Unleash Your Potential: Boosting Productivity at Work

In today’s fast-paced and competitive work environment, maximizing productivity is essential for success. As an employee, it’s important to constantly strive to unleash your potential and boost your productivity at work. By implementing effective strategies and techniques, you can take your performance to the next level and achieve great success in the workplace.

One of the key ways to unleash your potential and boost productivity at work is by setting clear goals for yourself. Having a clear vision of what you want to accomplish can help you stay focused and motivated throughout the day. Whether it’s completing a project ahead of schedule or increasing your sales targets, setting specific and achievable goals can push you to work harder and more efficiently.

Image Source: uattend.co.uk

Another important aspect of boosting productivity at work is time management. Time is a valuable resource, and it’s crucial to make the most of it in order to be successful. By prioritizing tasks, creating to-do lists, and setting deadlines, you can effectively manage your time and ensure that you are making progress towards your goals each day.

In addition to setting goals and managing your time effectively, it’s also important to take care of yourself both physically and mentally. A healthy lifestyle can have a significant impact on your productivity at work. Eating nutritious foods, getting enough sleep, and exercising regularly can help you stay energized and focused throughout the day.

Furthermore, it’s important to take breaks and recharge your batteries when needed. Working long hours without any breaks can lead to burnout and decreased productivity. By taking short breaks throughout the day and stepping away from your work to clear your mind, you can improve your focus and productivity when you return to your tasks.

Image Source: believeperform.com

Another strategy for boosting productivity at work is to eliminate distractions and create a conducive work environment. Whether it’s turning off notifications on your phone, closing unnecessary tabs on your computer, or setting boundaries with coworkers, minimizing distractions can help you stay focused and get more done in less time.

Moreover, it’s important to constantly seek out opportunities for growth and learning in the workplace. By taking on new challenges, learning new skills, and seeking feedback from colleagues and supervisors, you can continue to grow and improve your performance at work. Embracing change and being open to new experiences can help you unleash your full potential and achieve great success in your career.

In conclusion, boosting productivity at work requires a combination of setting clear goals, managing your time effectively, taking care of yourself, eliminating distractions, and seeking out opportunities for growth. By implementing these strategies and techniques, you can unleash your potential and achieve great success in the workplace. So, don’t wait any longer – start implementing these strategies today and watch your productivity soar to new heights!

Elevate Your Performance with Effective Strategies

Image Source: amazonaws.com

In today’s fast-paced work environment, it’s more important than ever to constantly strive for improvement and find effective strategies to elevate your performance. Whether you’re striving for a promotion, looking to increase your productivity, or simply want to excel in your current role, implementing the right strategies can make a significant impact on your success in the workplace.

One key strategy to elevate your performance is to set clear and achievable goals for yourself. By establishing specific objectives and creating a plan to achieve them, you can stay focused and motivated to reach new heights in your career. Whether it’s aiming to increase your sales numbers, streamline your processes, or improve your communication skills, having clear goals in mind can provide you with a roadmap to success.

Another important strategy for maximizing your productivity in the workplace is to prioritize tasks effectively. With multiple projects, deadlines, and responsibilities vying for your attention, it’s crucial to determine which tasks are the most important and require immediate action. By creating a prioritized to-do list and tackling high-priority tasks first, you can ensure that you’re making the most of your time and energy.

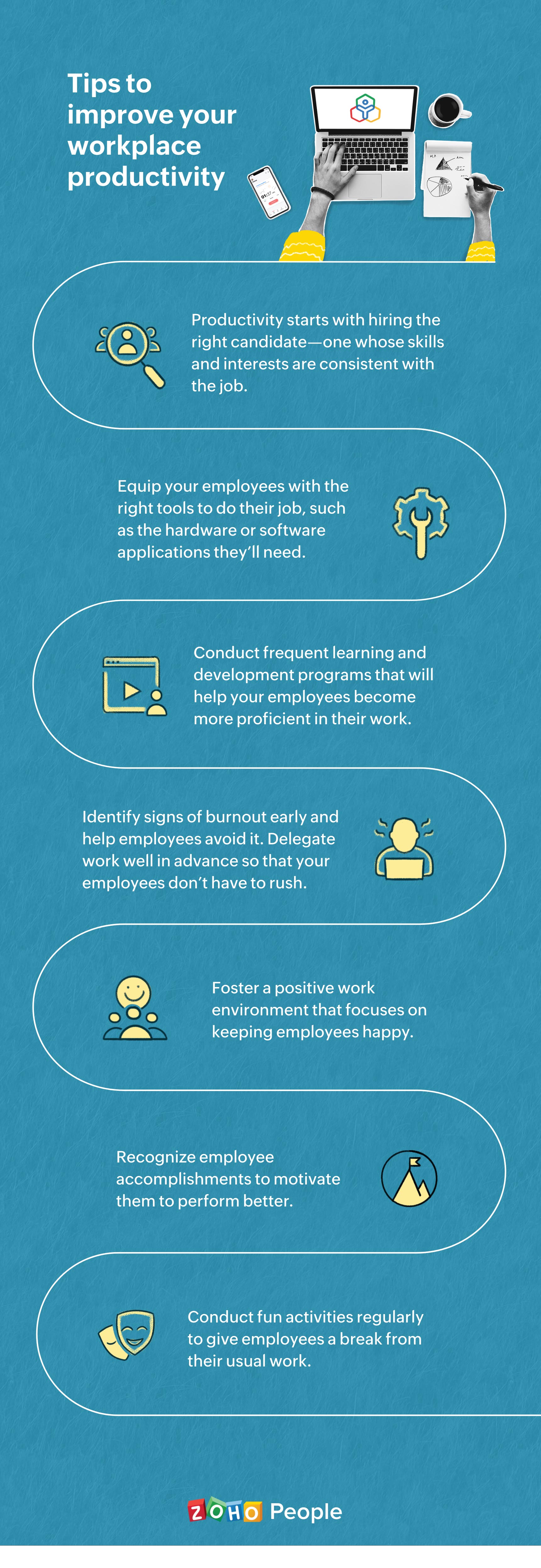

Image Source: zohowebstatic.com

In addition to setting goals and prioritizing tasks, it’s also essential to hone your time management skills. By developing a routine, minimizing distractions, and utilizing time-saving tools and techniques, you can make the most of your workday and accomplish more in less time. Whether it’s setting aside specific blocks of time for focused work, utilizing time-tracking apps to monitor your progress, or implementing the Pomodoro Technique to stay productive, finding the right time management strategies for you can help you work more efficiently and effectively.

Furthermore, one key aspect of elevating your performance in the workplace is to continuously seek opportunities for growth and development. By taking on new challenges, acquiring new skills, and seeking feedback from colleagues and mentors, you can expand your knowledge and expertise and become a more valuable asset to your organization. Whether it’s attending professional development workshops, pursuing further education, or volunteering for special projects, investing in your personal and professional growth can help you reach new levels of success in your career.

Moreover, it’s crucial to cultivate a positive mindset and maintain a healthy work-life balance to maximize your productivity and performance in the workplace. By staying optimistic, resilient, and focused on your goals, you can overcome obstacles and setbacks more easily and stay motivated to achieve success. Additionally, taking care of your physical and mental well-being through regular exercise, healthy eating, and stress management techniques can help you maintain high energy levels and stay productive throughout the day.

Image Source: wpengine.com

In conclusion, elevating your performance in the workplace requires a combination of effective strategies, including setting clear goals, prioritizing tasks, honing your time management skills, seeking opportunities for growth, and maintaining a positive mindset and work-life balance. By implementing these strategies and continuously striving for improvement, you can maximize your productivity, excel in your role, and reach new levels of success in your career. Remember, success is not just about working harder, but also about working smarter and making the most of your talents and abilities. So, go ahead and elevate your performance with these effective strategies and watch your career soar to new heights!

How to Be More Productive at Work

Image Source: healthshots.com