Investment banking bonuses are one of the most coveted perks in the finance industry. For many aspiring bankers, the allure of a six-figure bonus is enough to endure the long hours and high-pressure environment that comes with the job. But what exactly goes into determining these bonuses? How can you crack the code and maximize your earnings in the world of investment banking?

Cracking the Code: Investment Banking Bonuses Unwrapped

Investment banking bonuses are a complex and often mysterious aspect of the finance industry. While the exact formula for calculating bonuses varies from firm to firm, there are some common factors that play a role in determining how much you will take home at the end of the year.

Image Source: wallstreetprep.com

One of the key factors that determines your bonus is the performance of the firm as a whole. If the firm had a successful year and met or exceeded its revenue targets, chances are that bonuses will be higher across the board. On the other hand, if the firm underperformed, bonuses may be lower than expected.

Another important factor in determining your bonus is your individual performance. If you were able to bring in new clients, close big deals, or exceed your targets, you will likely be rewarded with a higher bonus. On the flip side, if you underperformed or made costly mistakes, your bonus may be lower than expected.

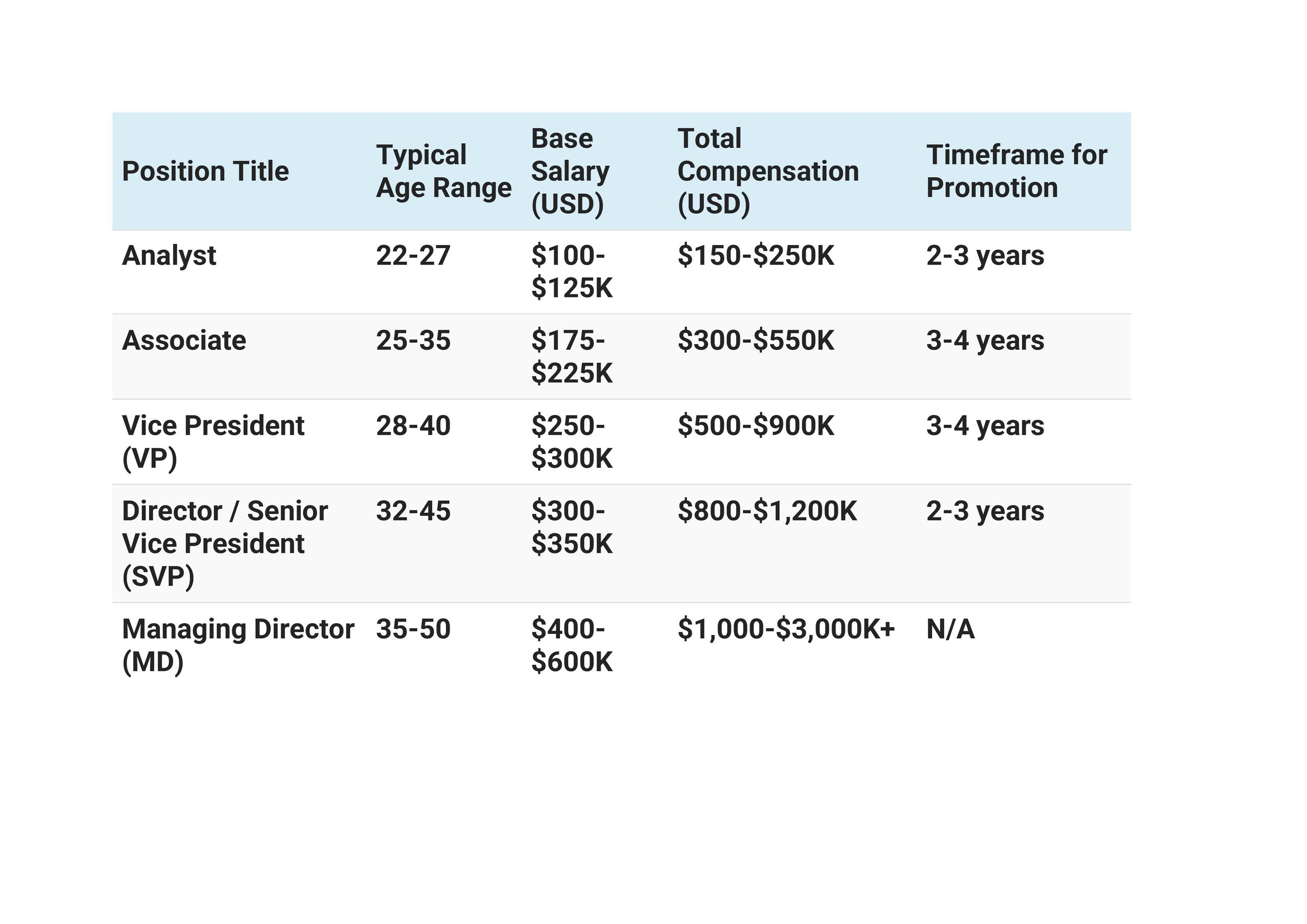

In addition to firm and individual performance, your level of seniority within the firm will also play a role in determining your bonus. Senior bankers who bring in big deals and generate significant revenue for the firm will typically receive higher bonuses than junior bankers who are just starting out in their careers.

Image Source: squarespace-cdn.com

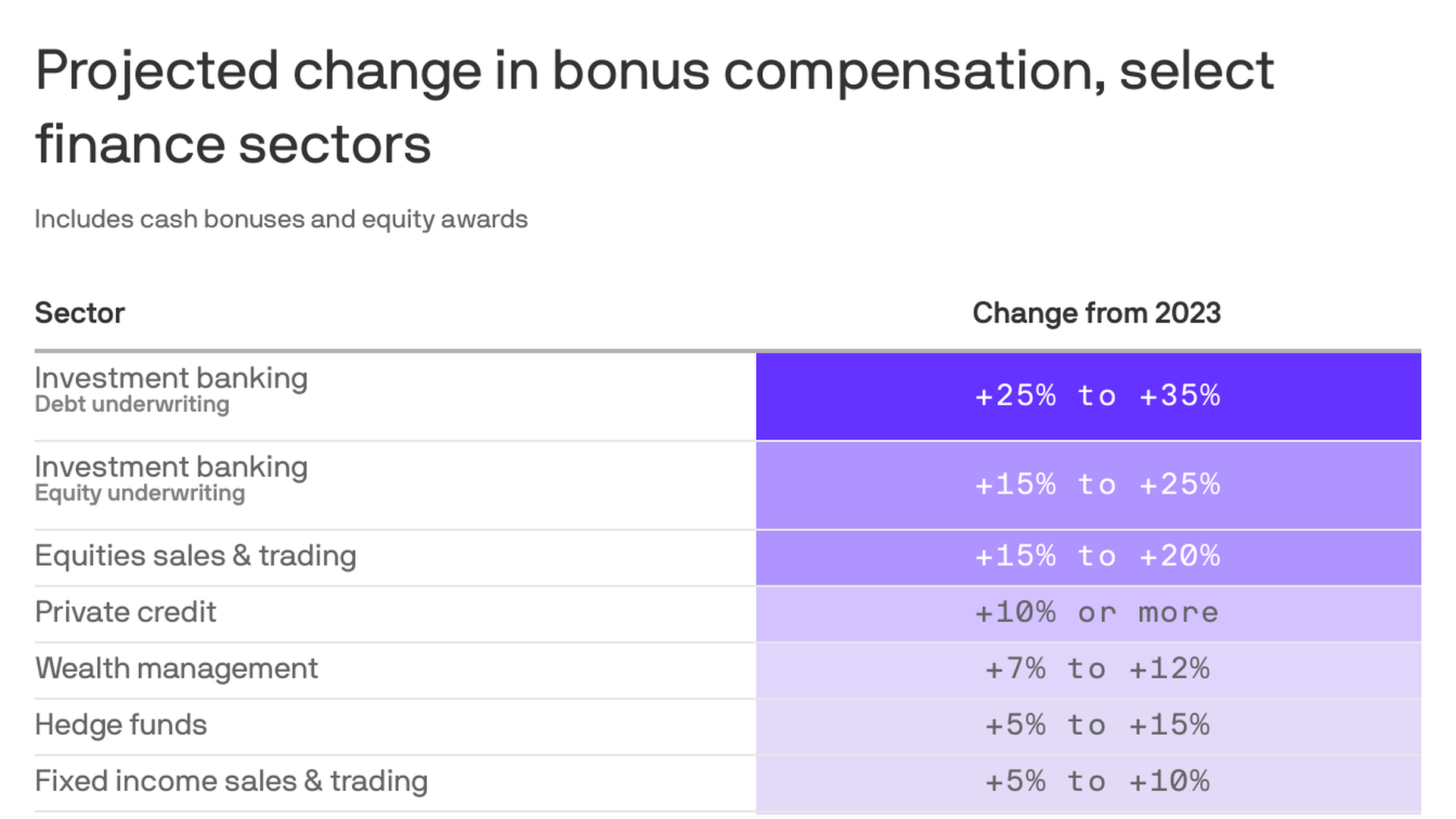

Aside from performance, another key factor in determining your bonus is market conditions. If the economy is booming and deals are flowing, bonuses are likely to be higher. Conversely, if the economy is in a downturn and deals are scarce, bonuses may be lower than expected.

Navigating the world of investment banking bonuses can be a daunting task, but with the right knowledge and strategies, you can crack the code and maximize your earnings. By understanding the factors that go into determining your bonus, you can position yourself for success and ensure that you are rewarded for your hard work and contributions to the firm.

In conclusion, investment banking bonuses are a highly coveted perk in the finance industry, but they are not handed out arbitrarily. By understanding the factors that go into determining your bonus, you can navigate the world of investment banking bonuses with confidence and maximize your earnings. So, roll up your sleeves, put in the hard work, and crack the code to unlock the lucrative bonuses that await you in the world of investment banking. Happy bonus hunting!

Investment banking bonuses are a hot topic in the financial world, and for good reason. These bonuses can make a significant impact on a banker’s earnings, often representing a substantial portion of their total compensation. In this guide, we will explore how to maximize your earnings through investment banking bonuses.

Image Source: wallstreetprep.com

First and foremost, it’s important to understand how investment banking bonuses work. Bonuses in the world of finance are typically based on performance metrics such as revenue generated, deals closed, and overall contribution to the team. The bonus structure can vary from firm to firm, but most investment banks have a formula in place that determines how much each banker will receive.

To maximize your earnings, it’s crucial to set yourself up for success early on in your career. Building a strong reputation within the firm, consistently exceeding expectations, and taking on challenging assignments can all work in your favor when bonus season rolls around. Networking with senior bankers and establishing strong relationships with clients can also help boost your chances of receiving a hefty bonus.

Another key strategy for maximizing your earnings is to diversify your revenue streams. In addition to your base salary and annual bonus, consider taking advantage of opportunities to earn additional compensation through performance-based bonuses, equity awards, and profit sharing. By diversifying your income sources, you can potentially increase your overall earnings and financial security.

Image Source: amazonaws.com

When it comes to negotiating your bonus, preparation is key. Before meeting with your superiors to discuss your compensation package, do your homework and gather data on your performance metrics, market trends, and industry benchmarks. Presenting a well-researched case for why you deserve a higher bonus can greatly improve your chances of success.

In addition to negotiating for a higher bonus, it’s also important to consider the long-term implications of your compensation package. For example, you may want to prioritize receiving more equity awards or profit-sharing opportunities over a larger cash bonus, as these forms of compensation can provide greater financial benefits in the long run.

Furthermore, it’s important to keep in mind the potential tax implications of your bonus. Depending on how your bonus is structured, you may be subject to higher tax rates or additional tax liabilities. Consulting with a financial advisor or tax professional can help you navigate these complexities and maximize your after-tax earnings.

Image Source: wallstreetprep.com

Ultimately, maximizing your earnings through investment banking bonuses requires a combination of hard work, strategic thinking, and effective negotiation skills. By taking a proactive approach to managing your compensation package and staying informed about industry trends, you can position yourself for financial success in the competitive world of investment banking.

In conclusion, investment banking bonuses are a critical component of a banker’s compensation package, and maximizing your earnings in this field requires careful planning and foresight. By focusing on building a strong reputation, diversifying your income sources, negotiating effectively, and considering the long-term implications of your compensation package, you can increase your overall earnings and financial security in the dynamic world of investment banking.

Image Source: axios.com

How Bonuses Work in Investment Banking