Get Your Financial Groove On: 10 Tips for Boosting Motivation!

Studying finance can be a daunting task, especially when you’re faced with complex equations and intricate concepts. However, with the right mindset and strategies, you can boost your motivation and make studying finance a fun and rewarding experience. Here are 10 tips to help you get your financial groove on:

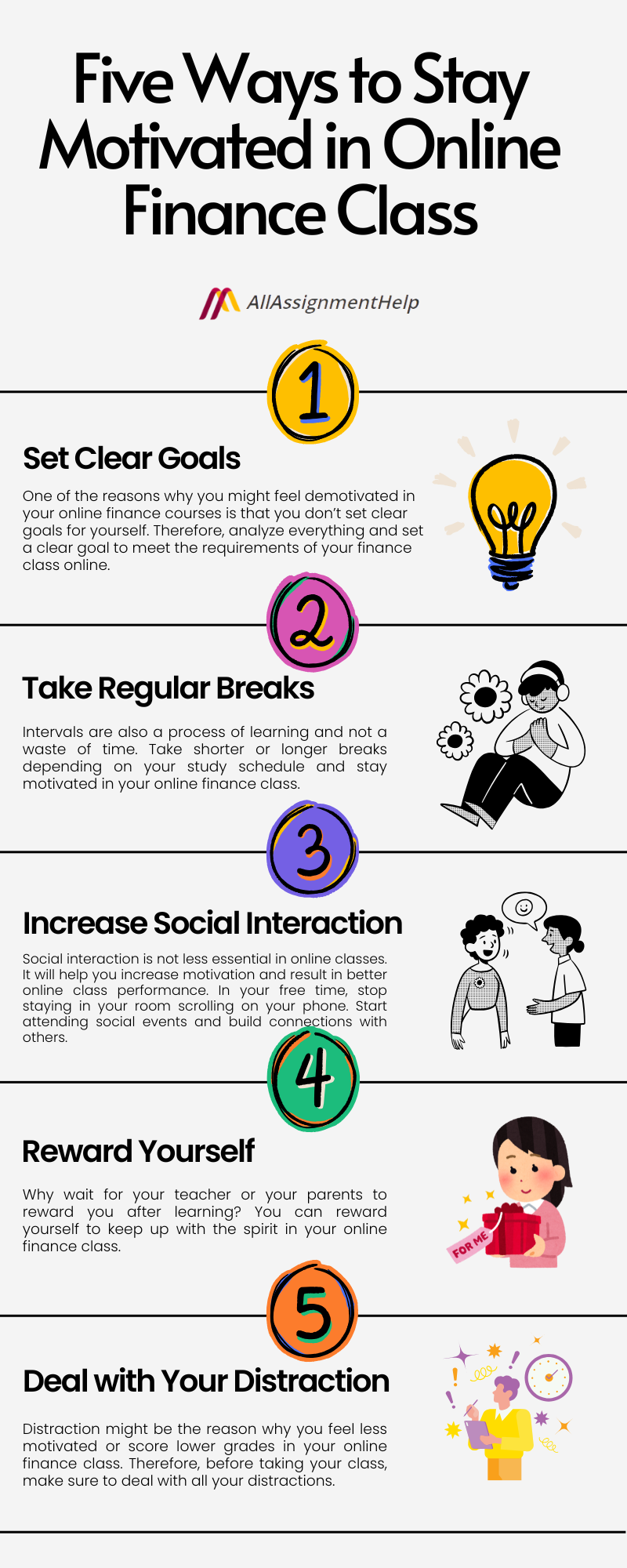

1. Set Clear Goals: Before you start studying finance, take some time to set clear and achievable goals for yourself. Whether you want to ace your finance exam or land a job in the finance industry, having a clear goal in mind will give you the motivation to work towards it.

Image Source: allassignmenthelp.com

2. Create a Study Schedule: To stay motivated while studying finance, it’s important to create a study schedule that works for you. Set aside dedicated time each day to review your notes, practice problems, and work on assignments. By sticking to a schedule, you’ll stay on track and make steady progress towards your goals.

3. Find a Study Buddy: Studying finance can be more enjoyable and motivating when you have a study buddy to work with. Find a classmate or friend who is also studying finance and schedule study sessions together. You can quiz each other, discuss challenging concepts, and keep each other accountable.

4. Take Breaks: It’s important to take regular breaks while studying finance to avoid burnout and stay motivated. Set a timer for 25-30 minutes of focused study time, followed by a 5-10 minute break. Use your break to stretch, grab a snack, or take a quick walk to refresh your mind.

Image Source: capitalone.com

5. Reward Yourself: To boost your motivation while studying finance, reward yourself for reaching milestones and achieving goals. Treat yourself to a movie night, a shopping spree, or a relaxing day at the spa after completing a challenging assignment or acing a difficult exam.

6. Stay Organized: Keep your study materials organized and easily accessible to stay motivated while studying finance. Use folders, binders, and digital tools to keep track of your notes, assignments, and study resources. A clutter-free study space will help you stay focused and motivated.

7. Stay Positive: Maintaining a positive attitude can go a long way in boosting your motivation while studying finance. Instead of focusing on the challenges and difficulties, remind yourself of your strengths and accomplishments. Stay positive, stay focused, and stay motivated to succeed in your finance studies.

Image Source: thebudgetbrigade.com

8. Seek Help When Needed: Don’t be afraid to seek help when you’re struggling with a difficult concept or assignment. Reach out to your professor, classmates, or online resources for assistance. Asking for help shows strength and determination, and it can help you stay motivated and make progress in your finance studies.

9. Mix It Up: Keep your finance studies interesting and engaging by mixing up your study routine. Try different study methods, such as flashcards, practice problems, and group discussions. Changing up your routine will keep you motivated and prevent boredom while studying finance.

10. Visualize Your Success: To boost your motivation while studying finance, take some time to visualize your success. Imagine yourself acing your finance exam, landing your dream job in the finance industry, or starting your own successful business. By visualizing your success, you’ll stay motivated and inspired to work towards your goals.

Image Source: medium.com

With these 10 tips, you can get your financial groove on and stay motivated while studying finance. Remember to set clear goals, create a study schedule, find a study buddy, take breaks, reward yourself, stay organized, stay positive, seek help when needed, mix up your study routine, and visualize your success. Keep pushing forward, stay motivated, and you’ll achieve great success in your finance studies!

Fueling Your Finance Study Fire: 10 Tips to Stay Inspired!

Studying finance can be a challenging and demanding task. With complex concepts, numbers, and calculations, it’s easy to feel overwhelmed and burnt out. However, staying motivated and inspired while studying finance is crucial to your success. Here are 10 tips to help you fuel your finance study fire and stay inspired throughout your journey:

1. Set Clear Goals: Before you start studying finance, take some time to set clear and achievable goals for yourself. Whether it’s passing a certain exam, landing a job in the finance industry, or simply improving your financial literacy, having a clear goal in mind will give you something to strive towards.

.png)

Image Source: paulcardrecruitment.co.uk

2. Create a Study Schedule: To stay on track and motivated, create a study schedule that works for you. Whether you prefer studying in short bursts or long stretches, make sure to allocate specific time slots for studying finance each day. This will help you stay organized and focused on your goals.

3. Find Your Study Environment: A conducive study environment is essential for staying motivated while studying finance. Whether you prefer studying in a quiet library, a cozy cafe, or your own Bedroom, find a space that helps you concentrate and stay focused on your studies.

4. Take Breaks: It’s important to give yourself regular breaks while studying finance to avoid burnout. Take short breaks every hour to stretch, relax, and recharge your mind. This will help you stay motivated and maintain your focus throughout your study sessions.

Image Source: wisdomhub.ca

5. Stay Positive: Positivity is key to staying motivated while studying finance. Instead of focusing on the challenges and obstacles, try to maintain a positive mindset and believe in your abilities to succeed. Celebrate your small victories and stay optimistic about your progress.

6. Seek Support: Studying finance can be a challenging journey, but you don’t have to go through it alone. Seek support from your friends, family, classmates, or professors to stay motivated and inspired. Join study groups, attend workshops, or seek mentorship to keep yourself motivated and on track.

7. Reward Yourself: To stay motivated while studying finance, reward yourself for reaching milestones and achieving your goals. Treat yourself to a movie night, a spa day, or a delicious meal to celebrate your hard work and dedication. Rewards can help you stay motivated and inspired throughout your finance study journey.

Image Source: rdfr.co.uk

8. Stay Organized: Staying organized is essential for staying motivated while studying finance. Keep track of your study materials, notes, and deadlines to avoid feeling overwhelmed and stressed. Use planners, calendars, or apps to stay organized and on top of your finance studies.

9. Mix It Up: To keep yourself engaged and motivated while studying finance, try mixing up your study routine. Explore different study methods, techniques, and resources to keep things interesting and challenging. This will help you stay inspired and motivated to continue learning and growing.

10. Remember Your Why: Finally, to stay motivated while studying finance, remember your why. Whether it’s pursuing your passion for finance, advancing your career, or achieving financial independence, remind yourself of the reasons why you started studying finance in the first place. This will help you stay motivated, inspired, and focused on your goals.

Image Source: onedigital.com

In conclusion, staying motivated and inspired while studying finance is crucial for your success. By setting clear goals, creating a study schedule, finding a conducive study environment, taking breaks, staying positive, seeking support, rewarding yourself, staying organized, mixing up your study routine, and remembering your why, you can fuel your finance study fire and stay inspired throughout your journey. Stay motivated, stay inspired, and reach for your finance study goals!

How to Stay Motivated When Studying Finance