Financial Fitness: Your Key to Career Success

In today’s fast-paced and competitive world, being financially fit is essential for achieving career success. Whether you are just starting out in your career or looking to take it to the next level, mastering money management is a crucial skill that can set you apart from the rest. By incorporating daily finance learning routines into your life, you can supercharge your savings, increase your financial literacy, and ultimately pave the way for a successful career.

One of the first steps to achieving financial fitness is creating a budget. This involves tracking your income and expenses to see where your money is going each month. By understanding your financial habits and making adjustments where necessary, you can ensure that you are living within your means and saving for the future. Setting financial goals is also key to staying on track and motivated. Whether it’s saving for a down payment on a house, investing in your education, or building an emergency fund, having clear goals can help you stay focused on your financial journey.

Image Source: ismartrecruit.com

Another important aspect of financial fitness is understanding the basics of investing. While it may seem daunting at first, investing is a powerful tool for growing your wealth over time. By learning about different investment options, such as stocks, bonds, and mutual funds, you can make informed decisions that align with your financial goals. Additionally, taking advantage of employer-sponsored retirement plans, such as 401(k)s, can help you build a strong financial foundation for the future.

In addition to budgeting and investing, it’s also important to build a strong credit history. Your credit score plays a significant role in your financial health, affecting everything from loan approvals to job opportunities. By making timely payments, keeping your credit utilization low, and monitoring your credit report regularly, you can maintain a healthy credit score that opens up doors for future financial opportunities.

To further enhance your financial fitness, consider expanding your financial knowledge through daily finance learning routines. This can involve reading personal finance books, listening to podcasts, attending workshops, or taking online courses. By staying informed and continuously learning about money management strategies, you can stay ahead of the curve and make informed decisions that benefit your financial future.

Image Source: aihr.com

Ultimately, achieving financial fitness is not just about managing your money—it’s about setting yourself up for long-term career success. By mastering money management skills and incorporating daily finance learning routines into your life, you can supercharge your savings, increase your financial literacy, and create a solid foundation for a successful career. So, take the first step towards financial fitness today and watch as your career soars to new heights.

Daily Money Habits to Supercharge Your Savings

In today’s fast-paced world, it can be easy to overlook the importance of managing your finances on a daily basis. However, when it comes to achieving career growth and overall success, mastering money management is key. By implementing daily money habits that focus on supercharging your savings, you can set yourself up for a prosperous future and financial stability.

One of the most important daily money habits to adopt is tracking your expenses. By keeping a close eye on where your money is going each day, you can identify areas where you may be overspending and make necessary adjustments. This can help you stay within your budget and increase the amount you are able to save each month.

Image Source: amazonaws.com

Another crucial habit is setting financial goals for yourself. Whether it’s saving for a new car, a down payment on a house, or a dream vacation, having specific goals in mind can help you stay motivated and focused on your savings efforts. By setting realistic and achievable goals, you can track your progress and celebrate your successes along the way.

In addition to tracking expenses and setting goals, it’s important to automate your savings whenever possible. By setting up automatic transfers from your checking account to your savings account each month, you can ensure that a portion of your income is consistently being set aside for the future. This can help prevent you from spending money that should be saved and make saving a priority in your daily routine.

One daily money habit that is often overlooked is reviewing your financial accounts regularly. By checking your bank statements, credit card statements, and investment accounts on a daily basis, you can identify any discrepancies or fraudulent activity quickly. This can help protect your hard-earned money and ensure that you are on track to meet your savings goals.

Image Source: licdn.com

Another important habit to supercharge your savings is to avoid impulse purchases. Before making a purchase, take a moment to ask yourself if it aligns with your financial goals and if it’s something you truly need. By practicing self-discipline and avoiding unnecessary spending, you can increase the amount of money you are able to save each month.

Lastly, it’s essential to educate yourself about personal finance and investment strategies. By reading books, listening to podcasts, and attending workshops on money management, you can expand your knowledge and make informed decisions about your finances. The more you know about managing money effectively, the better equipped you will be to grow your savings and achieve your long-term financial goals.

In conclusion, mastering money management is a vital component of achieving career growth and financial success. By implementing daily money habits that focus on supercharging your savings, you can set yourself up for a prosperous future and financial stability. By tracking expenses, setting goals, automating savings, reviewing accounts regularly, avoiding impulse purchases, and educating yourself about personal finance, you can take control of your finances and pave the way for a bright financial future.

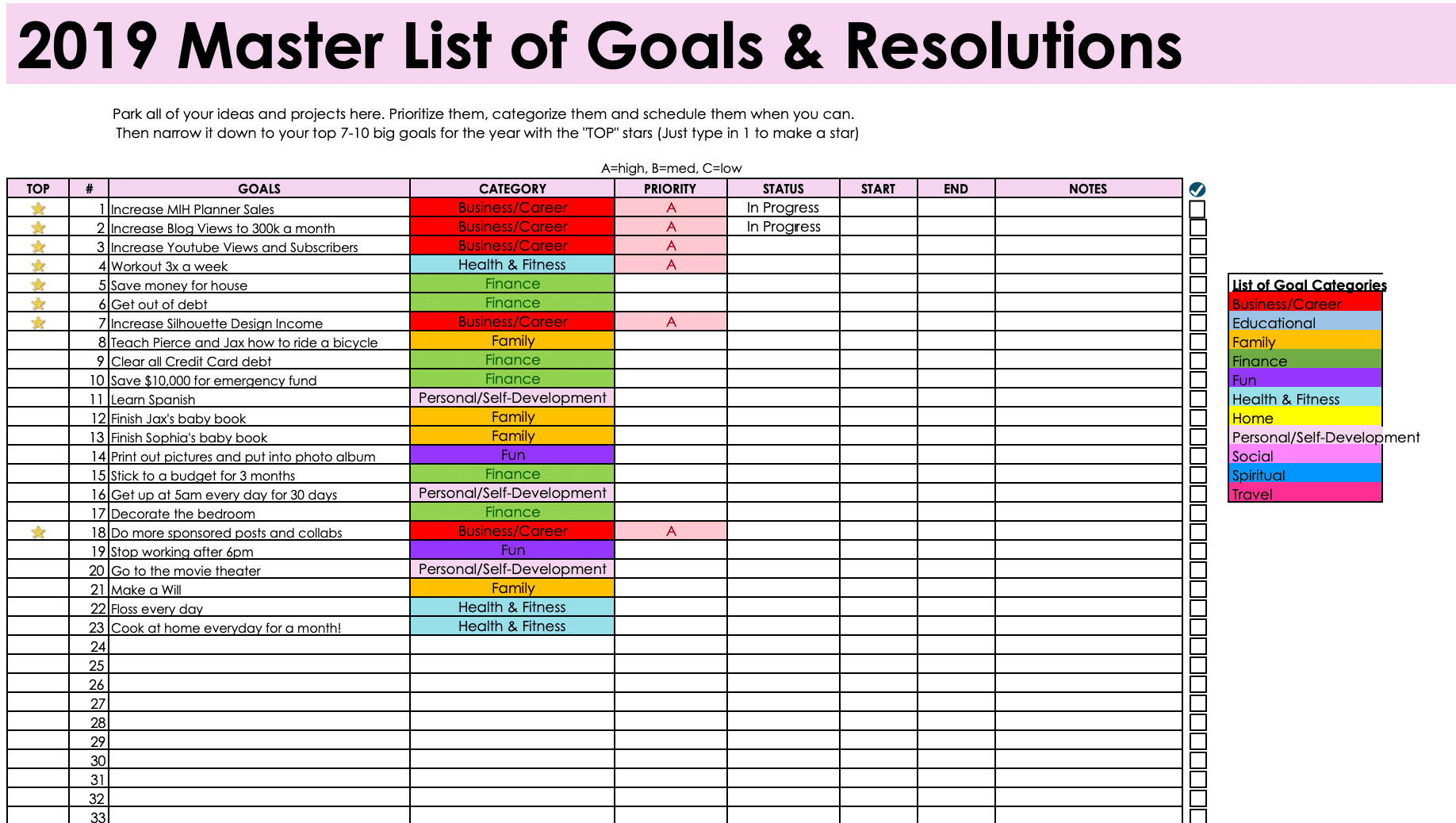

Image Source: wendaful.com

Daily Finance Learning Routine for Career Growth