Bridging the Gap: Gender Pay Equality in Finance

In the competitive world of finance, where numbers and statistics reign supreme, there is one glaring issue that continues to persist – the gender pay gap. Despite great strides being made in recent years towards gender equality in the workplace, women in finance still earn significantly less than their male counterparts. The question remains: is it still a problem, and what can be done to bridge this gap?

The gender pay gap in finance is a complex issue that has deep roots in societal norms and expectations. Women have historically been underrepresented in the finance industry, often facing barriers to entry and advancement. As a result, women are often concentrated in lower-paying roles and have fewer opportunities for career advancement. This disparity is further exacerbated by the fact that women are less likely to negotiate for higher salaries or promotions, leading to a perpetuation of the pay gap.

Image Source: payscale.com

Despite these challenges, progress is being made towards gender pay equality in finance. Many companies are implementing policies and initiatives aimed at closing the gap and promoting diversity and inclusion. From implementing transparent salary structures to offering mentorship programs and leadership development opportunities for women, there is a growing recognition of the importance of gender equality in the workplace.

One key factor in bridging the gender pay gap is education and awareness. Many women may not be aware of the pay disparities that exist within their own organizations, or may not feel empowered to advocate for themselves. By providing training and resources on negotiation skills and salary transparency, companies can empower women to take control of their own financial futures and work towards closing the pay gap.

Additionally, fostering a culture of inclusion and diversity is essential in creating a more equitable workplace. Companies that prioritize diversity and inclusion tend to have higher levels of employee satisfaction and retention, as well as better financial performance. By creating a more inclusive environment where all employees feel valued and supported, companies can help to level the playing field and promote gender pay equality.

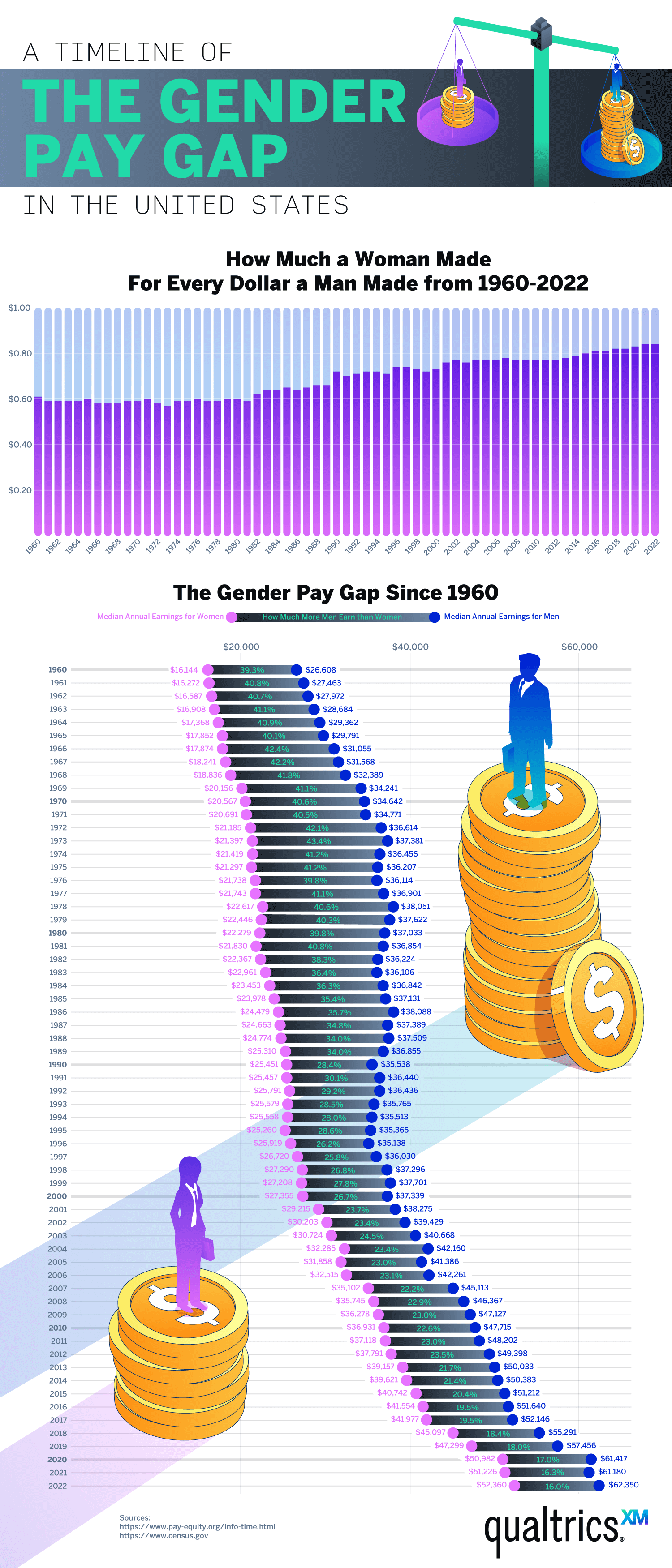

Image Source: qualtrics.com

Another important aspect of closing the gender pay gap in finance is addressing unconscious bias and systemic discrimination. Studies have shown that women are often overlooked for promotions or pay raises due to unconscious biases held by their male colleagues or managers. By implementing diversity training and unconscious bias awareness programs, companies can help to eliminate these barriers and create a more equitable workplace for all employees.

Overall, while progress has been made towards gender pay equality in finance, there is still much work to be done. By raising awareness, promoting diversity and inclusion, and addressing unconscious bias, companies can work towards closing the gender pay gap and creating a more equitable workplace for all employees. It is only through a collective effort and a commitment to change that we can truly bridge the gap and achieve gender pay equality in finance.

Breaking Barriers: Progress towards Pay Parity

In the world of finance, the gender pay gap has been a long-standing issue that has plagued the industry for decades. Women have historically been paid less than their male counterparts, despite having the same qualifications and doing the same work. However, in recent years, there has been a shift towards closing the gap and achieving pay parity between men and women in finance.

Image Source: payscale.com

One of the key factors contributing to the progress towards pay parity in finance is increased awareness and advocacy for gender equality in the workplace. Organizations and individuals alike have been pushing for more transparency around salary information, leading to greater accountability and pressure on companies to address any discrepancies in pay between genders. This heightened awareness has also sparked important conversations around the importance of equal pay and the negative impacts of the gender pay gap on women’s financial security and overall well-being.

Another factor that has contributed to progress towards pay parity in finance is the implementation of policies and initiatives aimed at promoting gender equality in the workplace. Many companies have committed to conducting regular pay audits to identify and address any gender pay gaps within their organization. Additionally, some companies have implemented salary transparency policies, where employees are encouraged to openly discuss their salaries and any disparities that may exist.

Furthermore, there has been a growing push for more women to enter and advance in the finance industry, leading to a more diverse and inclusive workforce. As more women enter the field and move up the ranks, there is a greater likelihood of achieving pay parity between genders. This increased representation of women in finance also helps to challenge traditional gender norms and stereotypes that have contributed to the pay gap in the past.

Image Source: finhealthnetwork.org

Additionally, there have been efforts to address systemic issues that have perpetuated the gender pay gap in finance. This includes challenging biases and discrimination in hiring and promotion processes, as well as addressing issues related to work-life balance and caregiving responsibilities that disproportionately affect women. By tackling these underlying issues, companies can create a more equitable and supportive work environment for all employees, regardless of gender.

While there has been significant progress towards pay parity in finance, there is still work to be done to fully close the gender pay gap. Women, especially women of color and women with disabilities, continue to face barriers to equal pay and advancement in the industry. It is important for companies to continue to prioritize gender equality and to actively work towards closing any remaining gaps in pay and opportunities for women in finance.

In conclusion, the progress towards pay parity in finance is a promising sign that the industry is moving in the right direction towards closing the gender pay gap. Through increased awareness, advocacy, policy changes, and efforts to address systemic issues, there is hope that one day soon, women and men in finance will be paid equally for their work. It is important to continue to push for gender equality in the workplace and to support initiatives that promote a more inclusive and equitable financial industry for all.

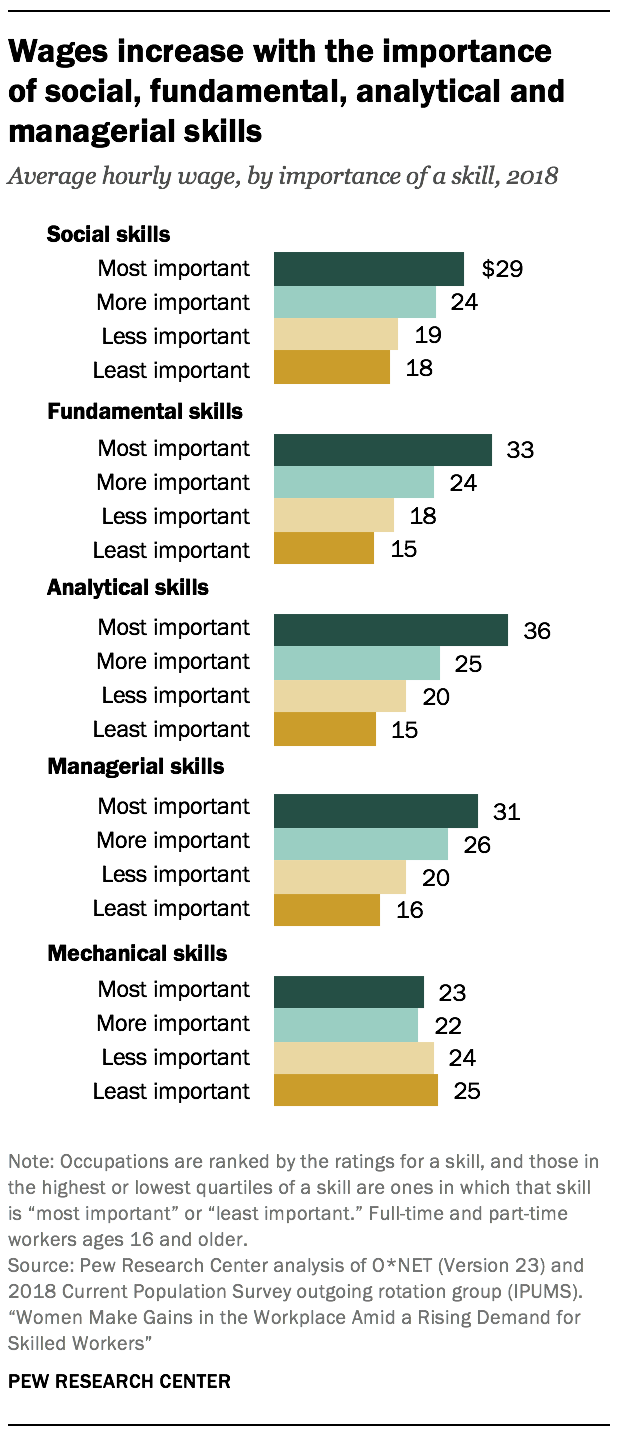

Image Source: pewresearch.org

Gender Pay Gap in Finance: Still a Problem?