Unleashing Your Potential: Dive into Financial Planning Certifications

When it comes to navigating the complex world of finance, having the right certifications can make all the difference in unlocking your full potential. Financial planning certifications not only demonstrate your expertise and dedication to the field, but they also open up a world of opportunities for career advancement and personal growth.

One of the most valuable financial planning certifications you can pursue is the Certified Financial Planner (CFP) designation. This prestigious certification is recognized worldwide and is a mark of excellence in the field of financial planning. By earning your CFP certification, you demonstrate to clients and employers alike that you have the knowledge, skills, and experience necessary to provide comprehensive financial planning services.

:max_bytes(150000):strip_icc()/Cfp_final-cdafe29d5d7046c9913d6ceb1ac9c380.png)

Image Source: investopedia.com

But the benefits of pursuing a financial planning certification go far beyond just having a few letters after your name. By diving into the world of financial planning certifications, you have the opportunity to expand your knowledge base, sharpen your skills, and stay up-to-date on the latest trends and developments in the industry. This continuous learning and professional development can not only enhance your career prospects but also help you better serve your clients and make a positive impact on their financial well-being.

In addition to the CFP certification, there are other valuable financial planning certifications that can help you further enhance your expertise and credibility in the field. For example, the Chartered Financial Analyst (CFA) designation is highly regarded in the investment management industry and demonstrates your proficiency in areas such as portfolio management, asset allocation, and risk management. By earning your CFA designation, you can position yourself as a trusted advisor and expert in the field of investment management.

Another valuable financial planning certification to consider is the Certified Investment Management Analyst (CIMA) designation. This certification is designed for financial professionals who specialize in investment management and provides advanced training in areas such as asset allocation, manager selection, and performance measurement. By earning your CIMA designation, you can demonstrate your expertise in the field of investment management and differentiate yourself from your peers.

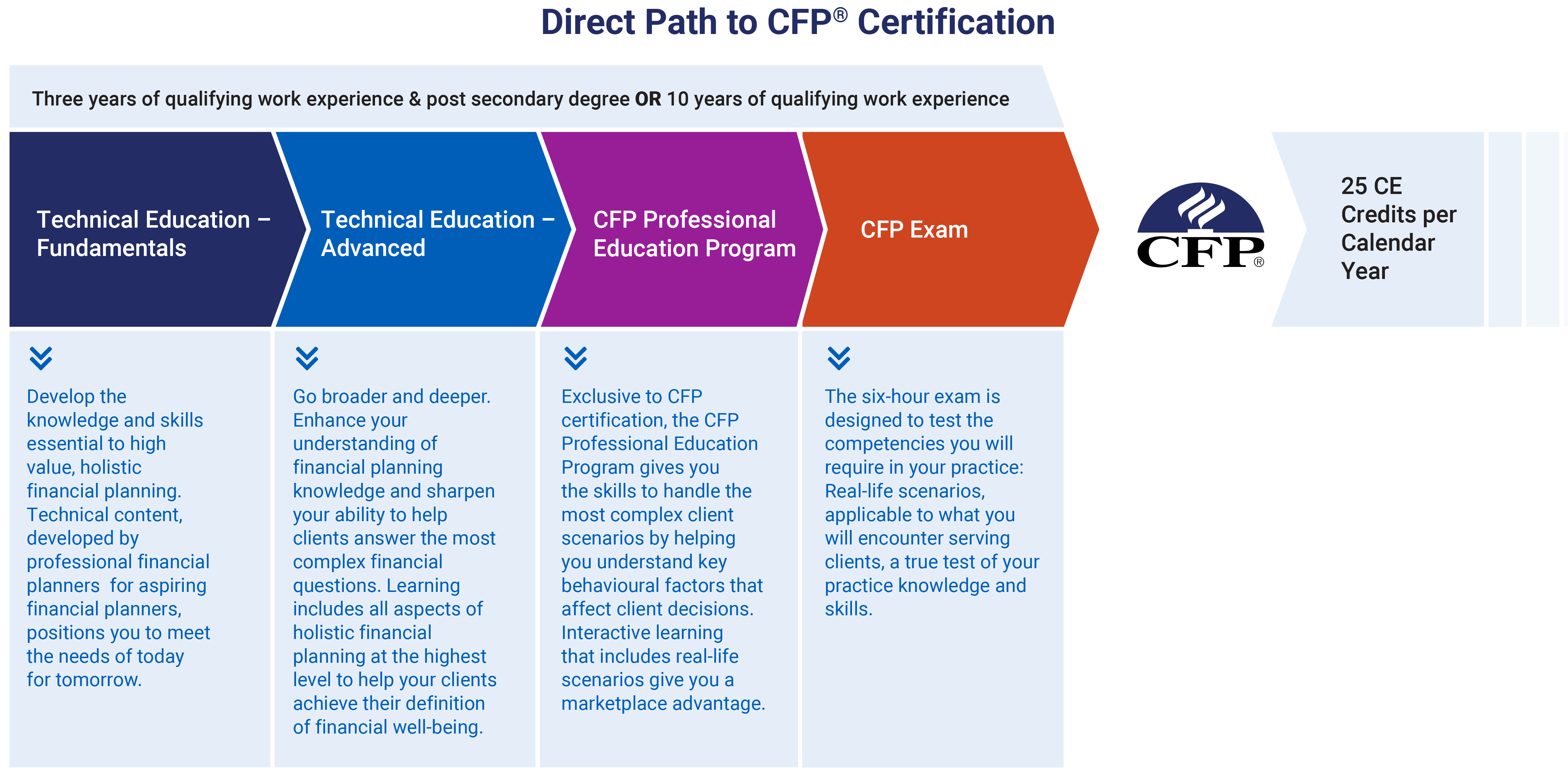

Image Source: fpcanada.ca

In addition to the technical knowledge and skills you gain through financial planning certifications, pursuing these certifications can also help you build a strong professional network and connect with other like-minded professionals in the industry. By attending conferences, workshops, and networking events related to financial planning certifications, you have the opportunity to exchange ideas, share best practices, and collaborate with other professionals who are passionate about advancing their careers and making a positive impact on their clients.

Ultimately, unlocking the benefits of financial planning certifications is about more than just earning a new credential or adding a line to your resume. It’s about investing in yourself, expanding your horizons, and positioning yourself for long-term success and fulfillment in the field of financial planning. So why wait? Dive into the world of financial planning certifications today and unleash your full potential!

Discover the Path to Success with Certified Financial Planning

When it comes to achieving success in the field of financial planning, one of the key components is obtaining the necessary certifications. These certifications not only validate your expertise and knowledge in the industry but also open up a world of opportunities for career advancement and personal growth. In this article, we will explore the benefits of pursuing a Certified Financial Planning (CFP) certification and how it can help you unlock your full potential in the financial planning industry.

Image Source: corporatefinanceinstitute.com

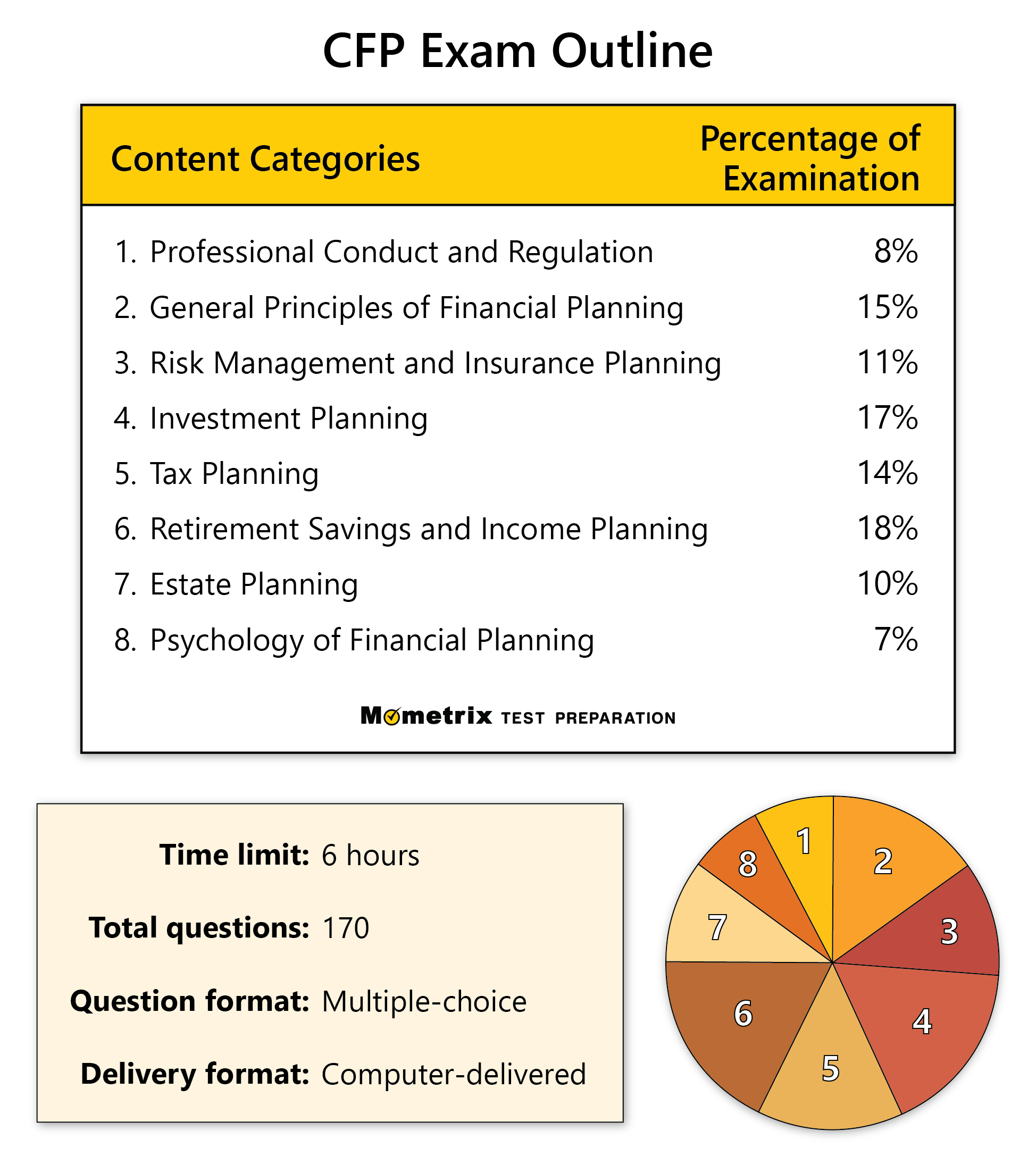

First and foremost, obtaining a CFP certification demonstrates to clients and employers that you have met the rigorous standards set by the Certified Financial Planner Board of Standards. This certification requires a comprehensive understanding of financial planning principles, investment strategies, tax planning, retirement planning, and more. By earning this certification, you are showcasing your dedication to excellence in the field and your commitment to upholding the highest ethical standards.

Furthermore, a CFP certification can significantly enhance your credibility and reputation as a financial planner. Clients are more likely to trust and seek advice from professionals who have demonstrated their expertise through certifications. This can lead to increased client satisfaction and loyalty, as well as referrals and recommendations to new clients. Employers also value CFP certifications when hiring financial planners, as it ensures that their employees have the knowledge and skills necessary to provide top-notch financial advice.

In addition to credibility and trust, a CFP certification can also open up new opportunities for career advancement. Many financial planning firms require their advisors to hold CFP certifications, and some even offer financial incentives for obtaining and maintaining these certifications. With a CFP certification, you may qualify for higher-paying positions, leadership roles, or specialized areas of financial planning such as estate planning or risk management. This can lead to a more fulfilling and rewarding career in the financial planning industry.

:max_bytes(150000):strip_icc()/financialplanner.asp-FINAL-1-55c5c0b665934b9d96cfe8af04fef3a3.png)

Image Source: investopedia.com

Moreover, a CFP certification can provide you with a competitive edge in the job market. In today’s competitive landscape, having a CFP certification sets you apart from other candidates and demonstrates your commitment to professional development. Employers are more likely to consider candidates with certifications, as it shows that they have invested time and effort into furthering their education and skills. This can give you a significant advantage when applying for new job opportunities or seeking promotions within your current organization.

On a personal level, obtaining a CFP certification can also boost your confidence and self-esteem. Knowing that you have achieved a prestigious certification in the financial planning industry can give you a sense of accomplishment and pride in your work. This can motivate you to continue growing and learning in your career, as well as inspire others to pursue their own professional development goals. Additionally, the knowledge and skills gained through the certification process can help you better serve your clients and make a positive impact on their financial well-being.

Overall, pursuing a Certified Financial Planning certification is a valuable investment in your future as a financial planner. It can enhance your credibility, reputation, and career opportunities, as well as provide you with personal satisfaction and growth. By obtaining this certification, you are positioning yourself for success in the financial planning industry and unlocking a wealth of benefits that will propel you towards your professional goals. So, if you are considering taking your financial planning career to the next level, look no further than pursuing a CFP certification and discover the path to success in this dynamic and rewarding industry.

Image Source: pressidium.com

Financial Planning Certifications Explained

Image Source: corporatefinanceinstitute.com

Image Source: kitces.com

:max_bytes(150000):strip_icc()/Cfp_final-cdafe29d5d7046c9913d6ceb1ac9c380.png?w=940&resize=940,0&ssl=1)