Maximize Your Income with These FinTech Skills

In today’s fast-paced world, technology is constantly evolving and shaping the way we live and work. One industry that has seen tremendous growth in recent years is FinTech, short for financial technology. FinTech is revolutionizing the way we manage our finances, make payments, and invest our money. If you are looking to boost your salary and unlock your earning potential, mastering FinTech skills is a great way to stay ahead of the curve.

1. Blockchain Technology

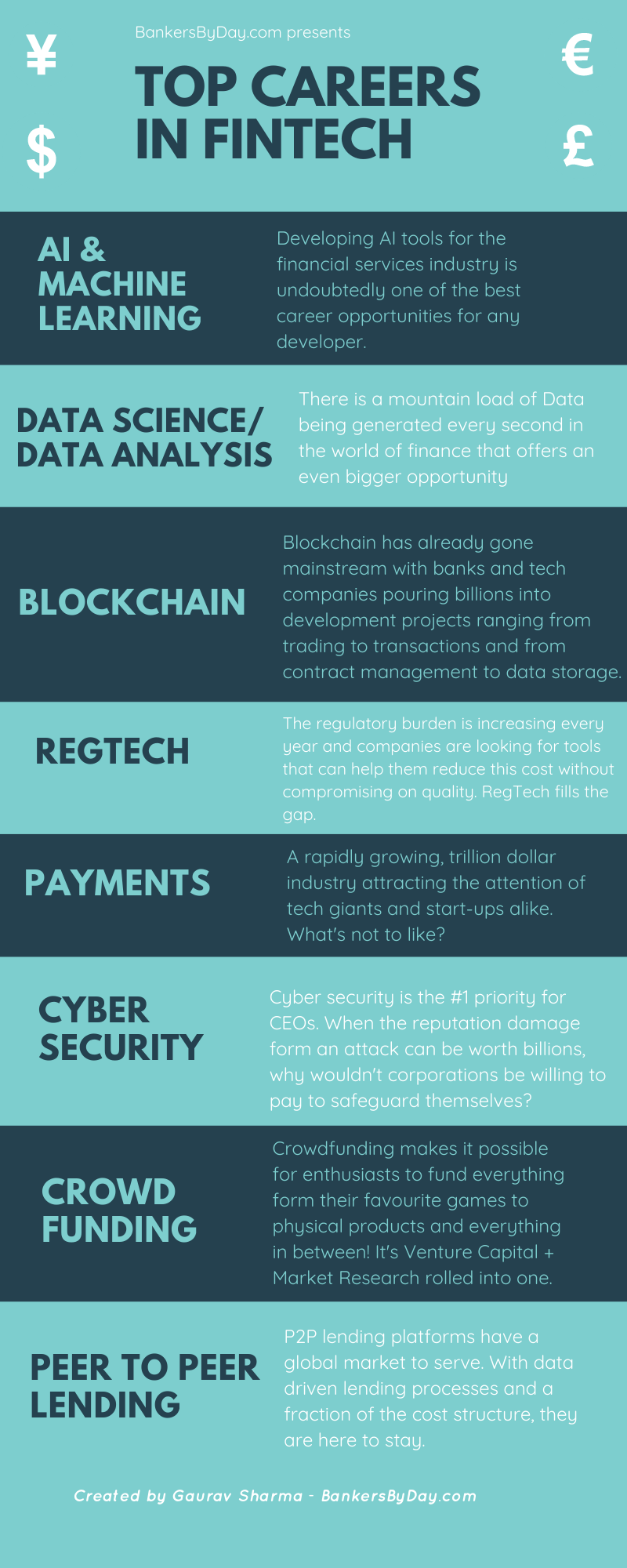

Image Source: bankersbyday.com

One of the hottest FinTech skills right now is blockchain technology. Blockchain is a decentralized, secure, and transparent digital ledger that records transactions across a network of computers. It has the potential to revolutionize industries such as banking, insurance, and supply chain management. By understanding how blockchain works and how it can be applied to various industries, you can position yourself as a valuable asset in the job market.

2. Data Analytics

Data is the new oil, and those who can analyze and interpret data effectively are in high demand in the FinTech industry. Data analytics skills are essential for making informed business decisions, detecting fraud, and identifying trends in the market. By mastering data analytics tools and techniques, you can help companies optimize their operations and drive profitability, leading to salary increases and career advancement.

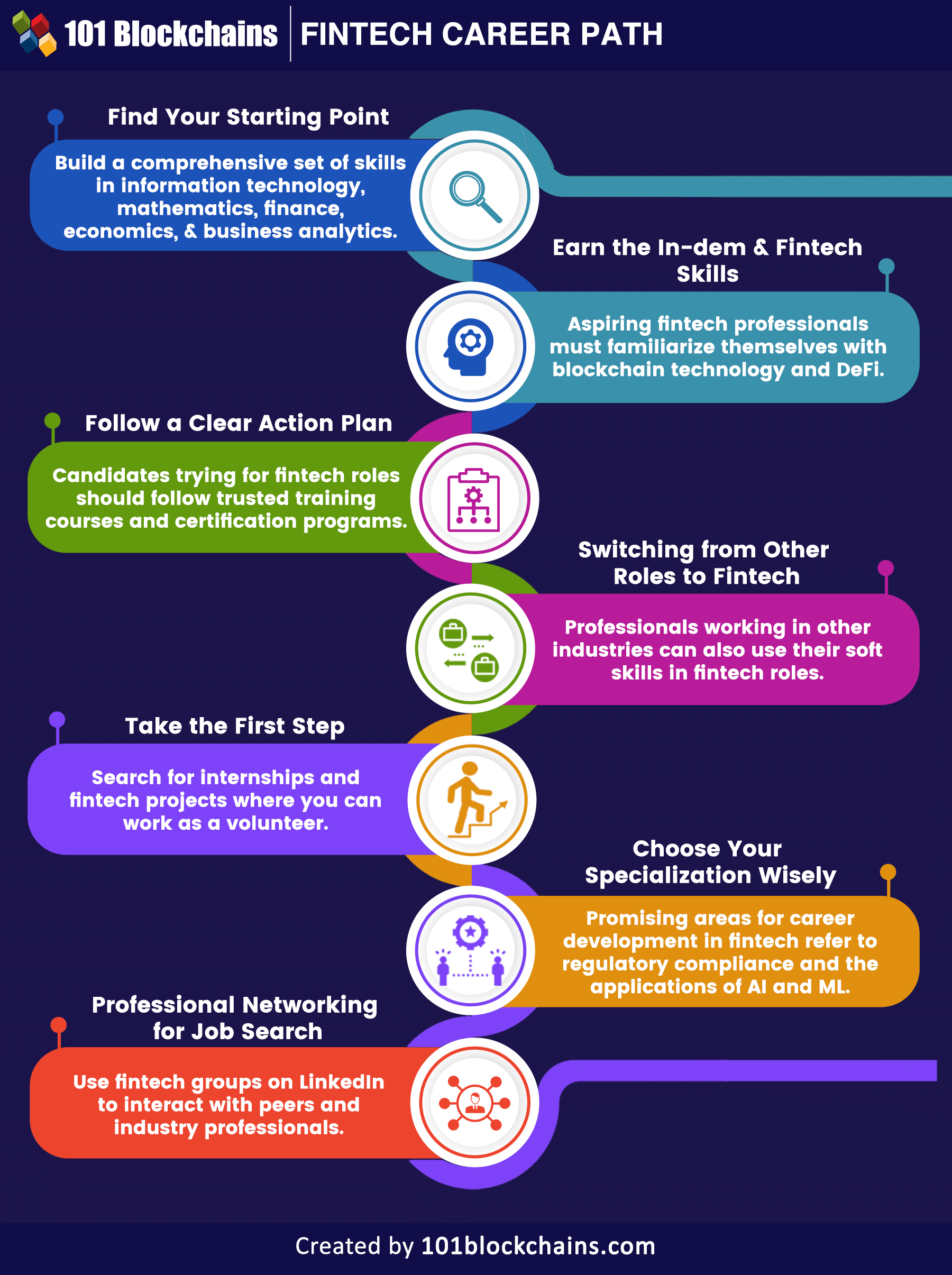

Image Source: 101blockchains.com

3. Cybersecurity

With the rise of online transactions and digital payments, cybersecurity has become a top priority for companies in the FinTech sector. Cyber attacks can have devastating consequences, including financial losses and damage to a company’s reputation. By developing cybersecurity skills, such as threat detection, risk assessment, and incident response, you can help protect companies from cyber threats and ensure the safety of their financial data.

4. Artificial Intelligence

Image Source: 101blockchains.com

Artificial intelligence (AI) is transforming the FinTech industry by automating processes, personalizing customer experiences, and detecting patterns in data. AI-powered chatbots, robo-advisors, and fraud detection systems are just a few examples of how AI is being used in FinTech. By learning how to develop and implement AI solutions, you can help companies improve efficiency, reduce costs, and drive innovation, ultimately leading to higher salaries and career growth.

5. Mobile Payments

The rise of mobile payments has made it easier than ever for people to make purchases and transfer money using their smartphones. Mobile payment apps, such as Apple Pay, Google Pay, and Venmo, are revolutionizing the way we pay for goods and services. By understanding how mobile payments work and staying up-to-date on the latest trends in mobile technology, you can position yourself as a FinTech expert and increase your earning potential.

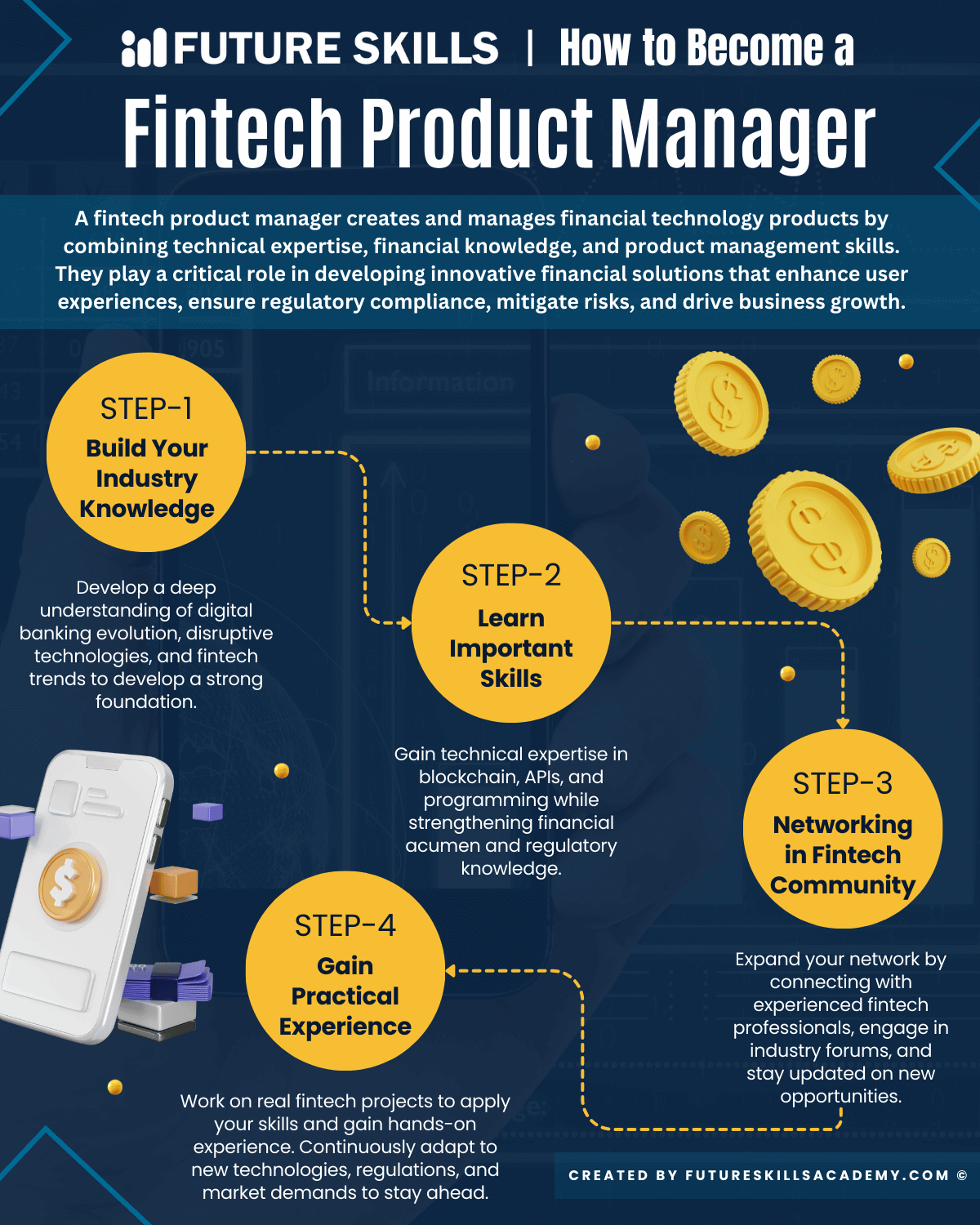

Image Source: futureskillsacademy.com

In conclusion, mastering FinTech skills is essential for unlocking your earning potential and boosting your salary in today’s competitive job market. By staying current with the latest trends in blockchain technology, data analytics, cybersecurity, artificial intelligence, and mobile payments, you can position yourself as a valuable asset to companies in the FinTech industry. So why wait? Start learning these in-demand skills today and watch your income soar to new heights.

Skyrocket Your Salary with These In-Demand Skills

In today’s rapidly evolving job market, having the right skills can make all the difference when it comes to boosting your salary. With the rise of financial technology (FinTech) companies and the increasing demand for professionals with expertise in this field, there are several key skills that can help you unlock your earning potential and take your career to the next level.

One of the most in-demand skills in the FinTech industry is data analysis. As more and more companies rely on data-driven insights to make informed business decisions, professionals who are proficient in analyzing and interpreting data are highly sought after. By developing your data analysis skills, you can help companies optimize their operations, improve their customer experiences, and drive growth, ultimately leading to higher earning potential.

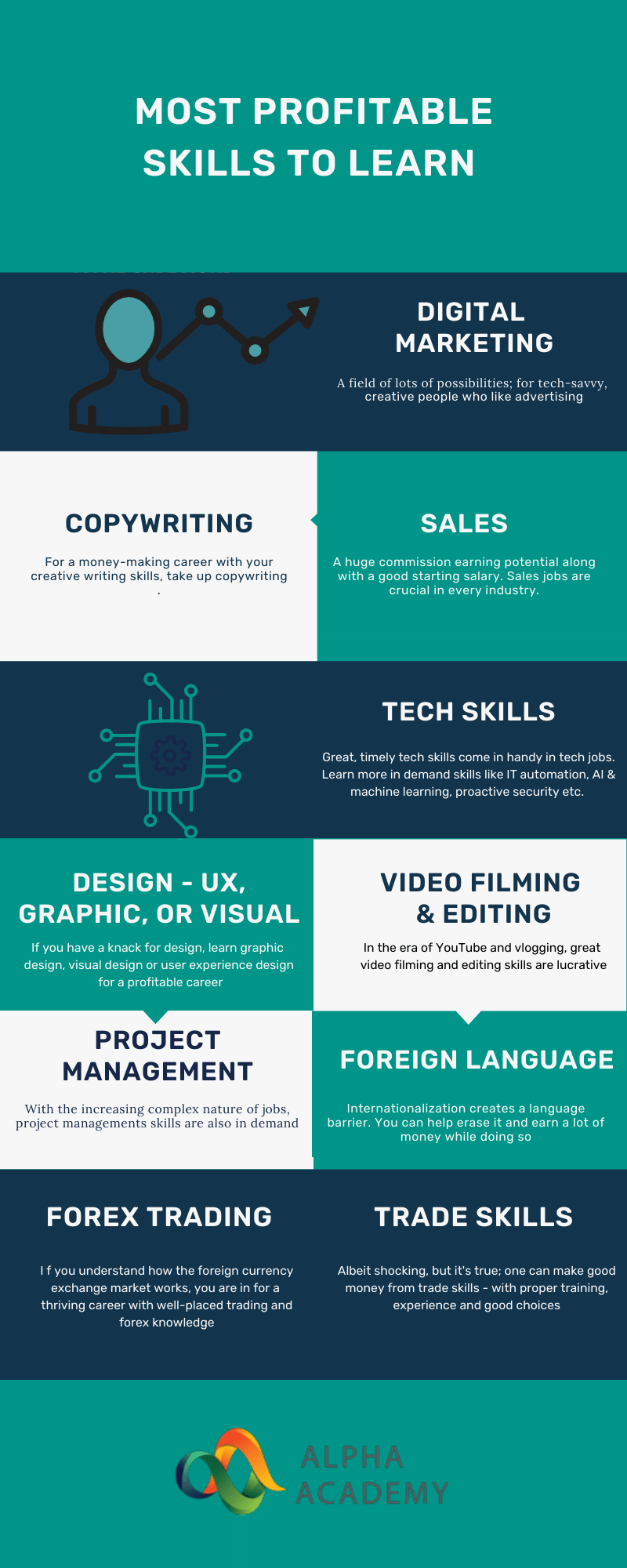

Image Source: alphaacademy.org

Another crucial skill that can help you skyrocket your salary in the FinTech industry is programming. With the increasing use of automation and artificial intelligence in financial services, professionals who are proficient in programming languages like Python, Java, and R are in high demand. By mastering these languages, you can develop software solutions, build algorithms, and automate processes, all of which can lead to increased efficiency and productivity, and ultimately, higher salaries.

In addition to data analysis and programming, cybersecurity is another in-demand skill that can help you boost your salary in the FinTech industry. With the growing threat of cyber attacks and data breaches, companies are looking for professionals who can help them protect their sensitive information and secure their systems. By becoming an expert in cybersecurity, you can help companies mitigate risks, comply with regulations, and safeguard their assets, all of which are essential for earning top dollar in the industry.

Furthermore, financial modeling is a skill that can significantly impact your earning potential in the FinTech industry. By mastering the art of financial modeling, you can help companies make accurate financial projections, assess investment opportunities, and evaluate risks, all of which are crucial for making sound business decisions. With strong financial modeling skills, you can demonstrate your value to employers and command a higher salary.

Image Source: 101blockchains.com

Lastly, communication skills are essential for success in the FinTech industry and can also help you increase your earning potential. As a FinTech professional, you will need to communicate complex technical concepts to non-technical stakeholders, collaborate with cross-functional teams, and engage with clients and customers. By honing your communication skills, you can build rapport, foster relationships, and demonstrate your expertise, all of which can lead to career advancement and higher salaries.

In conclusion, by developing these in-demand skills in data analysis, programming, cybersecurity, financial modeling, and communication, you can unlock your earning potential and skyrocket your salary in the FinTech industry. Whether you are just starting your career or looking to advance to the next level, investing in these skills can help you stand out in a competitive job market and secure lucrative opportunities. So, take the time to build your expertise in these areas and watch as your salary soars to new heights.

Image Source: siecindia.com

FinTech Skills That Will Boost Your Salary

Image Source: dashdevs.com