Bright Horizons: Financial Analysts in Malaysia

The future of financial analysts in Malaysia is looking brighter than ever, with exciting opportunities on the horizon and projected average salary trends indicating lucrative prospects for those in the field. As the demand for financial analysts continues to rise, so does the potential for growth and advancement in this dynamic industry.

Financial analysts play a crucial role in helping businesses make informed decisions by analyzing financial data, identifying trends, and providing valuable insights to drive strategic planning and investment decisions. In Malaysia, the demand for skilled financial analysts is expected to increase significantly by 2025, creating a wealth of opportunities for those looking to pursue a career in this field.

Image Source: sunwayuniversity.edu.my

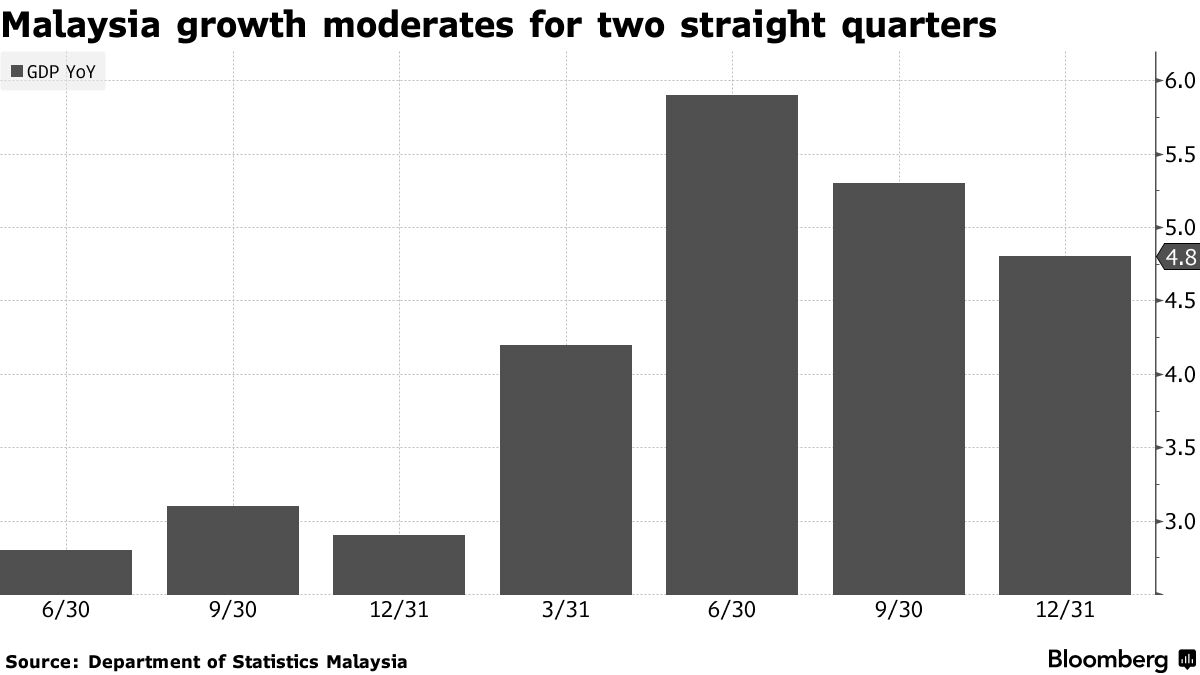

One of the key factors driving the demand for financial analysts in Malaysia is the country’s growing economy and expanding financial sector. As businesses continue to expand and diversify, the need for qualified professionals to help navigate the complex world of finance and investments becomes increasingly important. This has created a high demand for skilled financial analysts who can provide expert guidance and analysis to support business growth and success.

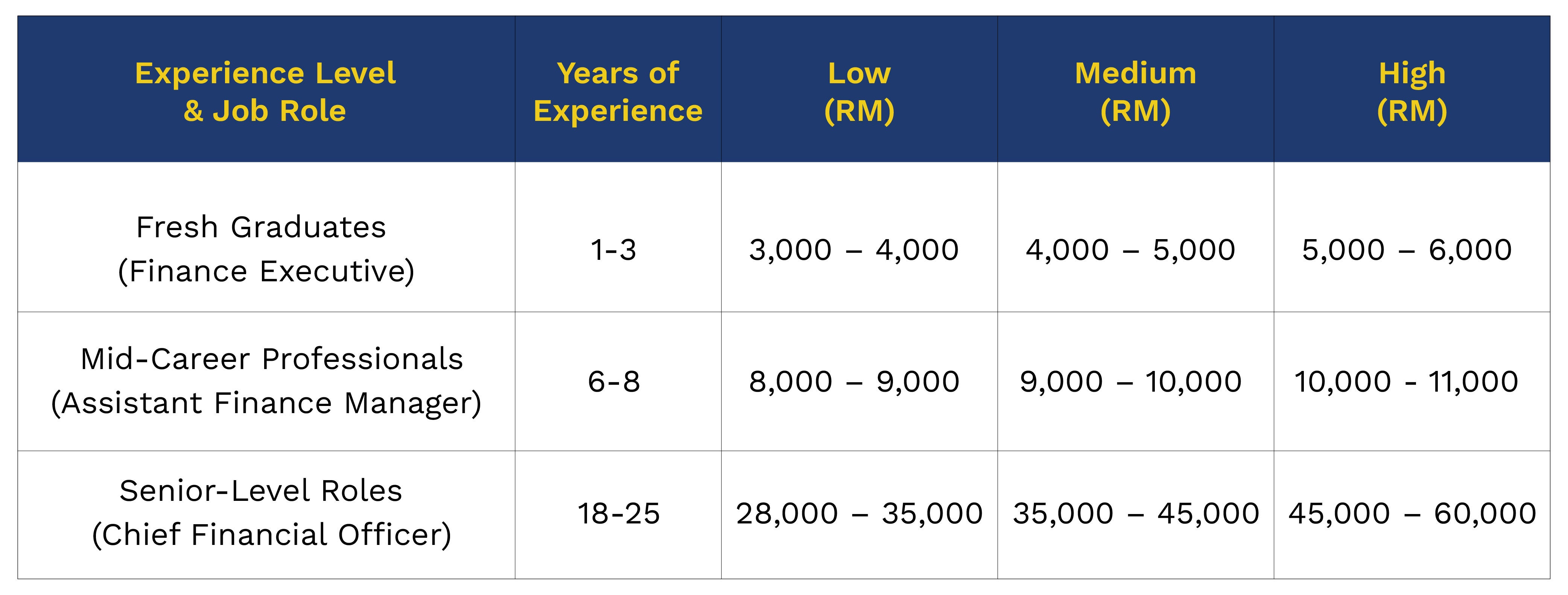

In addition to the growing demand for financial analysts, the projected average salary trends for 2025 are also quite promising. With the increasing complexity of financial markets and the need for specialized skills in areas such as risk management, investment analysis, and financial modeling, employers are willing to pay top dollar for talented financial analysts who can deliver results.

According to industry experts, the average salary for financial analysts in Malaysia is expected to increase significantly by 2025, with top performers in the field commanding even higher salaries. This trend is driven by a combination of factors, including the increasing demand for specialized skills, the growing complexity of financial markets, and the rising importance of data-driven decision-making in today’s business environment.

Image Source: sunwayuniversity.edu.my

For aspiring financial analysts in Malaysia, this is great news. Not only does the field offer exciting opportunities for growth and advancement, but the potential for a lucrative salary is also very promising. With the right skills, education, and experience, financial analysts in Malaysia can look forward to a bright future filled with opportunities for success and fulfillment.

In conclusion, the future of financial analysts in Malaysia is looking very bright indeed. With growing demand, exciting opportunities, and projected average salary trends indicating a promising outlook for 2025, now is a great time to pursue a career in this dynamic and rewarding field. As businesses continue to expand and evolve, the need for skilled financial analysts will only increase, creating a wealth of opportunities for those looking to make their mark in the world of finance.

Salary Projections for 2025: Exciting Outlook ahead

As we look ahead to the future of financial analysts in Malaysia, one of the most exciting factors to consider is the projected average salary trends for 2025. The landscape of the financial industry is constantly evolving, and with it, so too are the opportunities and earning potential for professionals in this field.

Image Source: housingwatch.my

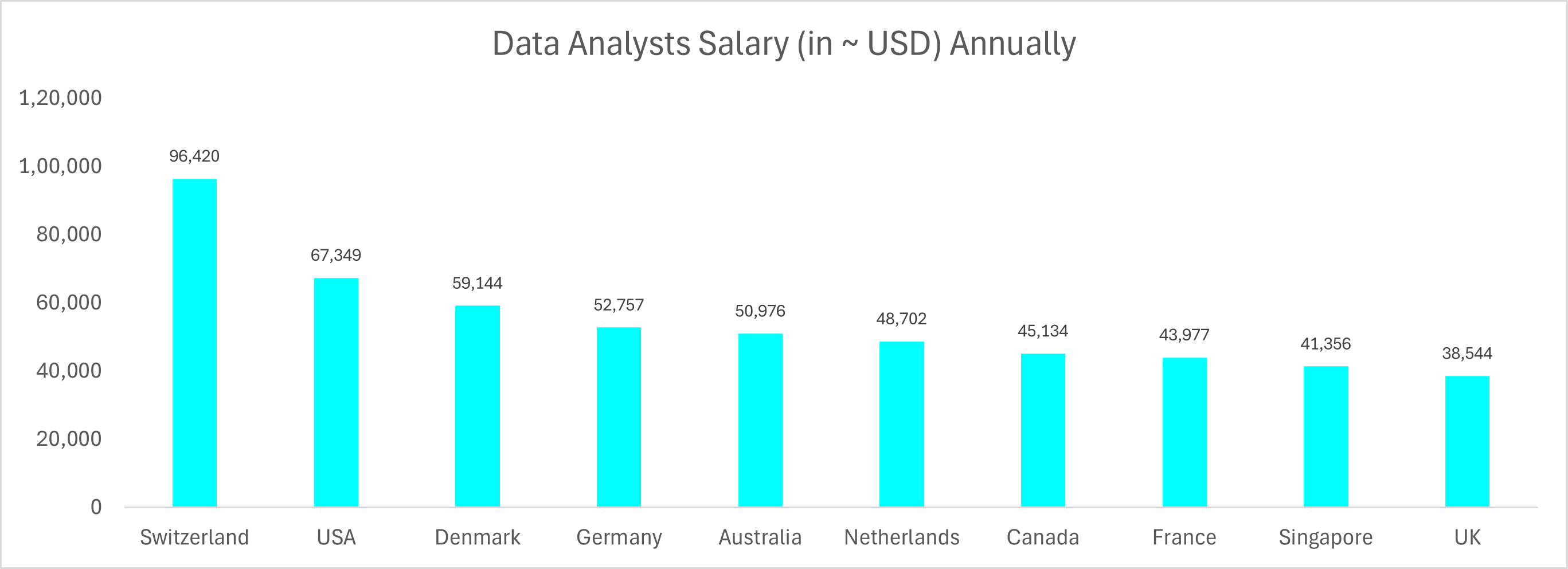

According to recent studies and industry experts, financial analysts in Malaysia can expect to see a significant increase in their average salary by the year 2025. This is due to a variety of factors, including the growing demand for skilled financial professionals, advancements in technology and data analytics, and the overall economic growth of the country.

One of the key drivers behind the projected salary growth for financial analysts in Malaysia is the increasing complexity of the global financial markets. As companies expand their operations internationally and explore new investment opportunities, there is a growing need for skilled analysts who can navigate these complexities and provide valuable insights and recommendations.

In addition, the rise of digital technology and data analytics has also had a significant impact on the role of financial analysts. With the increasing volume of data available to companies, analysts are now able to gather more information and make more informed decisions than ever before. This has led to a higher demand for analysts who possess strong quantitative and analytical skills, as well as the ability to interpret and communicate complex financial information.

Image Source: instarem.com

Another factor contributing to the exciting salary projections for financial analysts in Malaysia is the overall economic growth of the country. As Malaysia continues to develop and expand its financial sector, there will be a greater need for skilled professionals who can help companies navigate the complexities of the market and make sound financial decisions.

Overall, the future looks bright for financial analysts in Malaysia. With a projected increase in average salaries by 2025, professionals in this field can expect to see greater opportunities for career advancement, higher earning potential, and a more rewarding work environment. As the financial industry continues to evolve, so too will the role of the financial analyst – and with it, the opportunities for growth and success in this dynamic field.

Image Source: multiply.org.my

Average Salary for Financial Analysts in Malaysia (2025 Update)

Image Source: timedoctor.com

Image Source: bwbx.io