Unveiling the Mystery

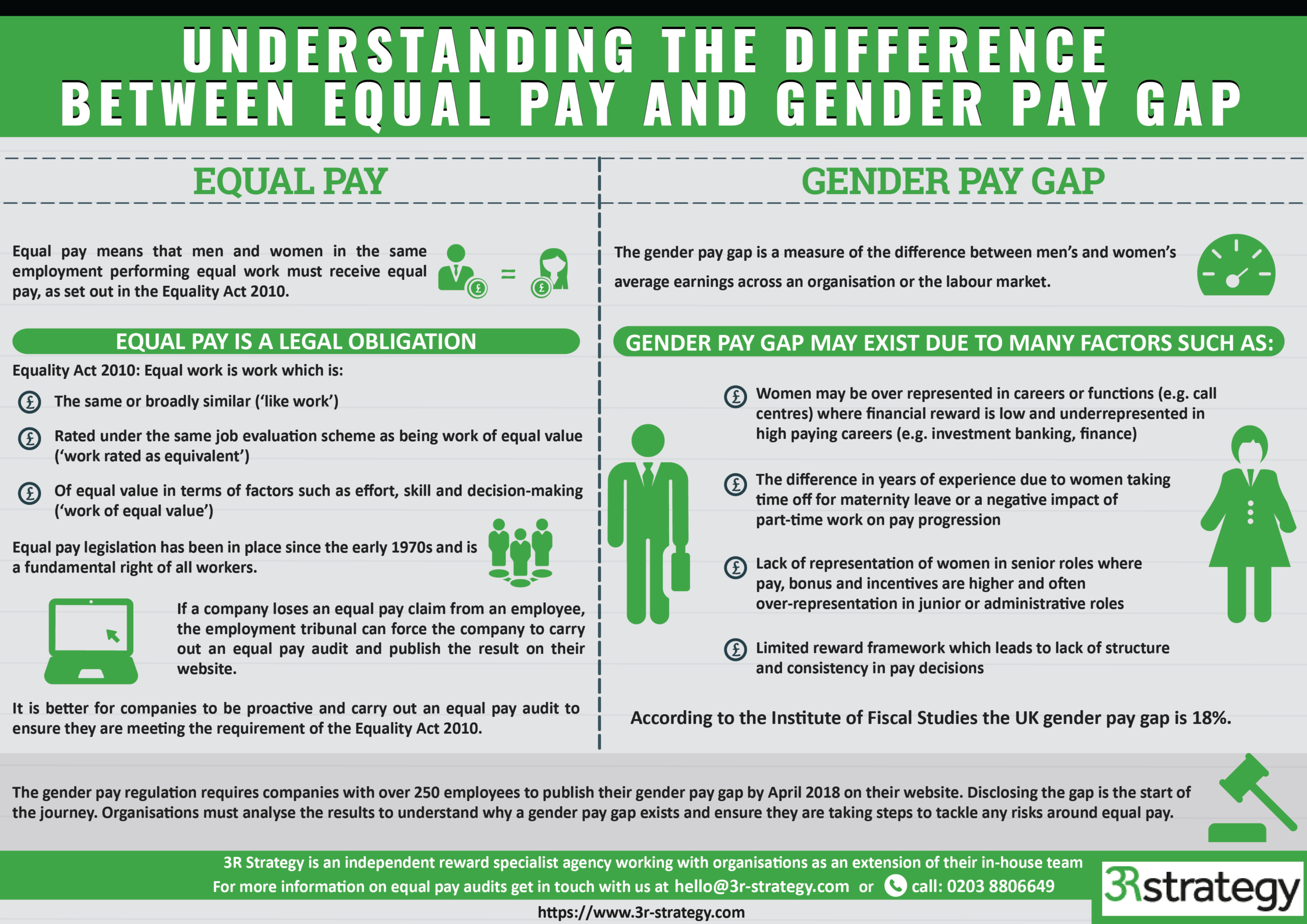

When it comes to the gender pay gap in the finance industry, there is often a shroud of mystery surrounding the reasons behind this inequality. Many people wonder why women are still earning less than their male counterparts in this field, despite making significant strides in education and professional achievement. In order to truly understand and address this issue, it is important to peel back the layers of this mystery and examine the factors at play.

One of the key reasons behind the gender pay gap in finance is the disparity in representation at different levels of the industry. While women make up a significant portion of entry-level positions, they are vastly underrepresented in senior leadership roles. This lack of representation not only limits women’s earning potential but also contributes to a culture of inequality within finance firms. In order to bridge this gap, it is essential for companies to actively work towards promoting gender diversity at all levels of their organizations.

Image Source: 3r-strategy.com

Another contributing factor to the gender pay gap in finance is the presence of unconscious bias in the workplace. Studies have shown that both men and women hold deep-seated biases against women in leadership positions, which can impact their ability to negotiate for higher salaries and promotions. By raising awareness about these biases and implementing training programs to combat them, finance firms can create a more level playing field for all employees.

Additionally, the lack of transparency around salary and promotion decisions in the finance industry can also perpetuate the gender pay gap. Without clear guidelines and metrics for determining compensation, women may be at a disadvantage when it comes to negotiating for fair pay. By implementing more transparent and equitable practices around salary and promotion decisions, finance firms can help to close the gender pay gap and create a more inclusive work environment.

In order to address the gender pay gap in finance, it is important for companies to take a comprehensive approach that addresses the root causes of inequality. By promoting gender diversity, combating unconscious bias, and fostering transparency in decision-making processes, finance firms can create a more equitable workplace for all employees. It is only through a concerted effort to understand and challenge the factors contributing to the gender pay gap that real progress can be made towards achieving gender equality in the finance industry.

A Closer Look at Inequality

Image Source: website-files.com

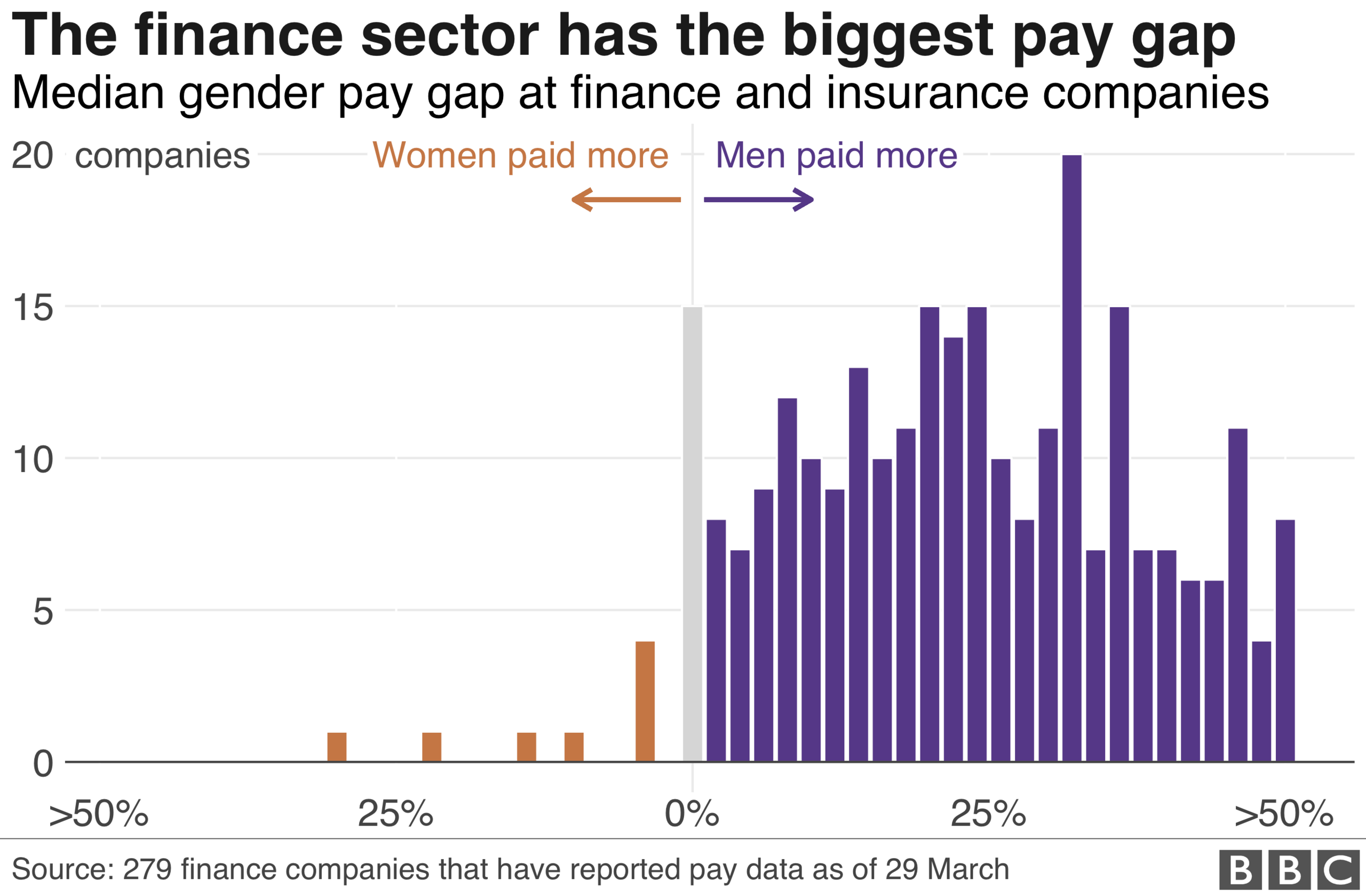

When discussing the gender pay gap in the finance industry, it is important to take a closer look at the underlying causes of inequality. While progress has been made in recent years towards closing the gap, disparities still exist that need to be addressed.

One of the main factors contributing to the gender pay gap in finance is the lack of representation of women in leadership positions. According to a study by Catalyst, women make up only 29% of executive positions in the finance industry. This lack of female representation at the top levels of the industry can lead to unequal pay, as women may not have the same opportunities for advancement and higher salaries as their male counterparts.

Additionally, women in finance often face challenges when it comes to negotiating salaries and promotions. Research has shown that women are less likely to negotiate for higher pay than men, which can result in lower salaries and fewer opportunities for career advancement. This can perpetuate the gender pay gap, as women may not be able to reach the same levels of compensation as their male colleagues.

Image Source: bbci.co.uk

Another factor that contributes to the gender pay gap in finance is the issue of unconscious bias. Studies have shown that both men and women hold unconscious biases against women in leadership positions, which can affect their opportunities for advancement and pay. These biases can lead to women being overlooked for promotions and raises, further contributing to the gender pay gap.

Furthermore, the finance industry has historically been dominated by men, creating a culture that may be unwelcoming to women. This lack of diversity can make it difficult for women to succeed in the industry, as they may face discrimination and harassment in the workplace. This can lead to women leaving the industry altogether, further exacerbating the gender pay gap.

To address the gender pay gap in finance, companies need to take proactive steps to promote gender equality in the workplace. This can include implementing policies to ensure equal pay for equal work, providing training on unconscious bias, and creating mentorship and leadership development programs for women. By creating a more inclusive and supportive work environment, companies can help to close the gender pay gap and promote greater diversity in the finance industry.

Image Source: finhealthnetwork.org

In conclusion, the gender pay gap in finance is a complex issue that requires a closer look at the underlying causes of inequality. By addressing factors such as the lack of female representation in leadership positions, challenges with salary negotiation, unconscious bias, and workplace culture, companies can work towards closing the gap and promoting greater gender equality in the industry. It is important for companies to take proactive steps to promote equality and create a more inclusive work environment for all employees.

Pay Gap in Finance: What You Need to Know

Image Source: website-files.com