Navigating the Tricky Waters of Office Politics

Ah, office politics. Just the mere mention of those words can send shivers down the spines of many employees. Navigating through the tricky waters of office politics can often feel like trying to navigate through a minefield – one wrong move and you could find yourself in hot water. But fear not, for with the right guide, you can master the art of office politics and keep your sanity intact.

Office politics is a reality in any workplace. It involves the complex relationships and power dynamics that exist between colleagues. From subtle power plays to blatant manipulation, office politics can be a minefield to navigate. However, understanding the dynamics at play and learning how to navigate them can help you not only survive, but thrive in your workplace.

Image Source: ytimg.com

The first step to mastering office politics is to always stay informed. Knowledge is power, and in the world of office politics, knowing who holds the power and how decisions are made is crucial. Stay up-to-date on office gossip, pay attention to who is in the inner circle, and be aware of any alliances that may exist. By staying informed, you can better understand the power dynamics at play and navigate them more effectively.

Another important aspect of office politics is building strong relationships with your colleagues. While it may be tempting to keep to yourself and avoid getting involved in office drama, building relationships with your coworkers can actually help you navigate office politics more successfully. By building trust and rapport with your colleagues, you can gain valuable allies who can support you in navigating the tricky waters of office politics.

In addition to building relationships, it is important to maintain a positive attitude in the workplace. Office politics can be draining and frustrating, but by staying positive and focusing on your work, you can avoid getting caught up in the negativity that often accompanies office politics. Remember to stay professional, treat others with respect, and remain focused on your goals. By maintaining a positive attitude, you can keep your sanity intact and navigate office politics with grace.

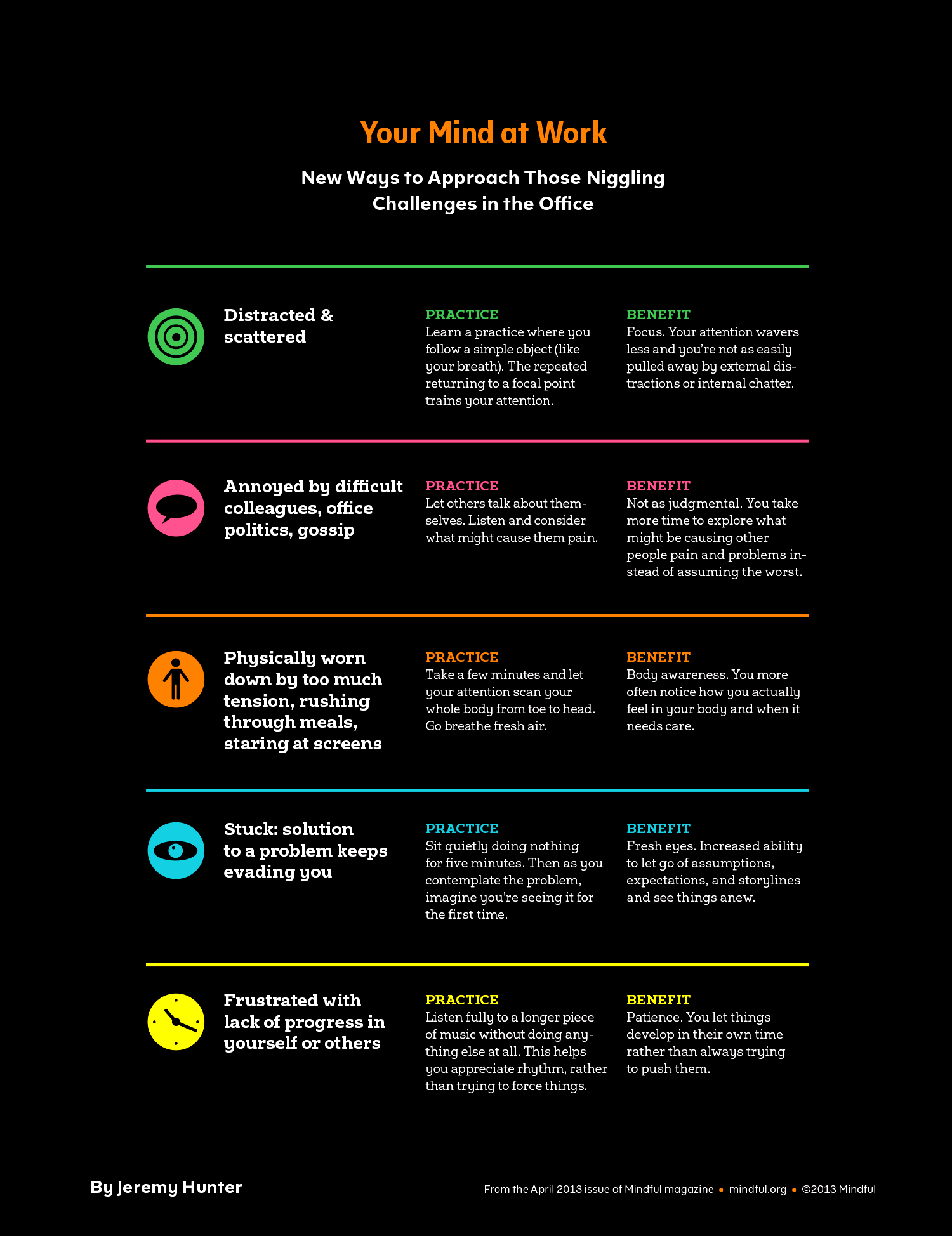

Image Source: mindful.org

Communication is also key when it comes to mastering office politics. Clear and effective communication can help you navigate conflicts, build alliances, and avoid misunderstandings. Be transparent in your communication, listen actively to your colleagues, and seek to understand their perspectives. By communicating effectively, you can build trust with your coworkers and navigate office politics more successfully.

Lastly, it is important to set boundaries in the workplace. Office politics can often blur the lines between professional and personal relationships, leading to conflicts and misunderstandings. By setting boundaries and maintaining a level of professionalism in your interactions with your colleagues, you can avoid getting caught up in unnecessary drama and focus on your work. Remember that it is okay to say no, to set limits on your time and energy, and to prioritize your well-being in the face of office politics.

In conclusion, mastering the art of navigating office politics is not an easy task, but with the right guide, you can keep your sanity intact and thrive in your workplace. By staying informed, building relationships, maintaining a positive attitude, communicating effectively, and setting boundaries, you can navigate the tricky waters of office politics with grace and confidence. So, take a deep breath, put on your best smile, and remember that you have the power to navigate office politics like a pro.

Your Essential Guide to Office Politics Survival

Image Source: hbr.org

In the fast-paced world of office politics, it can sometimes feel like you’re navigating a treacherous sea with no compass. But fear not, because with the right skills and mindset, you can not only survive but thrive in the sometimes murky waters of workplace dynamics. Here is your essential guide to mastering the art of navigating office politics and keeping your sanity intact.

First and foremost, it’s crucial to understand that office politics are a natural part of any workplace environment. Whether you like it or not, there will always be power dynamics, competition, and interpersonal relationships at play. The key is to recognize these dynamics and learn how to navigate them effectively.

One of the most important strategies for surviving office politics is to build strong relationships with your colleagues. This doesn’t mean you have to be best friends with everyone in the office, but it does mean being respectful, collaborative, and supportive. By building positive relationships with your coworkers, you’ll not only create a more pleasant work environment but also gain allies who can help you navigate the sometimes choppy waters of office politics.

Image Source: intelligentpeople.co.uk

Another essential aspect of office politics survival is communication. Clear and open communication is key to avoiding misunderstandings and conflicts in the workplace. Make sure to be transparent in your interactions with colleagues, keep them informed about important decisions or changes, and address any issues or concerns promptly. By fostering a culture of open communication, you can prevent misunderstandings and build trust among your coworkers.

It’s also important to be aware of your own strengths and weaknesses when it comes to office politics. Understanding your own communication style, conflict resolution skills, and emotional intelligence can help you navigate challenging situations more effectively. Take the time to reflect on your own behavior and how it impacts your relationships with colleagues. By being self-aware, you can make conscious choices that will help you navigate office politics with grace and confidence.

In addition to building relationships and improving communication, it’s important to stay neutral and avoid getting caught up in office gossip or drama. While it can be tempting to engage in office politics, getting involved in negative conversations or conflicts can quickly escalate and damage your reputation. Instead, focus on staying professional, maintaining boundaries, and keeping your focus on your work goals.

Image Source: hbr.org

Furthermore, it’s essential to understand the power dynamics at play in your office. Take the time to observe how decisions are made, who holds influence, and how conflicts are resolved. By understanding the power structures in your workplace, you can navigate office politics more effectively and strategically. Keep in mind that power dynamics can shift, so it’s important to stay adaptable and observant in your interactions with colleagues.

Lastly, remember to take care of yourself amidst the chaos of office politics. It’s easy to get swept up in the drama and stress of the workplace, but it’s crucial to prioritize your own well-being. Make time for self-care, set boundaries with colleagues, and seek support from friends or mentors when needed. By taking care of yourself and maintaining a healthy work-life balance, you’ll be better equipped to navigate office politics with resilience and grace.

In conclusion, mastering the art of navigating office politics is not an easy task, but with the right skills and mindset, you can keep your sanity intact and thrive in the workplace. By building strong relationships, improving communication, staying neutral, understanding power dynamics, and prioritizing self-care, you can navigate office politics with confidence and grace. Remember, you have the power to shape your own experience in the workplace, so embrace the challenge and approach it with positivity and resilience.

How to Manage Office Politics Without Losing Your Mind