Unleash Your Potential: Learn SQL for Finance Success

Are you looking to advance your career in the finance industry? Do you want to stand out from the crowd and boost your earning potential? If so, learning SQL could be the key to your success.

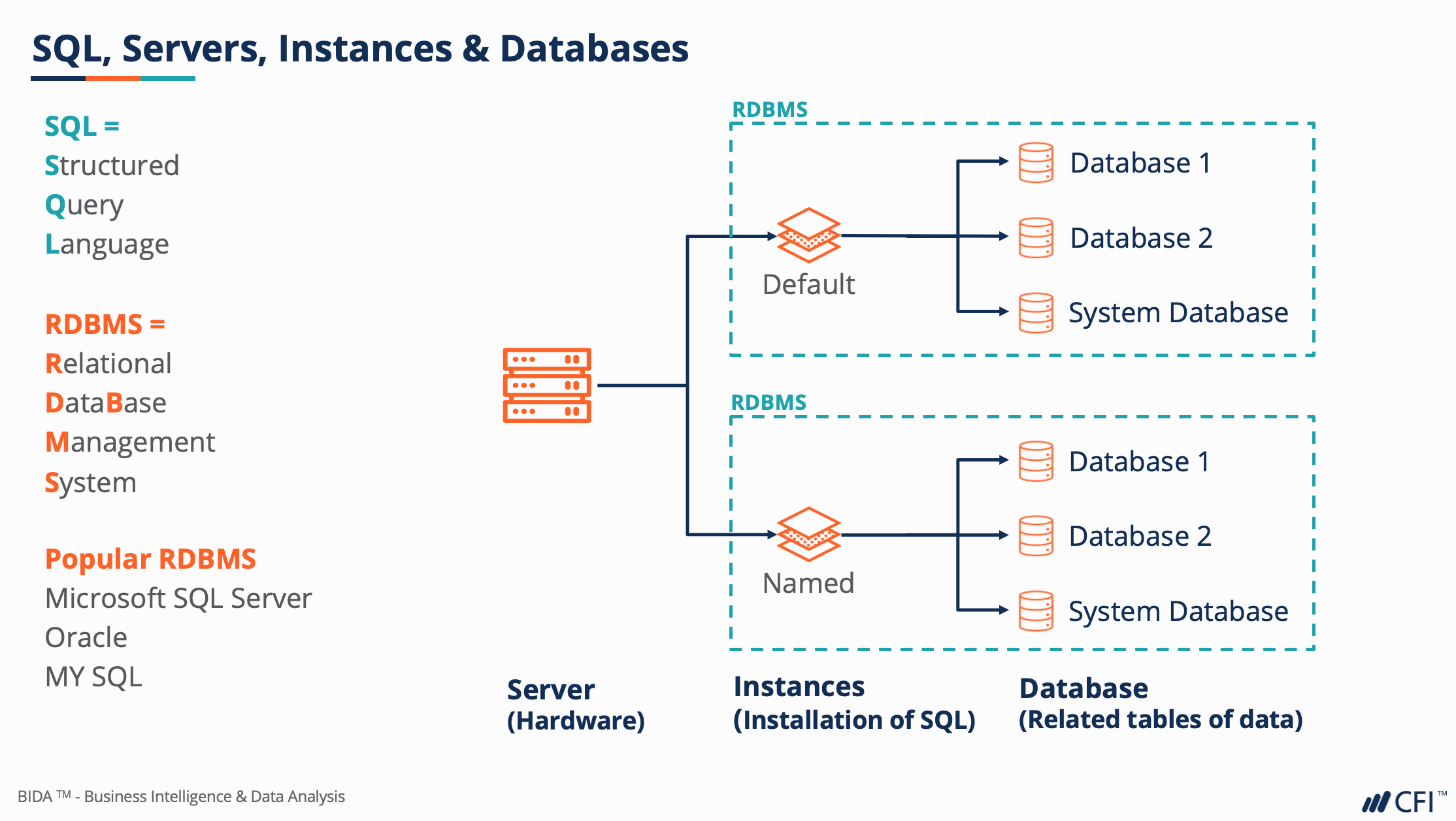

SQL, which stands for Structured Query Language, is a powerful tool used for managing and manipulating data in databases. In the finance world, where data is king, having a strong understanding of SQL can open up a world of opportunities for you.

Image Source: website-files.com

One of the main reasons why learning SQL is essential for a successful finance career is that it allows you to analyze and interpret large amounts of data quickly and efficiently. As a finance professional, you will often be tasked with making sense of complex financial data to help make informed decisions. By mastering SQL, you can streamline this process and become a valuable asset to your team.

Furthermore, SQL is widely used in the finance industry for tasks such as financial reporting, risk management, and regulatory compliance. By having a strong grasp of SQL, you can not only perform these tasks more effectively but also impress your superiors with your technical skills and expertise.

Another benefit of learning SQL for finance success is that it can help you advance in your career. As more and more companies rely on data-driven decision-making, professionals who can work with data efficiently are in high demand. By adding SQL to your skillset, you can set yourself apart from other candidates and increase your chances of landing that promotion or securing a higher-paying job.

Image Source: corporatefinanceinstitute.com

Moreover, learning SQL can also lead to increased job security. In today’s rapidly evolving business landscape, automation and artificial intelligence are becoming increasingly common in the finance industry. By being proficient in SQL, you can adapt to these changes more easily and ensure that you remain relevant and valuable in the workforce.

In addition to its practical applications, learning SQL can also be a fun and rewarding experience. The process of writing SQL queries to extract and manipulate data can be like solving a puzzle, and the feeling of successfully retrieving the information you need can be incredibly satisfying. As you continue to hone your SQL skills, you may even discover a passion for data analysis and embark on a new and exciting career path within the finance industry.

So, if you’re looking to unleash your potential and achieve success in the finance world, learning SQL is a must. Whether you’re a seasoned finance professional or just starting out in your career, mastering SQL can open doors and propel you towards your goals. Don’t wait any longer – dive into the world of SQL and take your finance career to new heights.

Elevate Your Career with SQL Mastery in Finance

Image Source: corporatefinanceinstitute.com

Are you looking to take your finance career to the next level? Do you want to stand out from the competition and unlock new opportunities for growth and advancement? If so, mastering SQL could be the key to achieving your goals.

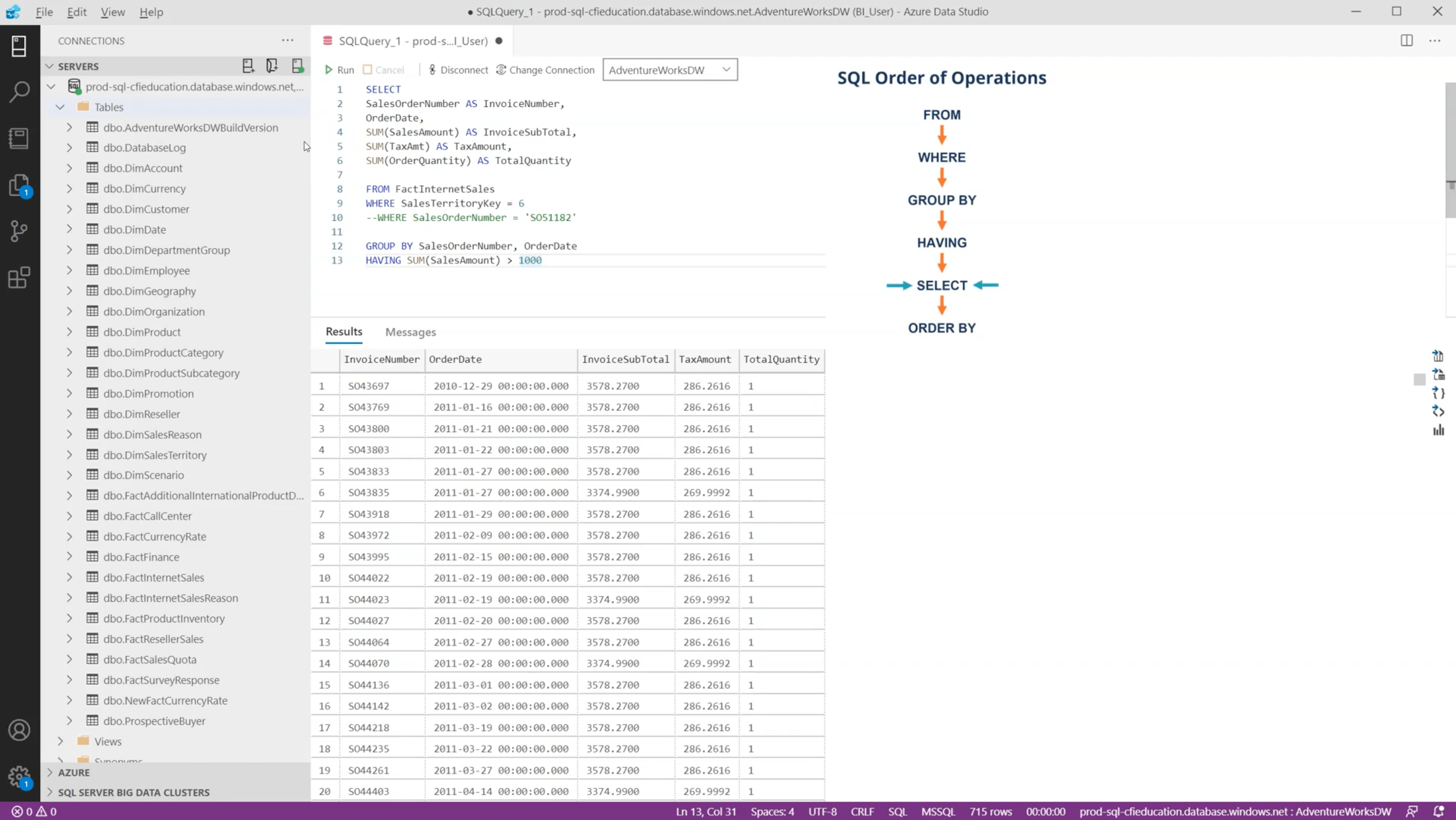

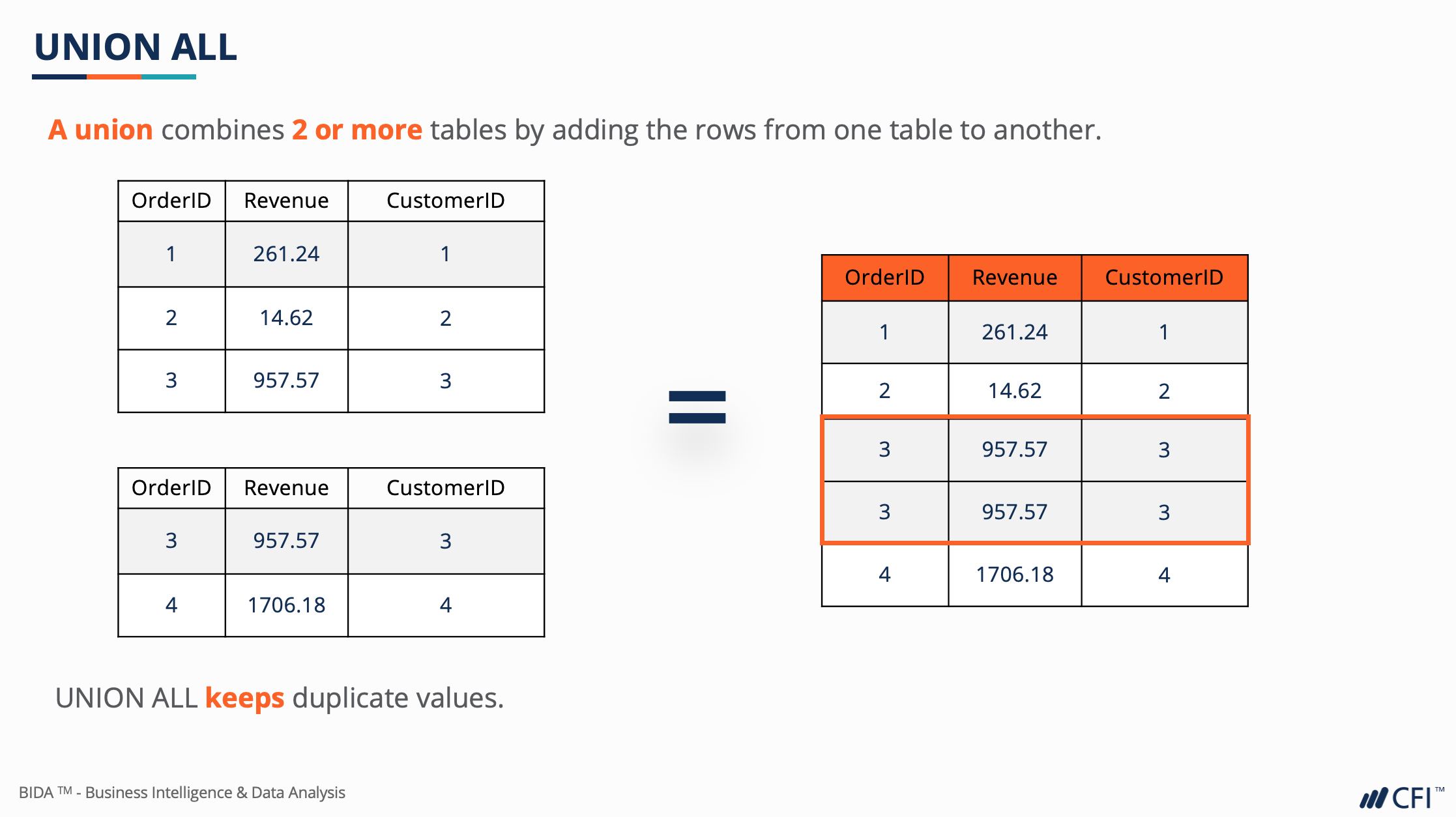

SQL, or Structured Query Language, is a powerful tool that is used to communicate with databases. In the world of finance, where data is king, having a strong understanding of SQL can give you a significant advantage. By learning SQL, you can analyze large datasets, extract valuable insights, and make informed decisions that drive business success.

One of the main reasons why mastering SQL is essential for a successful finance career is that it allows you to access and manipulate data quickly and efficiently. In today’s fast-paced business environment, the ability to work with data in real-time is crucial. By using SQL, you can write queries that retrieve specific information from databases in a matter of seconds, giving you the information you need to make important decisions on the spot.

Image Source: corporatefinanceinstitute.com

Furthermore, SQL mastery can also help you streamline your workflow and increase your productivity. Instead of spending hours manually sorting through spreadsheets and reports, you can use SQL to automate data extraction and analysis processes. This not only saves you time but also reduces the risk of errors, ensuring that your insights are accurate and reliable.

In addition to improving your data analysis skills, mastering SQL can also open up new career opportunities in finance. Many companies are looking for finance professionals who have a strong technical background and can work with complex datasets. By adding SQL to your skill set, you can set yourself apart from other candidates and position yourself as a valuable asset to potential employers.

Moreover, SQL is a versatile tool that can be applied to a wide range of finance roles. Whether you are working in investment banking, financial analysis, or risk management, having a solid understanding of SQL can help you excel in your current role and prepare you for future career advancements.

Image Source: website-files.com

Another benefit of learning SQL for finance is that it allows you to collaborate more effectively with other teams within your organization. By being able to access and analyze data independently, you can provide valuable insights to colleagues in marketing, sales, and operations, helping to drive cross-functional collaboration and business growth.

Furthermore, mastering SQL can also lead to increased job satisfaction and confidence in your abilities. As you become more proficient in writing complex queries and manipulating large datasets, you will feel more empowered in your role and better equipped to tackle challenging projects and tasks.

In conclusion, mastering SQL is a valuable skill that can help you elevate your career in finance. By improving your data analysis capabilities, streamlining your workflow, and opening up new career opportunities, SQL mastery can be a game-changer for your professional development. So why wait? Start learning SQL today and unlock your full potential in the world of finance.

Image Source: corporatefinanceinstitute.com

Should You Learn SQL for a Finance Career?