Harnessing the Magic of Data Analysis

In the fast-paced world of finance, data analysis has become an indispensable tool for making informed decisions, predicting market trends, and ultimately maximizing profitability. The ability to gather, organize, and interpret vast amounts of data has opened up a world of possibilities for financial professionals, giving them the power to uncover hidden patterns, identify risks, and capitalize on opportunities that were previously invisible.

Data analysis in finance involves the use of statistical techniques, mathematical models, and computer algorithms to analyze and interpret financial data. By harnessing the power of data analysis, financial professionals can gain valuable insights into market trends, customer behavior, and investment opportunities, allowing them to make more accurate predictions and strategic decisions.

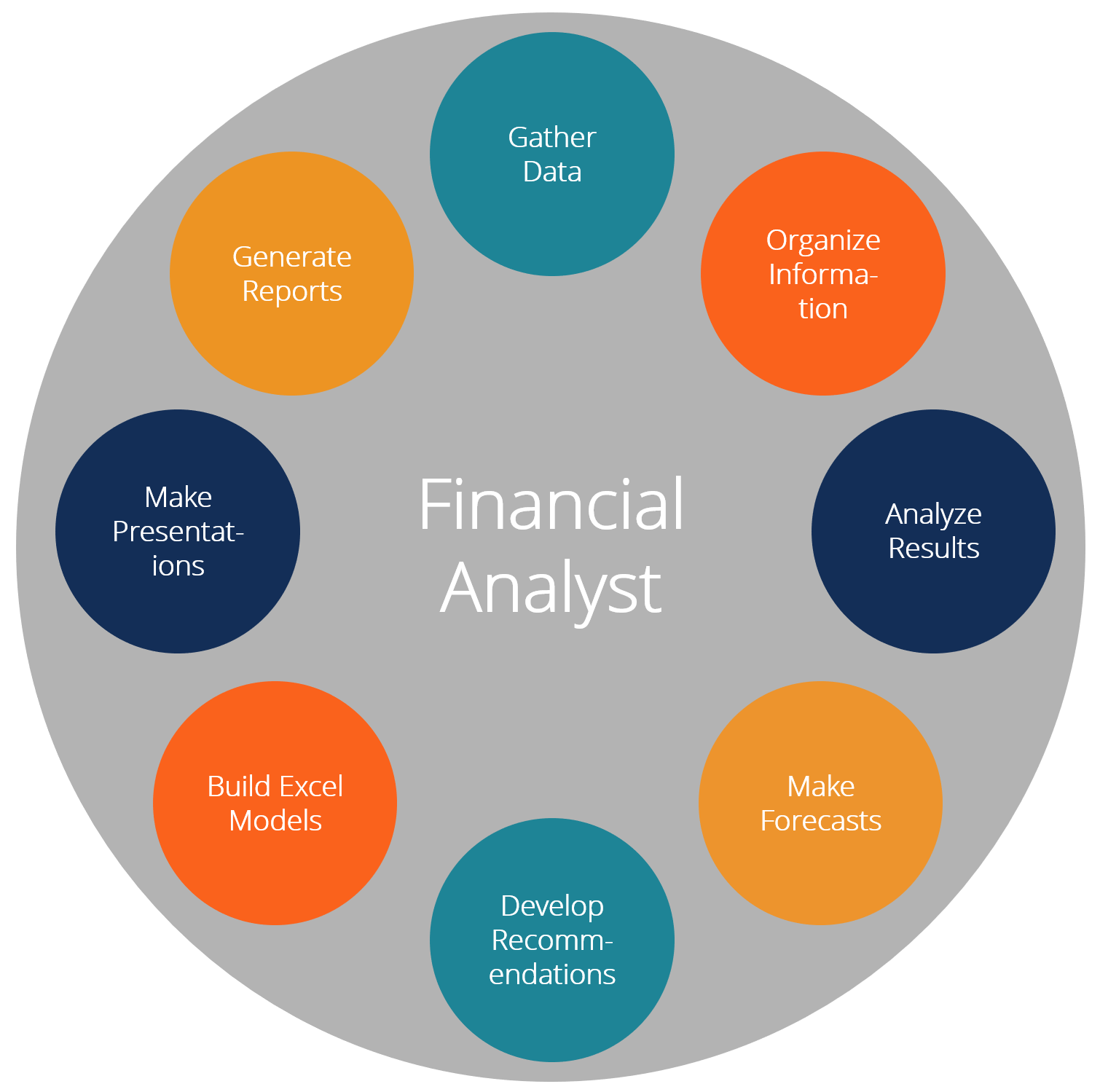

Image Source: corporatefinanceinstitute.com

One of the key roles of data analysis in finance is risk management. By analyzing historical data and market trends, financial professionals can identify potential risks and take proactive measures to mitigate them. Whether it’s identifying credit risks, market volatility, or operational risks, data analysis provides valuable insights that can help financial institutions protect their investments and minimize losses.

Another important role of data analysis in finance is predicting market trends. By analyzing historical data and market indicators, financial professionals can identify patterns and trends that may indicate future market movements. This can help investors make informed decisions about when to buy or sell assets, helping them maximize returns and minimize losses.

Data analysis also plays a crucial role in fraud detection and prevention in the finance industry. By analyzing transaction data and identifying anomalies, financial institutions can detect fraudulent activities and take immediate action to prevent further losses. This not only helps protect the financial institution’s assets but also helps maintain trust and confidence among customers.

:max_bytes(150000):strip_icc()/data-analytics-4198207-1-ad97301587ac43698a095690bc58c4c1.jpg)

Image Source: investopedia.com

Furthermore, data analysis in finance can also help improve customer experience and satisfaction. By analyzing customer data and behavior, financial institutions can gain insights into customer preferences, needs, and habits, allowing them to tailor their products and services to better meet customer needs. This can lead to increased customer loyalty, retention, and ultimately, profitability.

In today’s digital age, the amount of data available to financial professionals is growing exponentially. From transaction data and market indicators to social media trends and customer feedback, the sheer volume of data can be overwhelming. However, by harnessing the magic of data analysis, financial professionals can turn this data into actionable insights that drive business growth and success.

Data analysis tools and technologies, such as machine learning, artificial intelligence, and predictive analytics, are revolutionizing the finance industry, allowing financial professionals to make faster, more accurate decisions based on real-time data. These tools can identify patterns, trends, and anomalies that may not be apparent to the naked eye, giving financial institutions a competitive edge in the market.

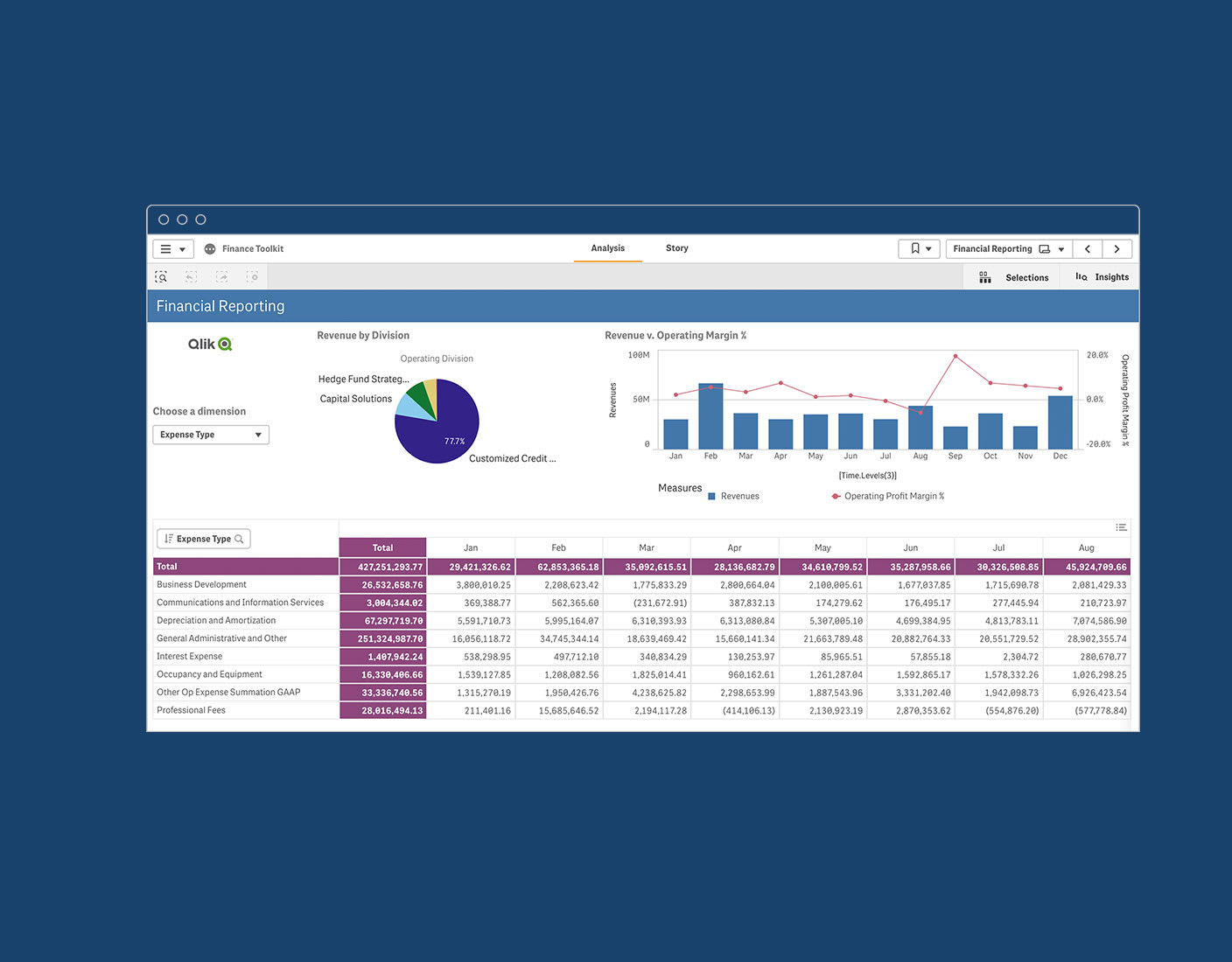

Image Source: qlik.com

Overall, data analysis plays a key role in finance by providing valuable insights, minimizing risks, and maximizing opportunities. By harnessing the magic of data analysis, financial professionals can unlock the full potential of their data, helping them make better decisions, drive growth, and achieve their financial goals.

Unveiling the Power of Data Analysis: Illuminating the Future of Finance

In today’s fast-paced and ever-evolving financial landscape, the role of data analysis has become more important than ever. With the exponential growth of data being generated every day, the ability to effectively analyze and interpret this data has become a crucial skill for finance professionals. From predicting market trends to identifying potential risks, data analysis plays a key role in helping businesses make informed decisions and stay ahead of the competition.

But what exactly is data analysis, and how does it impact the world of finance? Data analysis is the process of inspecting, cleansing, transforming, and modeling data with the goal of discovering useful information, informing conclusions, and supporting decision-making. In the context of finance, data analysis involves analyzing financial data to identify patterns, trends, and insights that can help businesses make strategic decisions and optimize their performance.

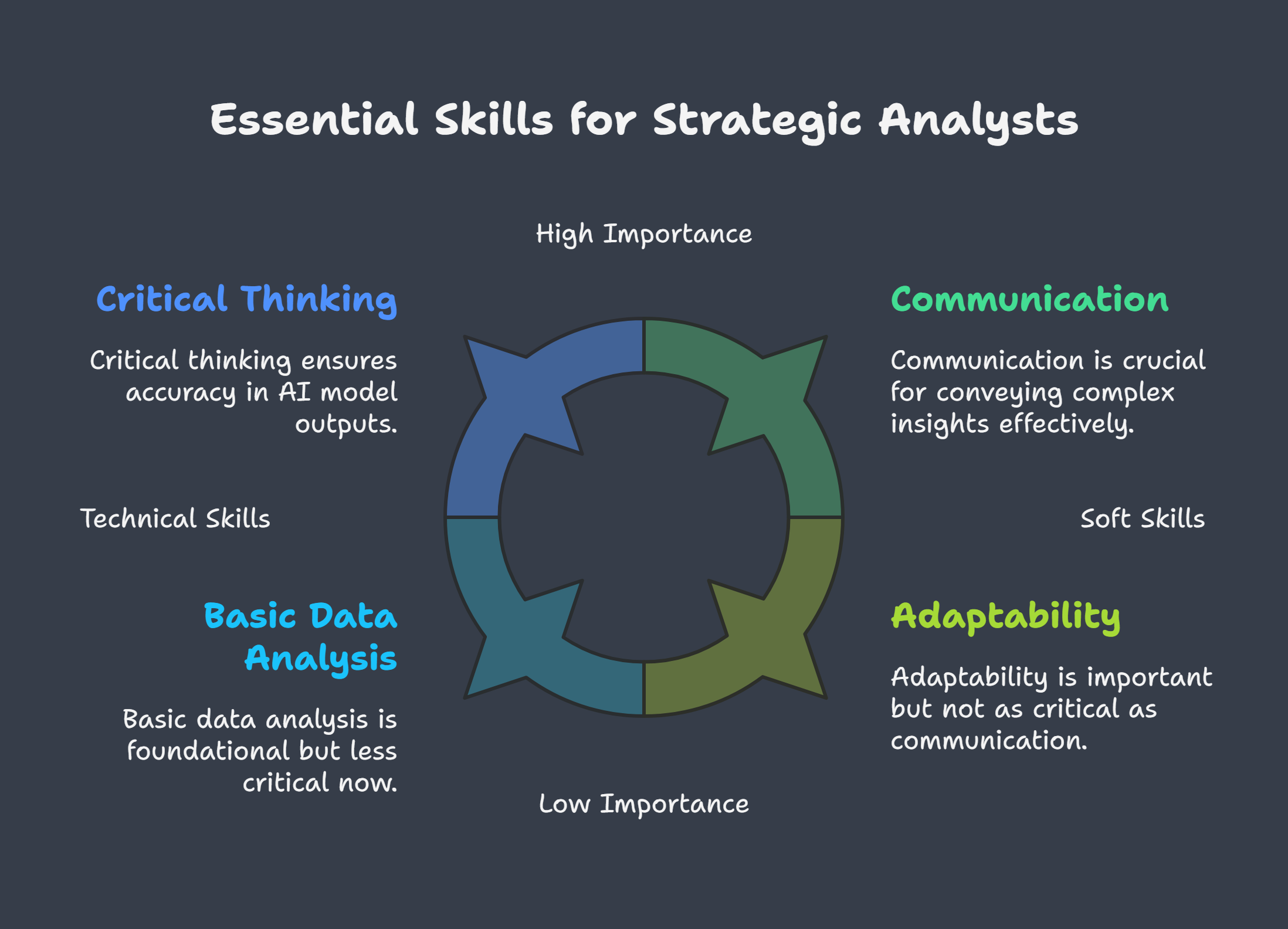

Image Source: jobaajlearnings.com

One of the key aspects of data analysis in finance is the ability to forecast future trends and make predictions based on historical data. By analyzing past financial data, finance professionals can gain valuable insights into market behavior, customer preferences, and other factors that can impact their business. This predictive analysis allows businesses to anticipate changes in the market and make proactive decisions to stay ahead of the competition.

Another important role of data analysis in finance is risk management. By analyzing financial data, businesses can identify potential risks and develop strategies to mitigate them. Whether it’s assessing credit risk, market risk, or operational risk, data analysis provides finance professionals with the tools they need to make informed decisions and protect their business from potential threats.

In addition to forecasting trends and managing risks, data analysis also plays a key role in optimizing financial performance. By analyzing key performance indicators (KPIs) and financial metrics, businesses can identify areas for improvement and make data-driven decisions to enhance their bottom line. Whether it’s streamlining processes, reducing costs, or maximizing revenue, data analysis helps businesses identify opportunities for growth and make informed decisions to drive success.

:max_bytes(150000):strip_icc()/quantitativeanalysis.asp_FINAL-a648a28b51bf4c0db606d8d88e356ffb.png)

Image Source: investopedia.com

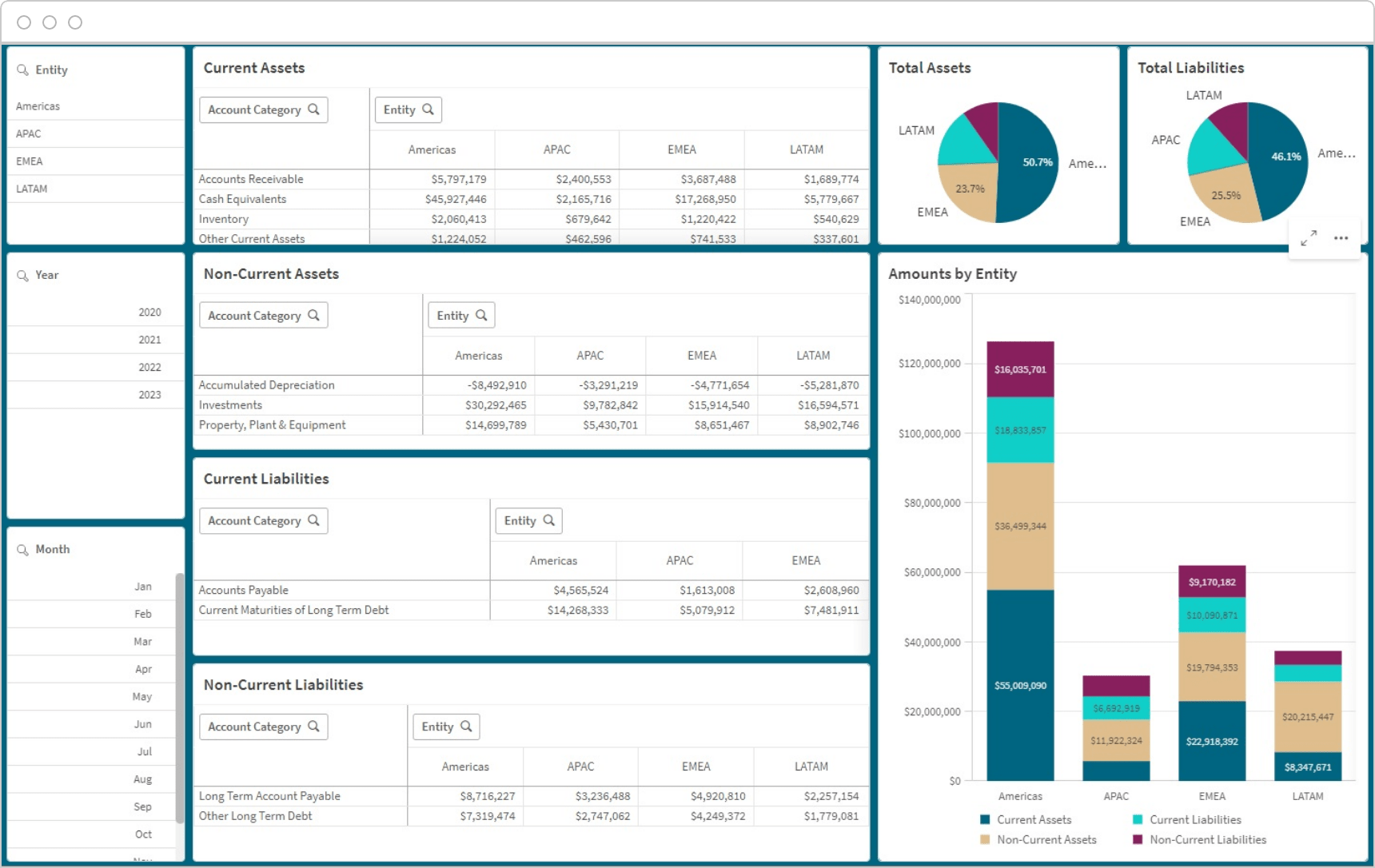

But data analysis is not just about crunching numbers and generating reports. It’s also about telling a story with data and communicating insights in a way that is clear, compelling, and actionable. Visualization tools like charts, graphs, and dashboards play a key role in helping finance professionals present their findings in a visually engaging way that is easy to understand and interpret. By combining the power of data analysis with the art of storytelling, finance professionals can effectively communicate their insights and drive meaningful change within their organizations.

As we look to the future of finance, the role of data analysis will only continue to grow in importance. With the rise of big data, artificial intelligence, and machine learning, finance professionals have access to more data than ever before. By harnessing the power of data analysis, finance professionals can unlock valuable insights, drive strategic decision-making, and navigate the complex and ever-changing world of finance with confidence.

In conclusion, data analysis plays a key role in illuminating the future of finance. By harnessing the magic of data analysis, finance professionals can uncover valuable insights, make informed decisions, and drive success within their organizations. As we continue to embrace the power of data analysis in finance, the possibilities are endless. So let’s embrace the power of data analysis and unlock a brighter future for finance together.

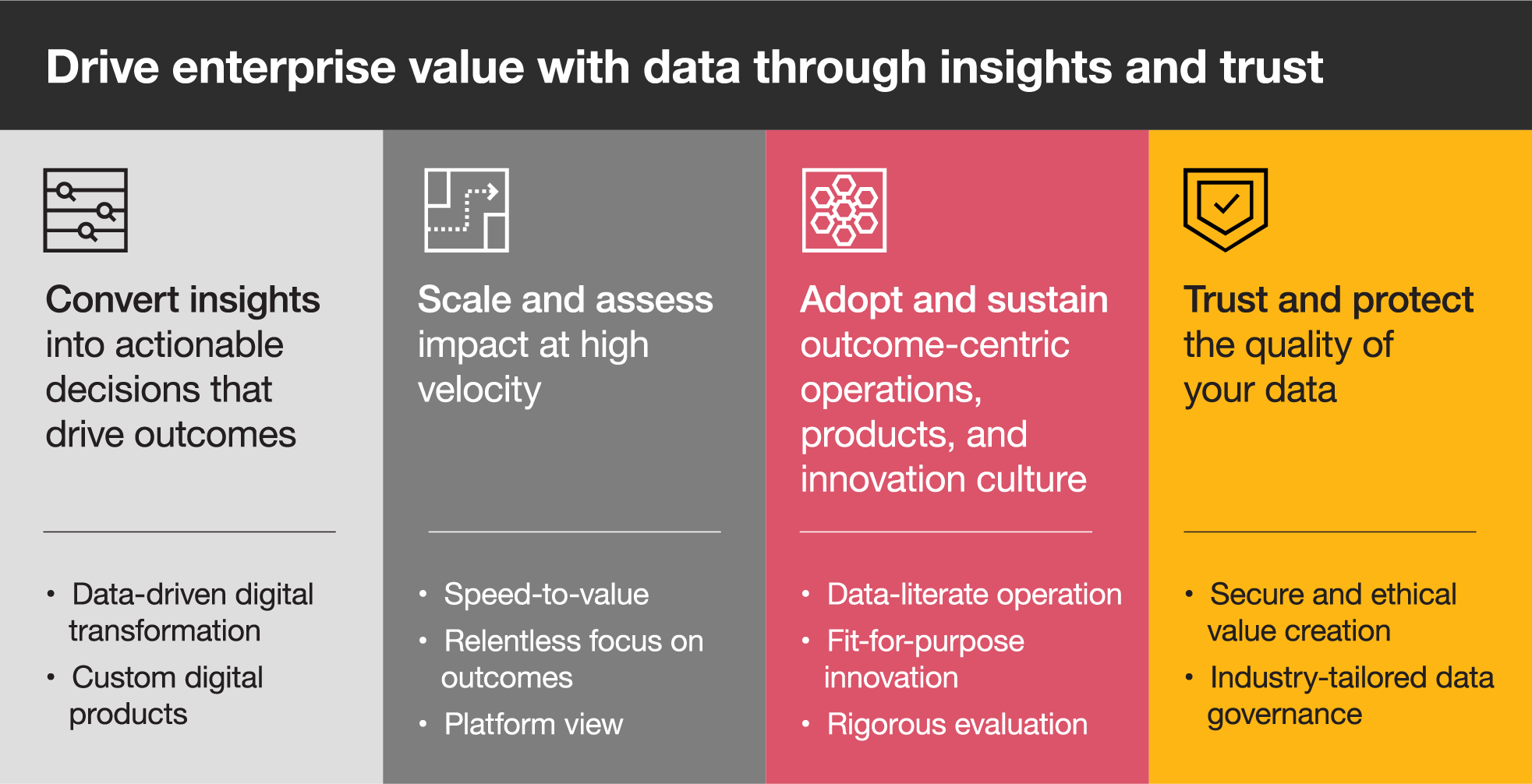

Image Source: pwc.com

The Importance of Data Analysis Skills in Finance

Image Source: qlik.com

Image Source: b-cdn.net