Climbing the Corporate Ladder: How to Ask for a Promotion

Are you feeling stuck in your current position at work? Are you ready to take the next step in your career and climb the corporate ladder? Asking for a promotion can be a daunting task, but with the right approach and mindset, you can successfully advance your career and achieve your professional goals. In this article, we will discuss some tips and strategies on how to ask for a promotion, along with real-life examples that will inspire and motivate you to take action.

Before you approach your boss and ask for a promotion, it’s important to prepare yourself both mentally and professionally. Take some time to reflect on your accomplishments, skills, and contributions to the company. Make a list of your achievements and the value you have added to your team and the organization as a whole. This will not only boost your confidence but also help you make a strong case for why you deserve a promotion.

Image Source: squarespace-cdn.com

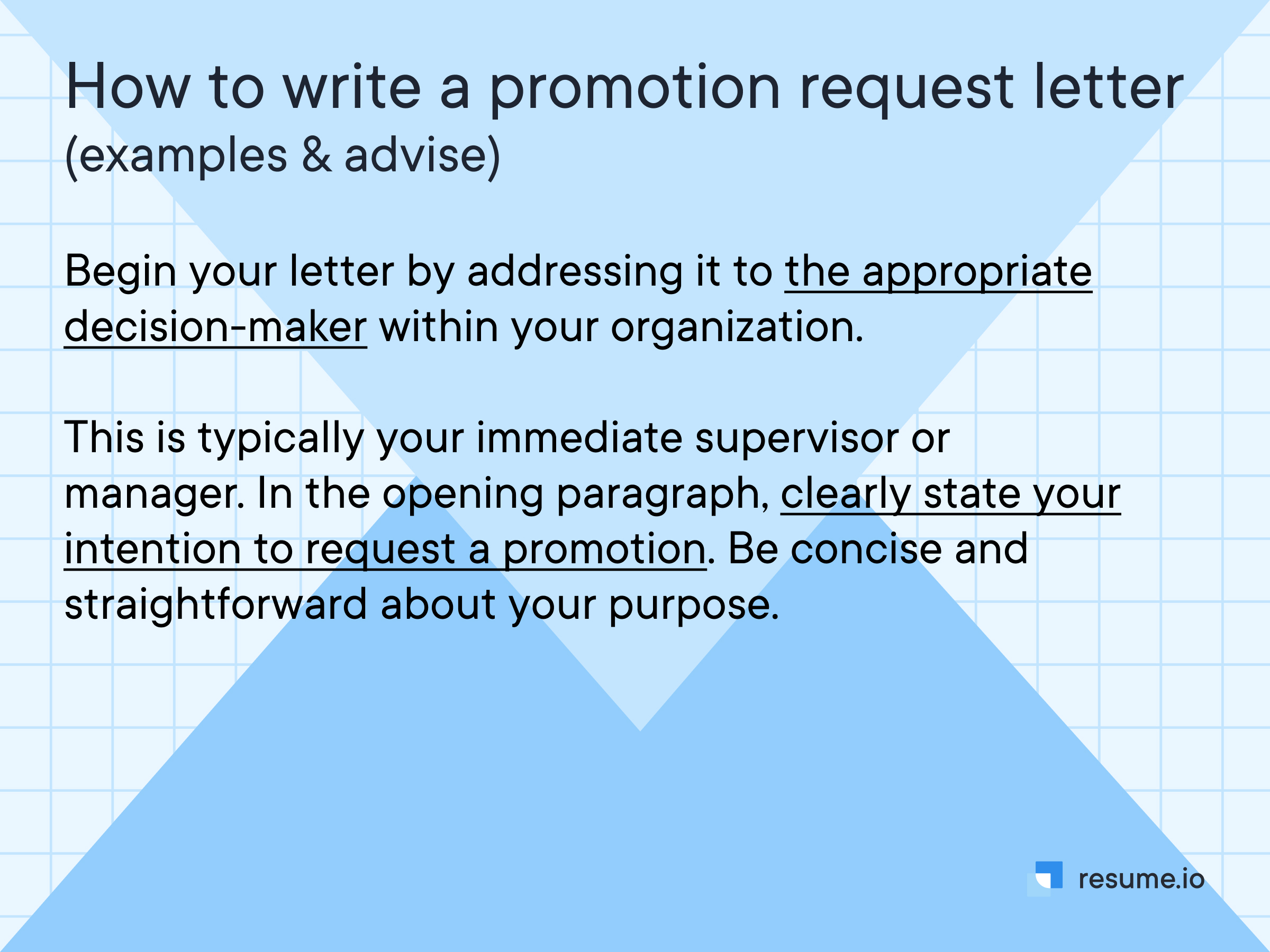

Next, do some research on the typical promotion process at your company. Find out what criteria are usually considered when evaluating candidates for promotions, such as performance reviews, tenure, and leadership potential. This will give you a better understanding of what is expected of you and how you can position yourself as a top candidate for advancement.

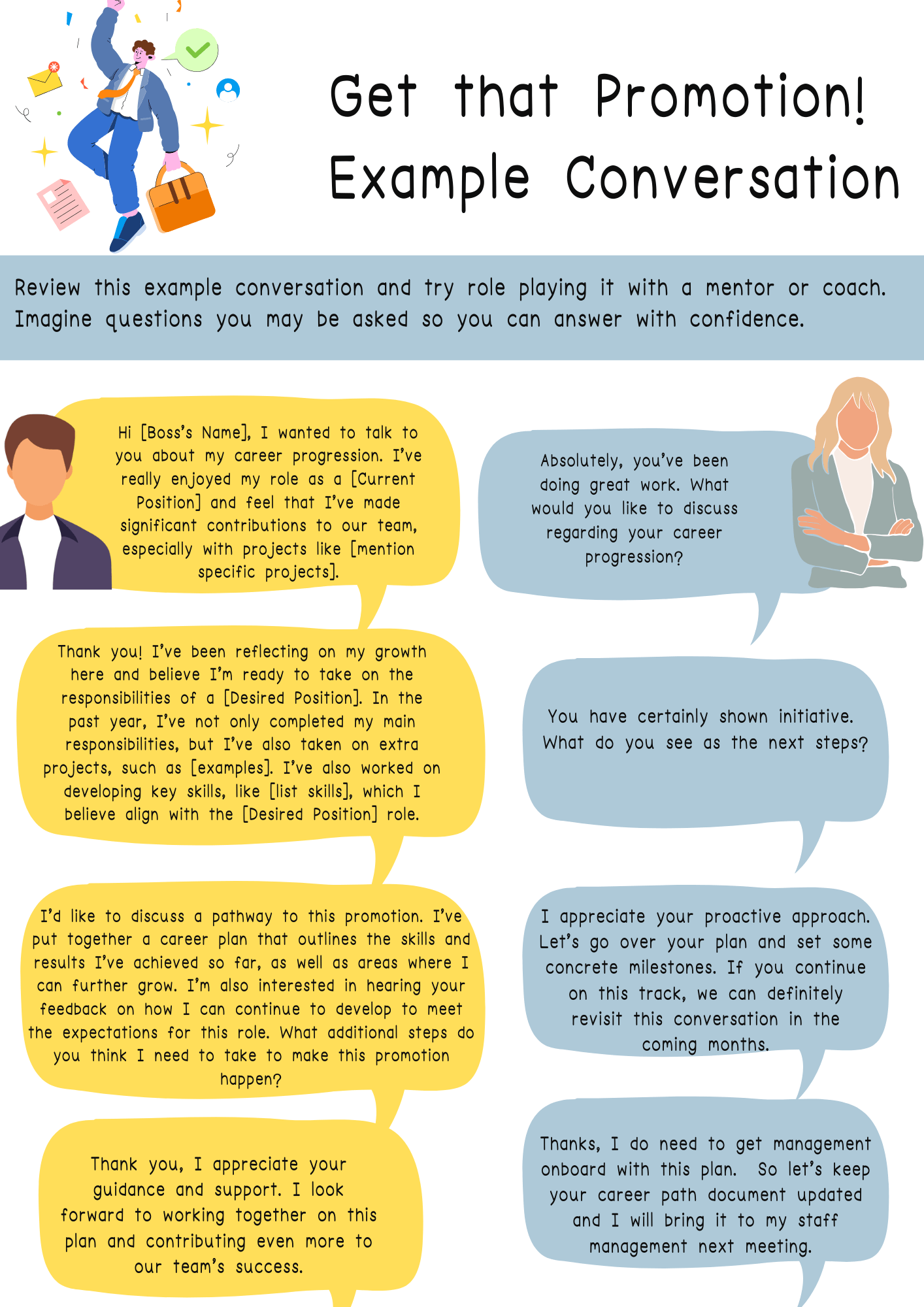

Once you have done your homework, schedule a meeting with your boss to discuss your career goals and aspirations. Be clear and direct about your intentions to seek a promotion, but also be open to feedback and suggestions for improvement. Show your enthusiasm and commitment to taking on new challenges and responsibilities, and emphasize how your skills and experience align with the requirements of the new role.

During the meeting, make sure to present your accomplishments and achievements in a concise and compelling manner. Use specific examples and metrics to illustrate your success and impact on the company. Highlight any projects or initiatives that you have led or contributed to, and demonstrate your ability to take on more responsibilities and deliver results.

Image Source: cke-cs.com

It’s also important to communicate your long-term vision for your career and how a promotion would help you achieve your goals. Share your passion for growth and development, and explain how the new role aligns with your professional aspirations. By showing your dedication and commitment to your career advancement, you will make a strong impression on your boss and increase your chances of getting promoted.

To further strengthen your case for a promotion, consider seeking endorsements and recommendations from colleagues, mentors, or other stakeholders in the company. Ask for their support and feedback on your performance and potential for advancement, and use their testimonials to bolster your credibility and credibility.

In conclusion, asking for a promotion can be a nerve-wracking experience, but with the right approach and mindset, you can successfully advance your career and climb the corporate ladder. By preparing yourself, doing your research, and presenting a strong case for why you deserve a promotion, you can increase your chances of success and achieve your professional goals. Remember to stay positive, confident, and proactive in pursuing your career advancement, and you will be well on your way to reaching new heights in your professional journey.

Real-life Success Stories: Strategies for Career Advancement

Image Source: templatelab.com

In the world of professional development, there is no shortage of advice on how to climb the corporate ladder and ask for a promotion. But sometimes, the best guidance comes not from textbooks or seminars, but from real-life success stories. These stories offer a glimpse into the strategies and techniques that have helped individuals advance their careers and achieve their goals.

One such success story comes from Sarah, a marketing manager at a Fortune 500 company. Sarah had been with the company for several years and had consistently exceeded her performance targets. Despite her hard work and dedication, she felt stuck in her current position and knew she was capable of more. So, she gathered her courage and scheduled a meeting with her supervisor to discuss her career goals and ambitions.

During the meeting, Sarah outlined her accomplishments, highlighted her skills and strengths, and made a compelling case for why she deserved a promotion. She also expressed her willingness to take on additional responsibilities and pursue further professional development opportunities. To her delight, her supervisor was impressed by her initiative and drive, and agreed to support her in her quest for advancement.

![image.title Free Printable Promotion Letter Templates [Word, PDF] Employee image.title Free Printable Promotion Letter Templates [Word, PDF] Employee](https://www.typecalendar.com/wp-content/uploads/2023/04/Promotion-Letter.jpg)

Image Source: typecalendar.com

Another inspiring success story comes from Alex, a software engineer at a tech startup. Alex had always been passionate about coding and technology, and had a natural talent for problem-solving. However, he struggled to assert himself and advocate for his own career advancement. That is, until he attended a networking event and connected with a senior executive from another company.

Through their conversations, Alex learned valuable insights and tips on how to position himself for success in the tech industry. He was encouraged to showcase his projects and achievements, build relationships with key stakeholders, and seek out mentorship opportunities. Armed with this newfound knowledge, Alex took bold steps to showcase his skills and expertise within his organization. His efforts paid off when he was promoted to a senior developer role, with a significant pay raise and greater responsibilities.

These real-life success stories highlight some key strategies for career advancement:

Image Source: slideserve.com

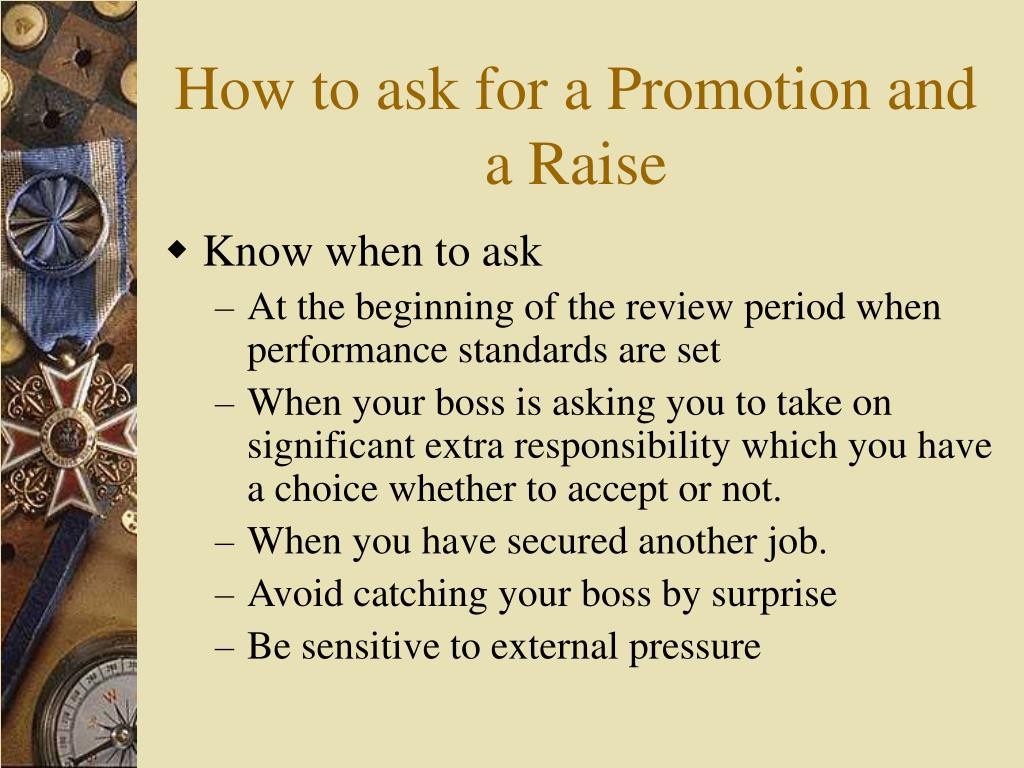

1. Self-awareness: Take the time to reflect on your skills, strengths, and areas for improvement. Understand what sets you apart from your peers and how you can leverage your unique talents to advance your career.

2. Proactive communication: Don’t wait for opportunities to come to you – create them. Schedule meetings with your supervisors to discuss your career goals, seek feedback on your performance, and make a case for why you deserve a promotion.

3. Networking: Build relationships with colleagues, mentors, and industry professionals who can support you in your career journey. Attend networking events, conferences, and workshops to expand your professional network and gain valuable insights.

4. Continuous learning: Invest in your professional development by pursuing further education, certifications, or training programs. Stay up-to-date on industry trends and technologies to remain competitive in your field.

By following these strategies and learning from real-life success stories, you can advance your career and achieve your professional goals. Remember, success is not a destination, but a journey – so take the first step towards your future today.

How to Ask for a Promotion (With Examples)