Navigating Your Future: The Importance of Career Planning

As the saying goes, if you fail to plan, you plan to fail. This holds true when it comes to mapping out your career path. Career planning is a crucial aspect of achieving success in your professional life, as it allows you to set goals, make informed decisions, and navigate the twists and turns of the ever-changing job market.

One of the key reasons why career planning is so important is that it gives you a sense of direction. Without a clear plan in place, you may find yourself drifting aimlessly from one job to the next, without a clear idea of where you want to go or how to get there. By taking the time to map out your career path, you can identify your strengths, weaknesses, interests, and values, and use this information to set achievable goals for your future.

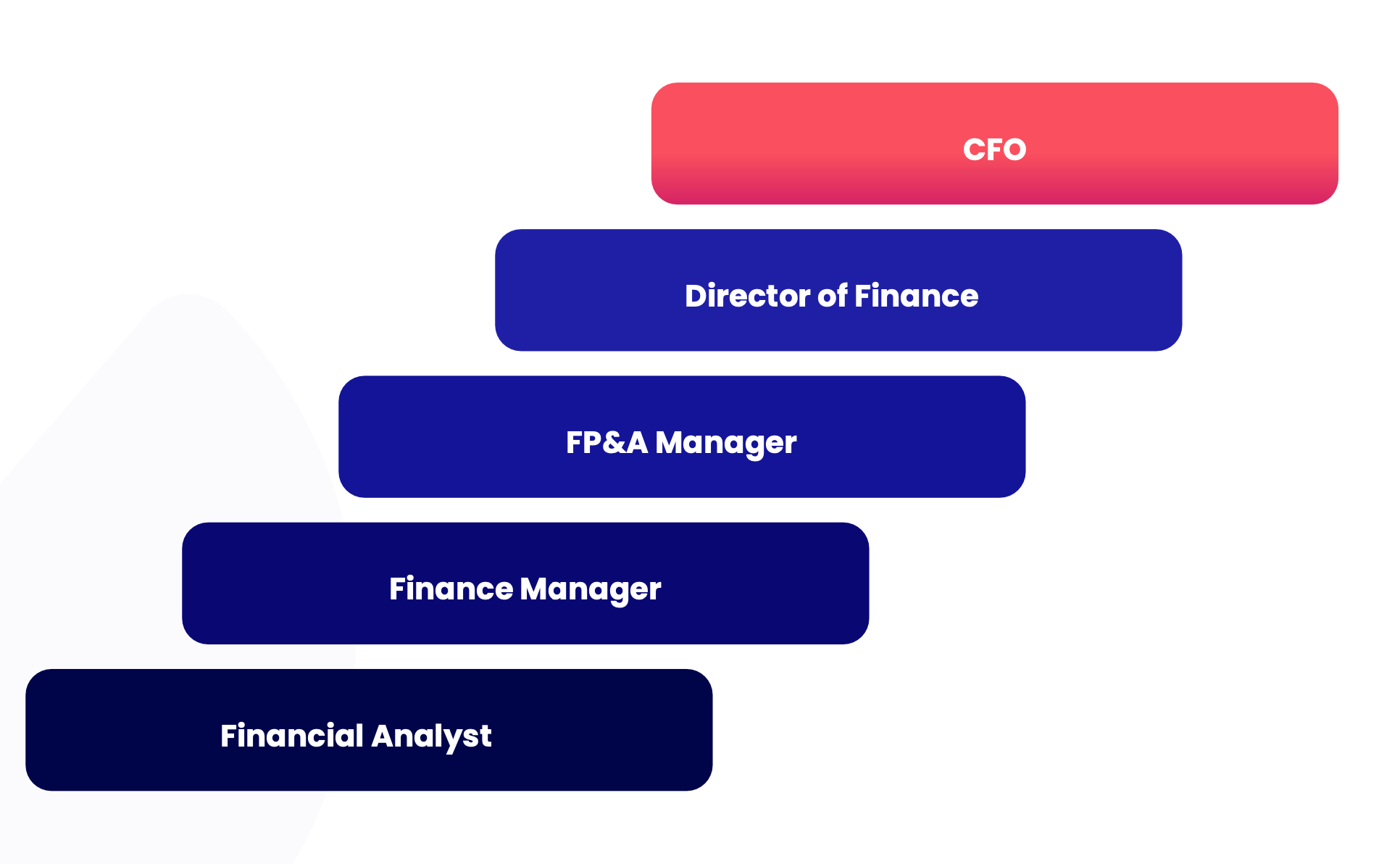

Image Source: financealliance.io

Career planning also helps you to stay focused and motivated. When you have a clear vision of where you want to go in your career, you are more likely to stay committed to your goals and take the necessary steps to achieve them. This sense of purpose can help you overcome obstacles and setbacks, and keep you on track even when the going gets tough.

In addition to providing direction and motivation, career planning can also help you to make informed decisions about your professional development. By taking the time to assess your skills, interests, and values, you can identify potential career paths that align with your goals and aspirations. This can help you to choose the right educational programs, training courses, and job opportunities that will help you to reach your full potential and achieve success in your chosen field.

Furthermore, career planning can help you to adapt to changes in the job market and make the most of new opportunities as they arise. In today’s fast-paced and competitive world, it is essential to be proactive and flexible in your career planning, so that you can stay ahead of the curve and take advantage of emerging trends and technologies. By regularly reviewing and updating your career plan, you can ensure that you are always well-prepared for whatever the future may hold.

![image.title Steps To Create an Employee Development Plan [Free Template] image.title Steps To Create an Employee Development Plan [Free Template]](https://www.aihr.com/wp-content/uploads/9-hr-steps-for-employee-development-plan-social-1.png)

Image Source: aihr.com

It is also worth noting that career planning is not a one-time event, but an ongoing process that requires commitment and dedication. As you progress in your career, your goals, interests, and values may change, and it is important to regularly reassess and adjust your plans accordingly. By staying proactive and flexible in your approach to career planning, you can ensure that you are always moving in the right direction and making the most of your potential.

In conclusion, career planning is a vital tool for success in today’s fast-paced and competitive job market. By taking the time to map out your career path, set goals, make informed decisions, and stay focused and motivated, you can navigate the twists and turns of your professional life with confidence and clarity. So, take the time to invest in your future, and start mapping out your career path today!

Money Moves: How Financial Growth Shapes Your Career Path

As you navigate through your career journey, it’s important to recognize the significant impact that financial growth can have on shaping your path. Money matters may not always be the most exciting topic to discuss, but understanding the relationship between financial stability and career planning is essential for setting yourself up for success in the long run.

:max_bytes(150000):strip_icc()/personalfinance_definition_final_0915-Final-977bed881e134785b4e75338d86dd463.jpg)

Image Source: investopedia.com

When it comes to mapping out your career path, financial considerations play a crucial role in determining the direction you take. Whether you’re just starting out in your career or looking to make a career change, your financial situation can influence the decisions you make and the opportunities you pursue.

One of the key ways in which financial growth shapes your career path is through the opportunities it affords you. Having a solid financial foundation can give you the freedom to explore different career paths, take risks, and pursue opportunities that may not have been possible otherwise. Whether it’s investing in further education, starting your own business, or making a career pivot, financial stability can provide you with the resources you need to take your career to the next level.

Additionally, financial growth can also impact your overall job satisfaction and well-being. Studies have shown that individuals who feel financially secure are more likely to be satisfied with their careers and experience less stress in the workplace. By taking steps to improve your financial situation, you can create a more stable and fulfilling career path for yourself.

Image Source: culturemonkey.io

Furthermore, financial growth can open up new possibilities for career advancement and professional development. Whether it’s negotiating a higher salary, seeking out opportunities for promotion, or investing in additional training and skills development, having a strong financial foundation can empower you to take control of your career and achieve your goals.

It’s important to remember that financial growth is not just about accumulating wealth; it’s about creating stability and security for yourself and your future. By taking a proactive approach to managing your finances and making smart financial decisions, you can position yourself for long-term success and ensure that your career path aligns with your personal and professional goals.

In conclusion, the relationship between financial growth and career planning is a crucial one that should not be overlooked. By understanding how your financial situation can shape your career path, you can make informed decisions that will set you up for success in the long run. So, as you map out your career journey, remember to consider the role that money plays in shaping your path and take steps to ensure that your financial growth aligns with your professional aspirations.

Image Source: scene7.com

Career Planning and Financial Growth Go Hand-in-Hand

Image Source: 4cornerresources.com

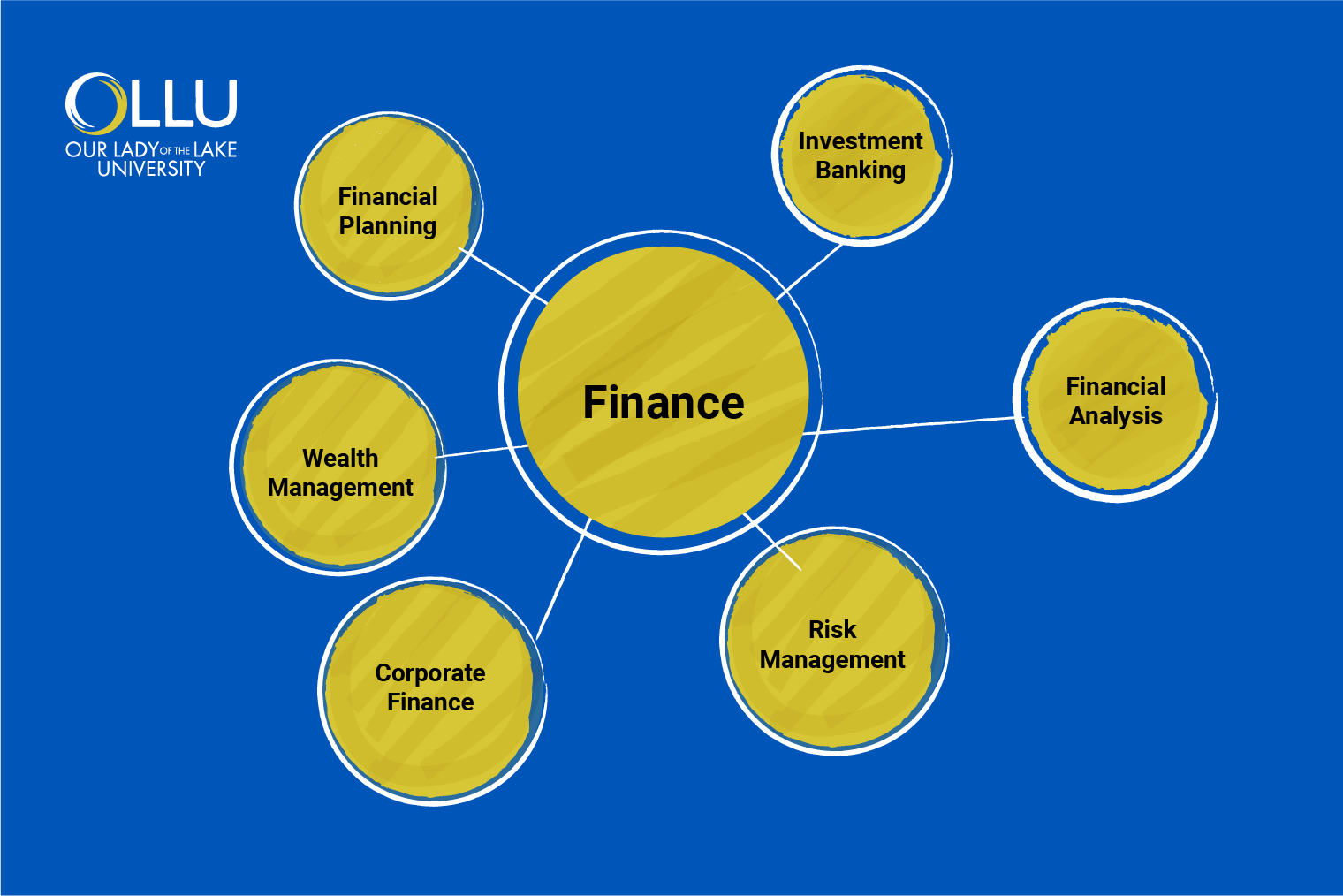

Image Source: ollusa.edu

![image.title Steps To Create an Employee Development Plan [Free Template] image.title Steps To Create an Employee Development Plan [Free Template]](https://www.aihr.com/wp-content/uploads/employee-development-plan-one-pager.png)

Image Source: aihr.com