Discover the Power of AI for Your Analytical Skills

In today’s fast-paced and data-driven world, the ability to analyze information effectively is a crucial skill. Whether you’re a business analyst, a data scientist, or just someone who wants to make informed decisions, having strong analytical skills can set you apart from the competition. And one of the most powerful tools at your disposal for enhancing your analytical abilities is artificial intelligence (AI).

AI has revolutionized the way we approach data analysis. By leveraging machine learning algorithms and advanced statistical techniques, AI tools can help you uncover valuable insights from complex datasets that would be nearly impossible to discover on your own. These tools can process massive amounts of data in a fraction of the time it would take a human analyst, allowing you to make faster and more informed decisions.

Image Source: medium.com

One of the key benefits of using AI for analytical purposes is its ability to identify patterns and trends that might otherwise go unnoticed. By analyzing data at a granular level, AI algorithms can uncover correlations and relationships that can help you predict future outcomes with a high degree of accuracy. This predictive capability can be invaluable for businesses looking to anticipate market trends, optimize operations, or identify potential risks.

Another advantage of AI tools is their ability to automate repetitive tasks, freeing up your time to focus on more strategic aspects of analysis. By offloading mundane data processing tasks to AI algorithms, you can streamline your workflow and explore more complex analytical techniques that require human expertise. This can lead to a more efficient and effective analytical process, ultimately enhancing your performance and productivity.

Furthermore, AI tools can help you overcome common challenges in data analysis, such as dealing with missing or incomplete data, handling outliers, or managing large datasets. By applying advanced techniques like imputation, outlier detection, and dimensionality reduction, AI algorithms can clean and preprocess data with a high degree of accuracy, ensuring that you’re working with reliable and actionable insights.

Image Source: ctfassets.net

When it comes to unlocking your analytical potential, AI tools can be a game-changer. By harnessing the power of machine learning and advanced analytics, you can elevate your performance to new heights and gain a competitive edge in your field. Whether you’re looking to improve your decision-making, enhance your forecasting abilities, or streamline your data processing workflows, AI tools can provide the support and capabilities you need to succeed.

In conclusion, the power of AI for analytical skills cannot be overstated. By incorporating AI tools into your analytical toolkit, you can unlock new possibilities, uncover deeper insights, and make more informed decisions. So why wait? Start exploring the world of AI-driven analytics today and take your performance to the next level.

Unlocking Your Analytical Potential: How AI Tools Can Elevate Your Performance

In today’s fast-paced world, staying ahead of the curve and excelling in your field requires more than just hard work and dedication. It also requires the use of cutting-edge tools and technology to enhance your performance and unlock your full analytical potential. This is where the power of Artificial Intelligence (AI) comes into play.

Image Source: licdn.com

AI tools are revolutionizing the way we work and analyze data, providing us with insights and solutions that were previously unimaginable. By leveraging AI tools, you can streamline your workflows, make faster and more informed decisions, and ultimately achieve greater success in your endeavors.

One of the key ways AI tools can elevate your performance is through their ability to process and analyze large amounts of data at lightning speed. As humans, our capacity to manually sift through vast datasets is limited, making it easy to miss important patterns and trends. AI, on the other hand, can quickly and accurately analyze data sets of any size, allowing you to uncover valuable insights and make data-driven decisions with confidence.

Imagine you are a marketing manager tasked with analyzing customer behavior and preferences to develop targeted advertising campaigns. With AI tools, you can easily analyze customer data from multiple sources, identify patterns in purchasing behavior, and predict future trends. This enables you to create highly personalized marketing campaigns that resonate with your target audience, ultimately driving higher engagement and conversion rates.

Image Source: inkoop.io

AI tools can also help you optimize your performance by automating repetitive tasks and freeing up your time for more strategic activities. For example, AI-powered chatbots can handle customer inquiries and provide real-time support, allowing you to focus on more complex and high-value tasks. By delegating routine tasks to AI tools, you can increase your productivity and efficiency, enabling you to achieve more in less time.

Furthermore, AI tools can enhance your decision-making process by providing you with valuable insights and recommendations based on data analysis. Whether you are a financial analyst evaluating investment opportunities or a healthcare professional diagnosing medical conditions, AI tools can help you make more accurate and informed decisions, leading to better outcomes for yourself and your organization.

In addition to streamlining workflows and improving decision-making, AI tools can also help you stay ahead of the competition by identifying emerging trends and opportunities in your industry. By analyzing market data and consumer behavior in real-time, AI tools can alert you to potential threats and opportunities, allowing you to proactively adjust your strategies and stay one step ahead of your competitors.

Image Source: licdn.com

Overall, the potential of AI tools to elevate your performance and unlock your analytical potential is truly remarkable. By leveraging the power of AI, you can gain valuable insights, automate routine tasks, optimize your workflows, and make better decisions, ultimately leading to greater success and achievement in your endeavors.

So why wait? Embrace AI tools today and take your performance to the next level!

Image Source: wondershare.com

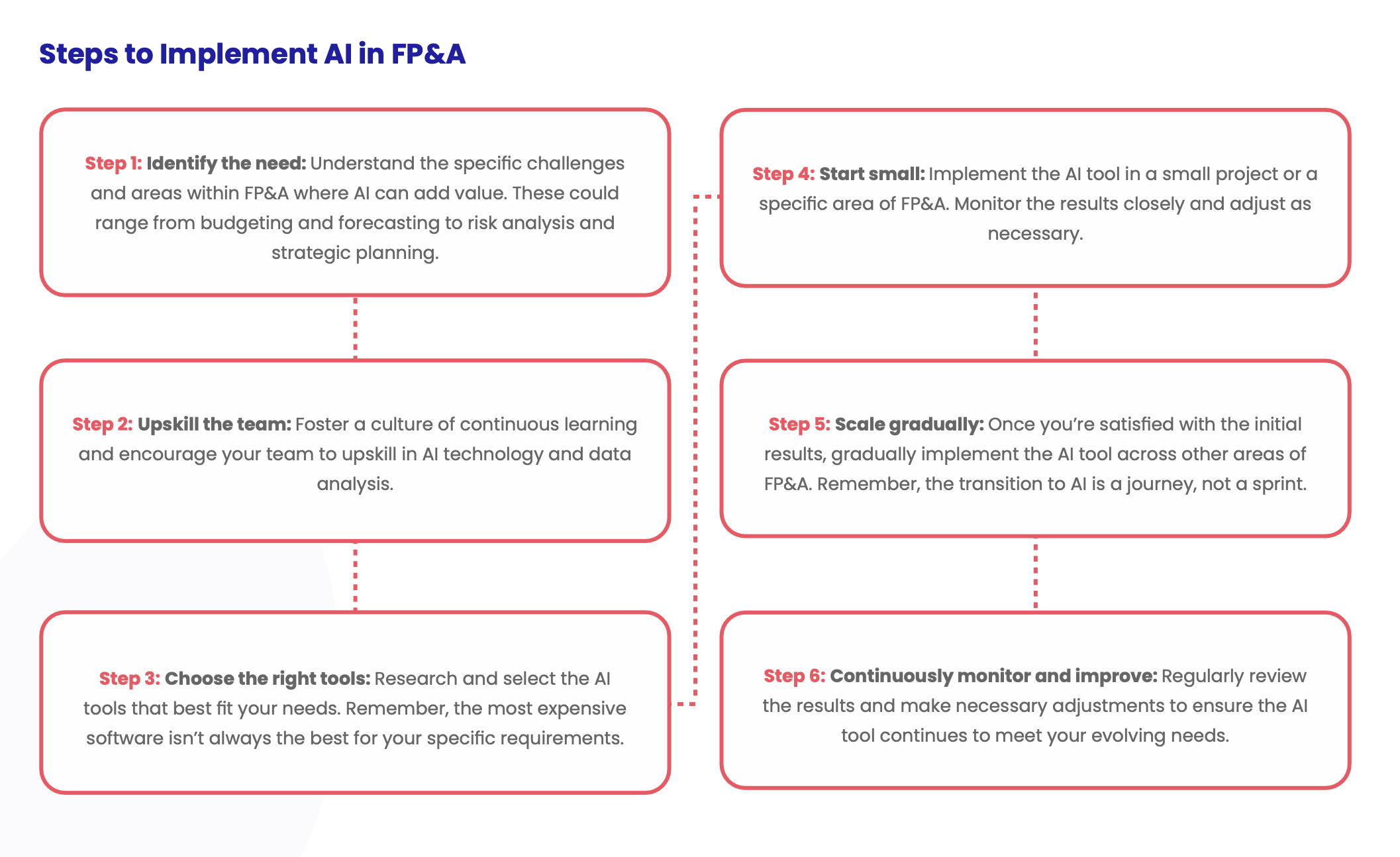

Can AI Tools Help You Become a Better Analyst?

Image Source: financealliance.io

Image Source: medium.com