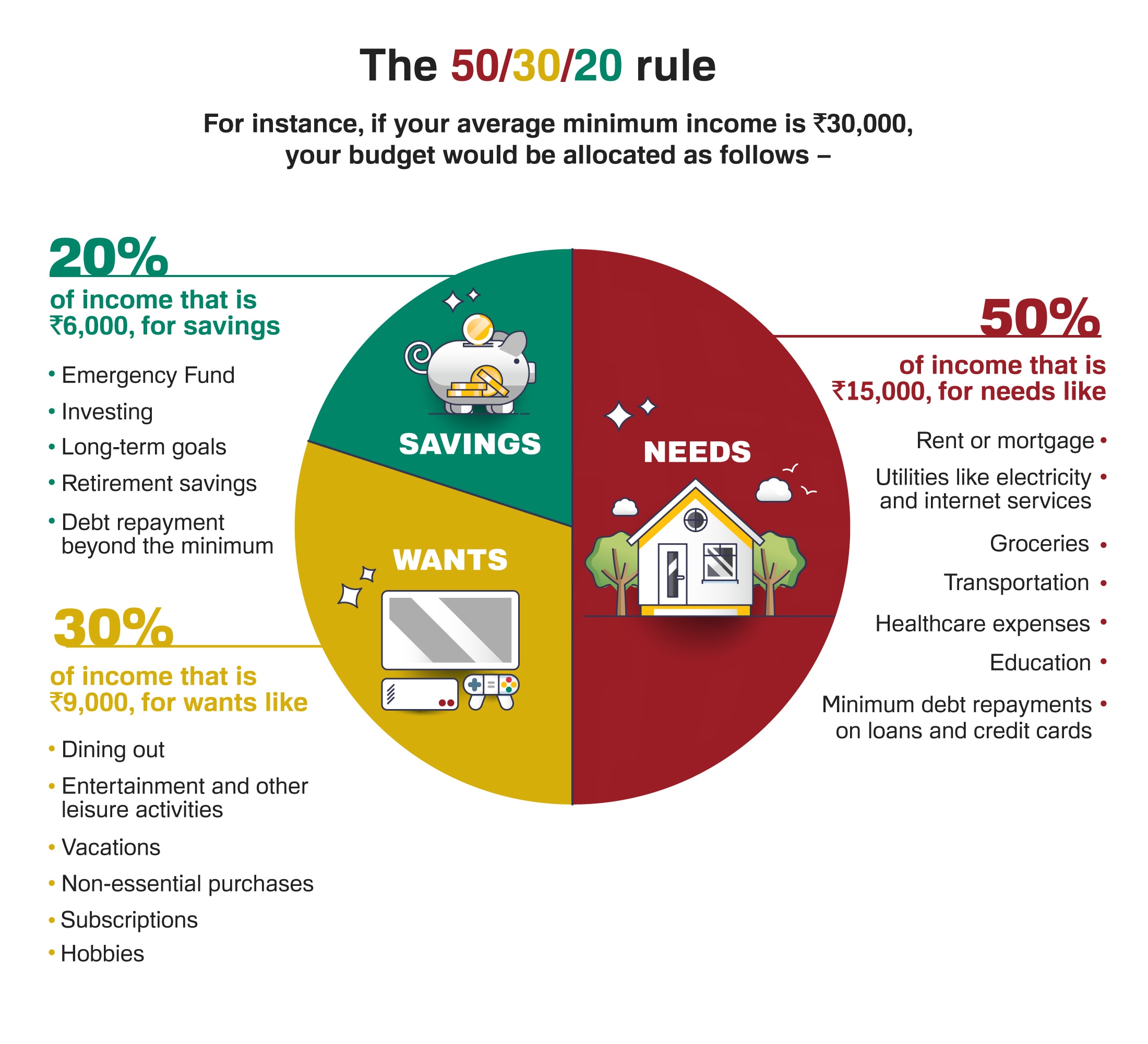

Image Source: idfcfirstbank.com

The first step in budgeting like a boss is to track your income and expenses. This may seem like a basic step, but you’d be surprised at how many freelancers neglect to keep a close eye on their finances. By tracking every dollar that comes in and goes out, you’ll have a clear picture of your financial situation and be better equipped to make informed decisions about your spending and saving habits.

Once you have a handle on your income and expenses, it’s time to create a budget that works for you. Start by listing all of your fixed expenses, such as rent, utilities, and insurance. Then, factor in your variable expenses, like groceries, entertainment, and transportation. Finally, don’t forget to set aside money for savings and unexpected expenses – having an emergency fund is crucial for freelancers who may experience fluctuations in their income.

Another important aspect of budgeting like a boss is to prioritize your spending. It can be tempting to splurge on the latest gadgets or designer clothes, but if you want to thrive as a freelancer, you need to be strategic about where your money goes. Consider what is most important to you and allocate your funds accordingly. For example, investing in professional development or marketing your services may have a greater long-term impact on your career than buying the latest tech toy.

Image Source: skydo.com

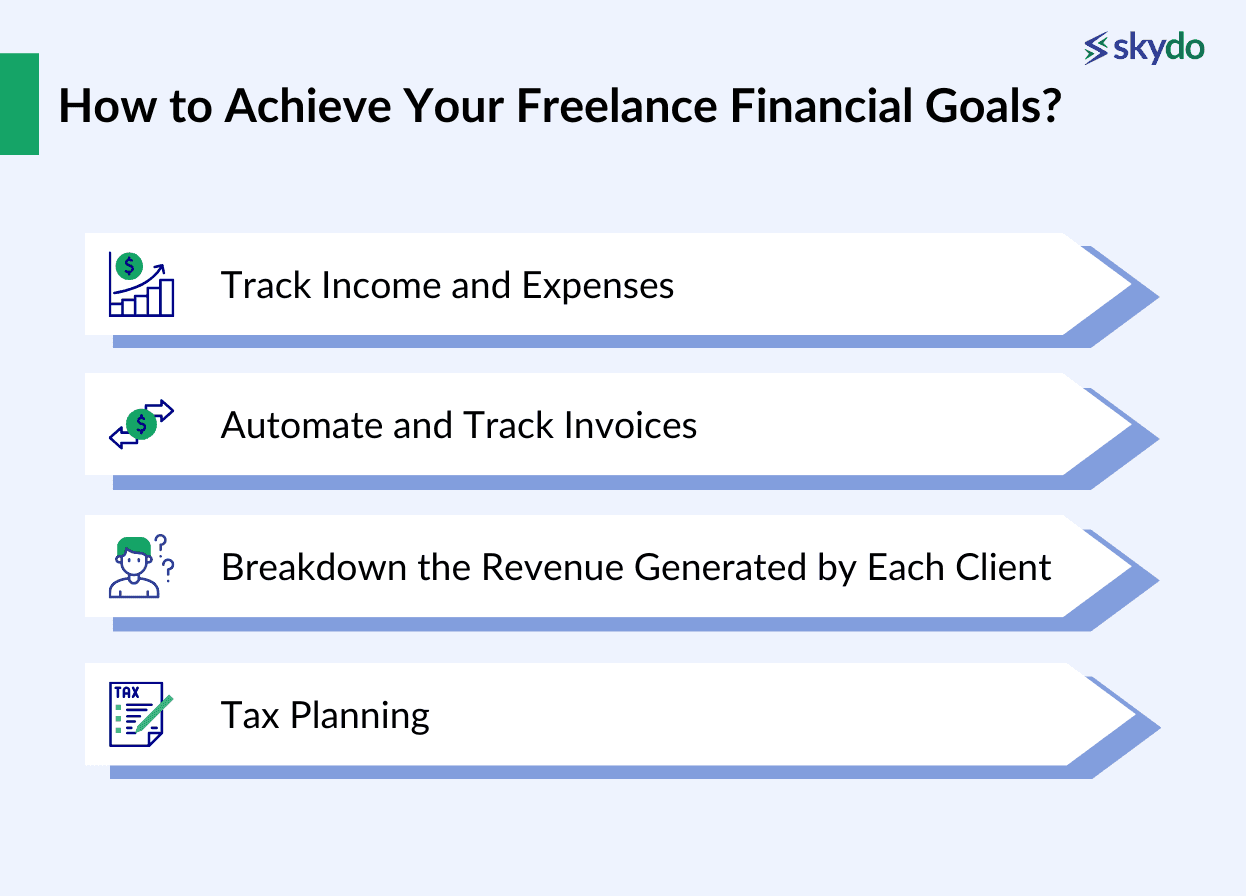

In addition to tracking your income and expenses and creating a budget, it’s also important to regularly review and adjust your financial plan. As a freelancer, your income may vary from month to month, so it’s essential to stay flexible and make changes as needed. Set aside time each month to evaluate your budget, identify areas for improvement, and make any necessary adjustments.

One way to stay on top of your finances and budget like a boss is to use tools and resources that can help you manage your money more effectively. There are plenty of budgeting apps and software available that can simplify the process of tracking your income and expenses, creating a budget, and monitoring your financial progress. Additionally, consider working with a financial advisor who specializes in working with freelancers – they can provide personalized guidance and support to help you achieve your financial goals.

In conclusion, mastering your money as a freelancer is essential for long-term success. By tracking your income and expenses, creating a budget, prioritizing your spending, and regularly reviewing and adjusting your financial plan, you can set yourself up for financial stability and success in your freelance career. With the right strategies and mindset, you can budget like a boss and thrive as a freelancer.

Image Source: skillshare.com

How to Plan Your Finances When Freelancing