Nailing the First Impression: Key Strategies for Success!

Mastering the first impression is crucial when starting a new job, especially when it comes to impressing your boss in the first 30 days. Your first few weeks at a new job can set the tone for your entire tenure at the company, so it’s important to make a strong and positive impression right from the start. Here are some key strategies for success in nailing that first impression and impressing your boss in the first 30 days.

First and foremost, it’s essential to be prepared. Before your first day on the job, take some time to research the company, its culture, and its values. Familiarize yourself with the company’s mission and goals, as well as any recent news or developments. This will show your boss that you are proactive and invested in the company’s success.

Image Source: medium.com

When you first meet your boss, make sure to greet them with a warm smile and a firm handshake. The way you present yourself in those first few moments can leave a lasting impression, so be sure to make a good one. Dress professionally and appropriately for the workplace, and maintain good posture and eye contact during your interactions.

Another key strategy for success in nailing the first impression is to listen and observe. Take the time to really listen to what your boss has to say, and pay attention to their communication style and preferences. Observe how they interact with others and try to adapt your own communication style to match theirs. This will show your boss that you are attentive and eager to learn.

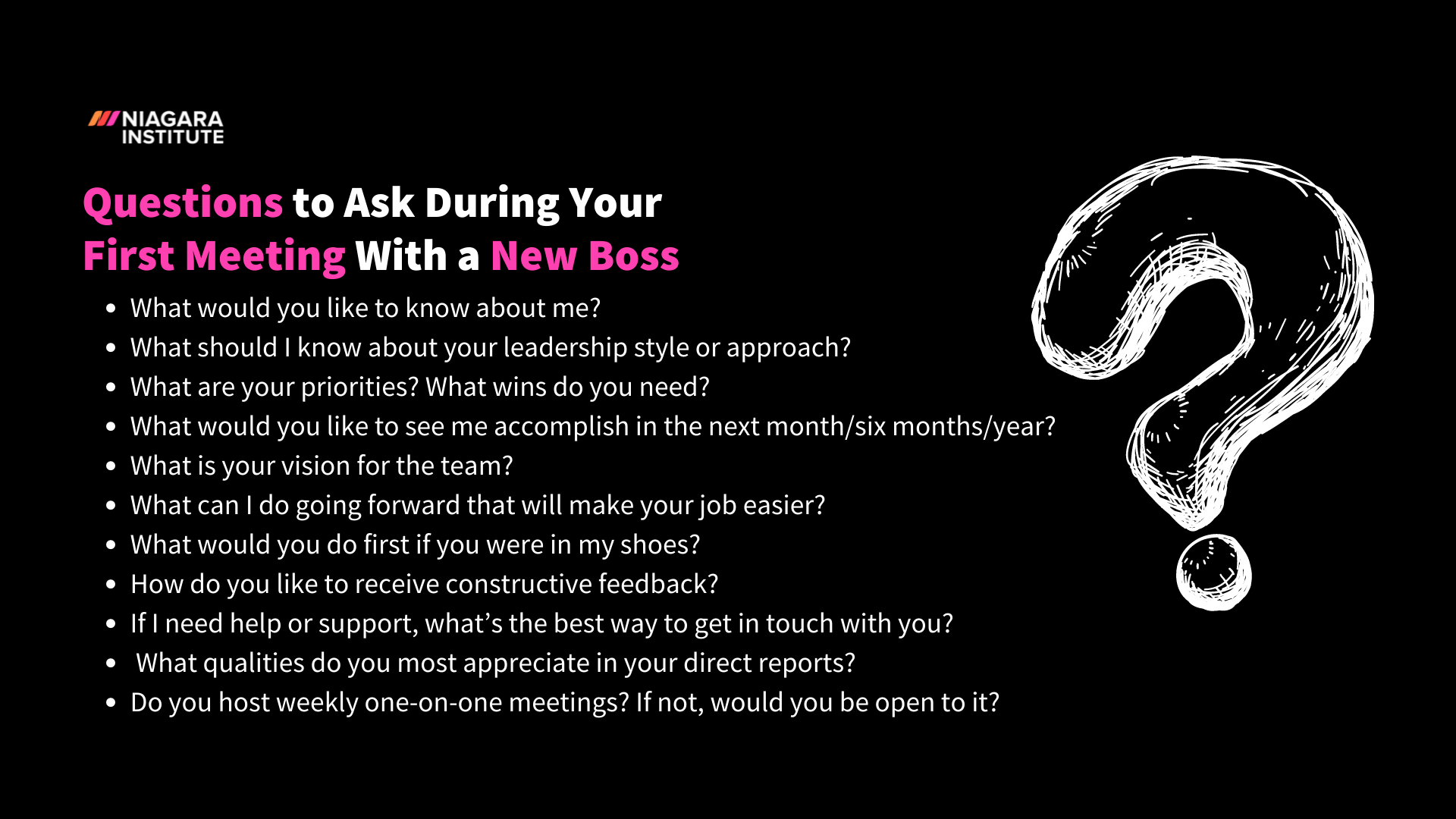

In addition to listening and observing, it’s important to ask questions. Asking thoughtful and insightful questions shows that you are engaged and interested in your new role. It also demonstrates that you are proactive and willing to learn. Don’t be afraid to ask for clarification or guidance when needed, as this will show your boss that you are committed to doing your best work.

Image Source: niagarainstitute.com

One of the best ways to impress your boss in the first 30 days is to go above and beyond. Take on additional tasks or projects, volunteer to help out with team initiatives, and show that you are willing to put in the extra effort to succeed. This will demonstrate your dedication and work ethic, and show your boss that you are a valuable asset to the team.

Finally, be sure to follow up and follow through. If you make a promise or commitment, make sure to follow through on it in a timely manner. Send a follow-up email after meetings or conversations to summarize key points and next steps. This will show your boss that you are organized, reliable, and committed to success.

In conclusion, nailing the first impression and impressing your boss in the first 30 days is essential for success in a new job. By being prepared, presenting yourself professionally, listening and observing, asking questions, going above and beyond, and following up and following through, you can make a strong and positive impression that will set you up for success in your new role. So go out there, make a great first impression, and show your boss what you’re made of!

Impress Your Boss from Day One: Proven Tips and Tricks!

Image Source: website-files.com

Congratulations on your new job! Starting a new job can be exciting, but it can also be nerve-wracking, especially when it comes to making a good impression on your boss. The first 30 days are crucial in setting the tone for your time at the company, so it’s important to make sure you start off on the right foot. Here are some proven tips and tricks to help you impress your boss from day one.

1. Dress to Impress

They say you should dress for the job you want, not the job you have. This is especially true when starting a new job. Make sure you dress professionally and appropriately for your new workplace. Pay attention to the dress code and try to dress slightly more formal than the norm. Your appearance is the first thing your boss will notice about you, so make sure it’s a good impression.

2. Be Punctual

One of the easiest ways to impress your boss is to show up on time, or even better, early. Being punctual shows that you are reliable, responsible, and respectful of other people’s time. Make sure you arrive at work early on your first day and continue to do so throughout your first 30 days. It’s a simple but effective way to make a good impression.

Image Source: redd.it

3. Show Enthusiasm

Your attitude and enthusiasm can go a long way in impressing your boss. Show that you are excited to be there and eager to learn and contribute. Ask questions, take on new challenges, and show initiative. Your boss will appreciate your enthusiasm and it will help you stand out from the crowd.

4. Be a Team Player

It’s important to remember that you are part of a team. Show that you are a team player by being cooperative, helpful, and willing to pitch in wherever needed. Offer to help your colleagues with their tasks, collaborate on projects, and be supportive of your team members. Your boss will appreciate your willingness to work together towards a common goal.

5. Communicate Effectively

Effective communication is key in any workplace. Make sure you communicate clearly, concisely, and professionally with your boss and colleagues. Keep them informed of your progress, ask for feedback, and be open to constructive criticism. Good communication skills will help you build strong relationships with your team and impress your boss in the process.

Image Source: canopy.is

6. Set Goals

Setting goals for yourself in your first 30 days can show your boss that you are proactive and ambitious. Think about what you want to achieve in your new role and how you can make a positive impact. Share your goals with your boss and work towards achieving them. This will demonstrate your commitment to your role and your willingness to go above and beyond.

7. Be Flexible

Things don’t always go as planned in the workplace. Be flexible and adaptable when faced with challenges or changes. Show that you can handle unexpected situations with grace and professionalism. Your boss will appreciate your ability to think on your feet and problem-solve effectively.

8. Seek Feedback

Feedback is a valuable tool for growth and improvement. Don’t be afraid to ask your boss for feedback on your performance. Take their advice on board and use it to make adjustments and improvements. Showing that you are open to feedback demonstrates your willingness to learn and grow in your role.

In conclusion, the first 30 days in a new job are crucial in making a good impression on your boss. By following these proven tips and tricks, you can impress your boss from day one and set yourself up for success in your new role. Remember to dress to impress, be punctual, show enthusiasm, be a team player, communicate effectively, set goals, be flexible, and seek feedback. Good luck!

Tips to Impress Your Boss in the First 30 Days