Money Milestones to Hit Before 30!

Turning 30 is a significant milestone in anyone’s life. It marks the end of your carefree 20s and the beginning of a more mature and responsible chapter. One of the most important aspects of adulthood is managing your finances effectively. By setting and achieving money goals before you hit the big 3-0, you can set yourself up for a secure financial future. Here are 10 essential money goals to achieve before turning 30.

1. Establish an Emergency Fund

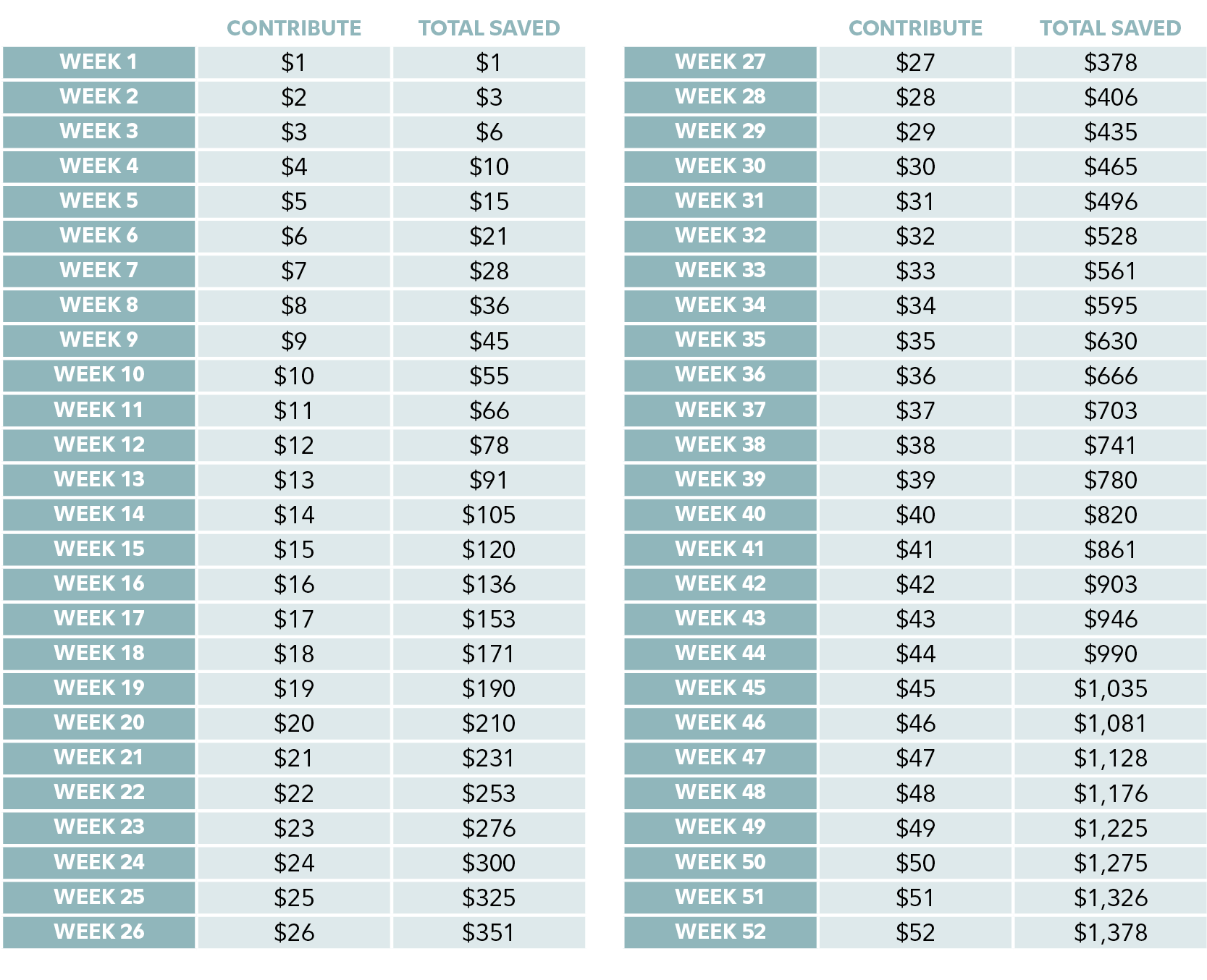

One of the first money milestones you should aim to hit before 30 is establishing an emergency fund. An emergency fund is a pot of money set aside to cover unexpected expenses, such as medical bills, car repairs, or job loss. Financial experts recommend having at least three to six months’ worth of living expenses saved in your emergency fund. By having this safety net in place, you can avoid going into debt in times of crisis.

Image Source: careercontessa.com

2. Pay off High-Interest Debt

Another crucial money goal to achieve before turning 30 is paying off high-interest debt. High-interest debt, such as credit card debt, can quickly spiral out of control and hinder your financial progress. By making a plan to pay off your high-interest debt as soon as possible, you can free up more money for saving and investing in the future.

3. Start Investing

Investing is an essential part of building wealth and securing your financial future. Before you turn 30, it’s important to start investing in assets that will grow over time, such as stocks, bonds, or real estate. By starting to invest early, you can take advantage of compound interest and potentially grow your wealth significantly over the long term.

4. Create a Budget

Creating a budget is a fundamental money goal that everyone should strive to achieve before turning 30. A budget helps you track your income and expenses, prioritize your spending, and achieve your financial goals. By creating a budget and sticking to it, you can avoid overspending, save more money, and make smarter financial decisions.

Image Source: pinimg.com

5. Save for Retirement

Saving for retirement is another important money milestone to hit before 30. The earlier you start saving for retirement, the more time your money has to grow. Consider contributing to a 401(k) or IRA account, and aim to save at least 10% of your income for retirement. By saving for retirement early, you can enjoy a comfortable and secure future.

6. Build Your Credit Score

Your credit score plays a crucial role in your financial health. Before turning 30, make it a goal to build and maintain a good credit score. Pay your bills on time, keep your credit card balances low, and avoid opening too many new accounts. A good credit score can help you qualify for better interest rates on loans and credit cards, saving you money in the long run.

7. Set Financial Goals

Setting financial goals is essential for achieving success in your financial life. Before turning 30, take the time to define your short-term and long-term financial goals. Whether it’s buying a home, starting a business, or traveling the world, having clear goals can motivate you to save and invest wisely.

Image Source: imgix.net

8. Live Below Your Means

Living below your means is a key money goal to achieve before 30. Avoid the temptation to keep up with the Joneses and instead focus on living within your means. By spending less than you earn, you can save more money, avoid debt, and build wealth over time.

9. Educate Yourself

Financial literacy is a critical skill that everyone should possess. Before turning 30, make it a goal to educate yourself about personal finance. Read books, take courses, and seek advice from financial professionals to increase your knowledge and confidence in managing your money effectively.

10. Seek Professional Help

Finally, don’t be afraid to seek professional help with your finances. Before turning 30, consider working with a financial advisor or planner to help you set and achieve your money goals. A professional can provide personalized advice, guidance, and support to help you make smart financial decisions and secure your financial future.

Image Source: fidelity.com

In conclusion, hitting these money milestones before turning 30 can set you up for a secure and successful financial future. By establishing an emergency fund, paying off debt, investing, creating a budget, saving for retirement, building your credit score, setting financial goals, living below your means, educating yourself, and seeking professional help, you can take control of your finances and achieve your money goals before the big 3-0.

Secure Your Financial Future Now!

As you approach the age of 30, it is important to start thinking about securing your financial future. This means setting yourself up for success in the long term by making smart money decisions now. There are several key steps you can take to ensure that you are on the right track to financial stability and prosperity. Here are some essential money goals to achieve before turning 30:

1. Establish an Emergency Fund

One of the first things you should do to secure your financial future is to establish an emergency fund. This fund should ideally cover three to six months’ worth of living expenses in case of unexpected events such as job loss or medical emergencies. Having an emergency fund will provide you with a financial safety net and peace of mind knowing that you are financially prepared for any curveballs life may throw your way.

Image Source: imgix.net

2. Create a Budget and Stick to It

Creating a budget is essential for managing your finances effectively. Take the time to track your income and expenses to get a clear picture of where your money is going. Once you have a budget in place, make sure to stick to it by prioritizing your spending on essentials and cutting back on unnecessary expenses. By living within your means, you can avoid accumulating debt and build a solid financial foundation for the future.

3. Save for Retirement

It’s never too early to start saving for retirement. By contributing to a retirement account such as a 401(k) or IRA, you can take advantage of compound interest and grow your savings over time. Aim to save at least 10% of your income for retirement to ensure that you have enough funds to support yourself in your golden years. Starting early will give your money more time to grow and set you up for a comfortable retirement.

4. Pay Off Debt

Debt can be a major obstacle to achieving financial security. Before turning 30, make it a priority to pay off high-interest debt such as credit card balances and student loans. By reducing your debt load, you can free up more of your income for saving and investing. Develop a debt repayment plan and stick to it to become debt-free faster and improve your financial health.

Image Source: ctfassets.net

5. Build an Investment Portfolio

Investing is a key component of building wealth over the long term. Consider investing in stocks, bonds, mutual funds, or real estate to diversify your portfolio and maximize your returns. Start small and gradually increase your investments as your financial situation allows. By investing wisely, you can grow your wealth and achieve your financial goals faster.

6. Protect Your Assets with Insurance

Insurance is an important tool for protecting your assets and safeguarding your financial future. Make sure you have adequate health, auto, home, and life insurance coverage to mitigate financial risks in case of emergencies. Review your insurance policies regularly to ensure that you have the right amount of coverage for your needs and make any necessary adjustments as your circumstances change.

7. Increase Your Income

Increasing your income can significantly impact your financial future. Look for opportunities to advance in your career, ask for a raise, or pursue side hustles to boost your earnings. Consider upgrading your skills or furthering your education to qualify for higher-paying job opportunities. By increasing your income, you can accelerate your progress towards your financial goals and achieve greater financial security.

Image Source: imgix.net

8. Plan for Major Life Events

As you approach 30, it’s important to start planning for major life events such as buying a home, getting married, or starting a family. Set specific financial goals for these milestones and create a savings plan to achieve them. By planning ahead and saving strategically, you can navigate these life transitions with financial confidence and peace of mind.

9. Seek Professional Financial Advice

If you’re unsure about how to achieve your financial goals or need guidance on investment strategies, consider seeking professional financial advice. A financial advisor can help you create a customized financial plan based on your goals and risk tolerance. They can also provide valuable insights and recommendations to help you make informed decisions about your money and investments.

10. Practice Financial Discipline

Ultimately, achieving financial security requires practicing discipline and making smart money choices on a daily basis. Avoid impulse spending, prioritize saving and investing, and stay focused on your long-term financial goals. By developing good financial habits and staying committed to your financial plan, you can secure your financial future and enjoy a lifetime of financial stability and prosperity.

Image Source: i2.wp.com

In conclusion, securing your financial future is a journey that requires planning, discipline, and commitment. By setting and achieving these essential money goals before turning 30, you can lay the foundation for a secure and prosperous financial future. Take the time to assess your current financial situation, set specific goals, and take actionable steps to achieve them. With the right mindset and determination, you can build a solid financial future that will serve you well for years to come.

Money Goals to Hit Before You Turn 30