Money Mastery Magic: Unlocking the Secrets to Financial Success

Welcome to the ultimate guide to mastering money and staying current on finance trends and skills! In this article, we will delve into the secrets of financial success and explore how you can unlock the magic of money mastery.

Money has the power to transform lives, create opportunities, and fulfill dreams. However, many people struggle with managing their finances effectively and fail to achieve their financial goals. That’s where money mastery comes in. By mastering the art of money management, you can take control of your financial future and pave the way for success.

Image Source: ytimg.com

So, what exactly is money mastery? At its core, money mastery is about understanding how money works, making informed financial decisions, and developing healthy money habits. It involves mastering the skills of budgeting, saving, investing, and planning for the future. With the right knowledge and mindset, you can unlock the secrets to financial success and build a solid foundation for your financial well-being.

One of the key aspects of money mastery is financial literacy. This means having a good understanding of basic financial concepts such as budgeting, saving, investing, and managing debt. By improving your financial literacy, you can make better financial decisions, avoid common money pitfalls, and set yourself up for long-term financial success.

Another important component of money mastery is setting clear financial goals. Whether you want to buy a house, start a business, or save for retirement, having clear financial goals can help you stay focused and motivated. By setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals, you can create a roadmap to financial success and track your progress along the way.

:max_bytes(150000):strip_icc()/StructuredContentArticles-TrendTrading-final-8f1316f1116f49d89c27cb7bc80ec984.png)

Image Source: investopedia.com

In addition to financial literacy and goal setting, mastering money also involves developing good money habits. This includes living within your means, avoiding debt, saving regularly, and investing wisely. By making these habits a part of your daily routine, you can build a strong financial foundation and achieve your financial goals more easily.

But mastering money is not just about managing your finances effectively. It also requires staying current on finance trends and skills. In today’s fast-paced world, financial markets are constantly changing, new technologies are emerging, and economic conditions are evolving. To stay ahead of the game, it’s essential to keep up with the latest finance trends and skills.

One way to stay current on finance trends is to regularly read financial news and publications. By staying informed about the latest market developments, economic trends, and investment opportunities, you can make more informed financial decisions and stay ahead of the curve. Additionally, attending finance conferences, workshops, and seminars can provide valuable insights and networking opportunities to help you stay current on finance trends and skills.

Image Source: website-files.com

In conclusion, mastering money is a lifelong journey that requires a combination of financial literacy, goal setting, and good money habits. By unlocking the secrets to financial success and staying current on finance trends and skills, you can take control of your financial future and achieve your financial goals. So, are you ready to unleash the magic of money mastery and transform your financial future? Let’s embark on this exciting journey together!

Staying Ahead of the Game: Your Ultimate Guide to Finance Trends

In today’s fast-paced world, staying current on finance trends is essential for mastering money and achieving financial success. Whether you’re a seasoned investor or just starting out, keeping up with the latest trends in the financial world can help you make informed decisions and stay ahead of the game. From new technologies to changing regulations, there are a variety of factors that can impact the way we manage our money. This ultimate guide will provide you with the tools and resources you need to stay current on finance trends and skills.

One of the most important aspects of staying ahead of the game in finance is staying informed. This means keeping up to date on the latest news and developments in the financial world. Whether it’s reading financial news websites, following key influencers on social media, or attending finance seminars and conferences, staying informed is crucial for staying ahead of the curve. By staying informed, you can better anticipate market trends and make smarter investment decisions.

Image Source: prophix.com

Another key aspect of staying ahead of the game in finance is developing your skills and knowledge. In today’s rapidly changing financial landscape, it’s important to continually update your skills and stay current on best practices. This could involve taking finance courses, obtaining certifications, or attending workshops to learn about new trends and technologies in the finance industry. By investing in your education and skill development, you can position yourself for success and stay ahead of the competition.

In addition to staying informed and developing your skills, networking is also essential for staying ahead in finance. Building relationships with other finance professionals, attending networking events, and joining industry associations can help you stay connected and informed about the latest trends and opportunities in the financial world. By networking with other professionals, you can gain valuable insights, exchange ideas, and stay current on industry news and developments.

Technology is also a key trend to watch in the finance industry. From mobile banking to cryptocurrency, new technologies are revolutionizing the way we manage our money. By staying current on technology trends, you can take advantage of new opportunities and stay ahead of the curve. Whether it’s using apps to track your spending, investing in fintech companies, or exploring blockchain technology, staying current on technology trends can give you a competitive edge in the finance industry.

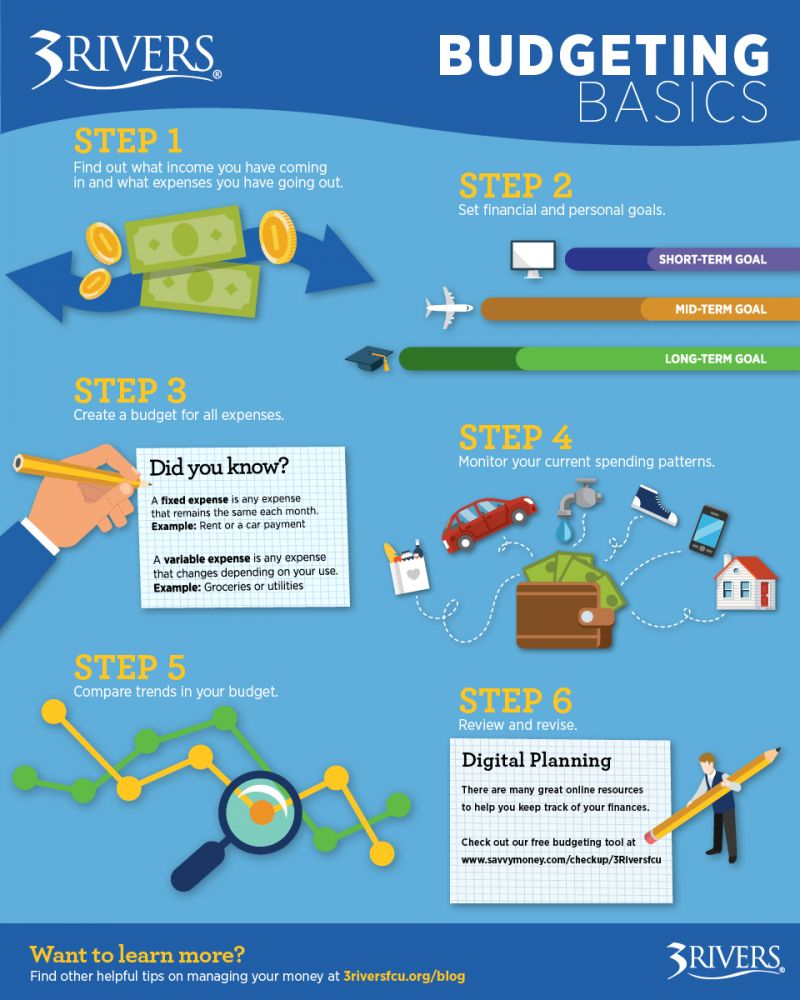

Image Source: 3riversfcu.org

Regulatory changes are another important trend to watch in finance. From tax laws to banking regulations, changes in the regulatory environment can have a significant impact on your finances. By staying informed on regulatory trends and changes, you can ensure that you are compliant with the latest laws and regulations and avoid any potential pitfalls. Whether it’s consulting with a financial advisor or staying up to date on government websites, staying current on regulatory trends is essential for mastering money and staying ahead of the game.

In conclusion, staying ahead of the game in finance requires a combination of staying informed, developing your skills, networking, and staying current on technology and regulatory trends. By following this ultimate guide to finance trends, you can position yourself for success and achieve financial mastery. So, what are you waiting for? Start mastering money today and stay ahead of the game in the ever-changing world of finance!

Image Source: licdn.com

How to Stay Updated on Finance Trends & Skills

Image Source: licdn.com