Navigating the Jungle of Job Portals

Job hunting can often feel like navigating through a dense jungle, with countless job portals offering a plethora of opportunities. It can be overwhelming to sift through the countless listings and find the ones that are truly relevant to your skills and interests. However, with the right approach and strategies, you can master the art of using job portals like a pro.

The first step in navigating the jungle of job portals is to create a targeted and well-crafted resume. Your resume is essentially your first impression to potential employers, so it’s important to make sure it highlights your skills, experiences, and achievements in a clear and concise manner. Tailoring your resume to each job application will increase your chances of standing out among the crowd.

Image Source: burnetts.com

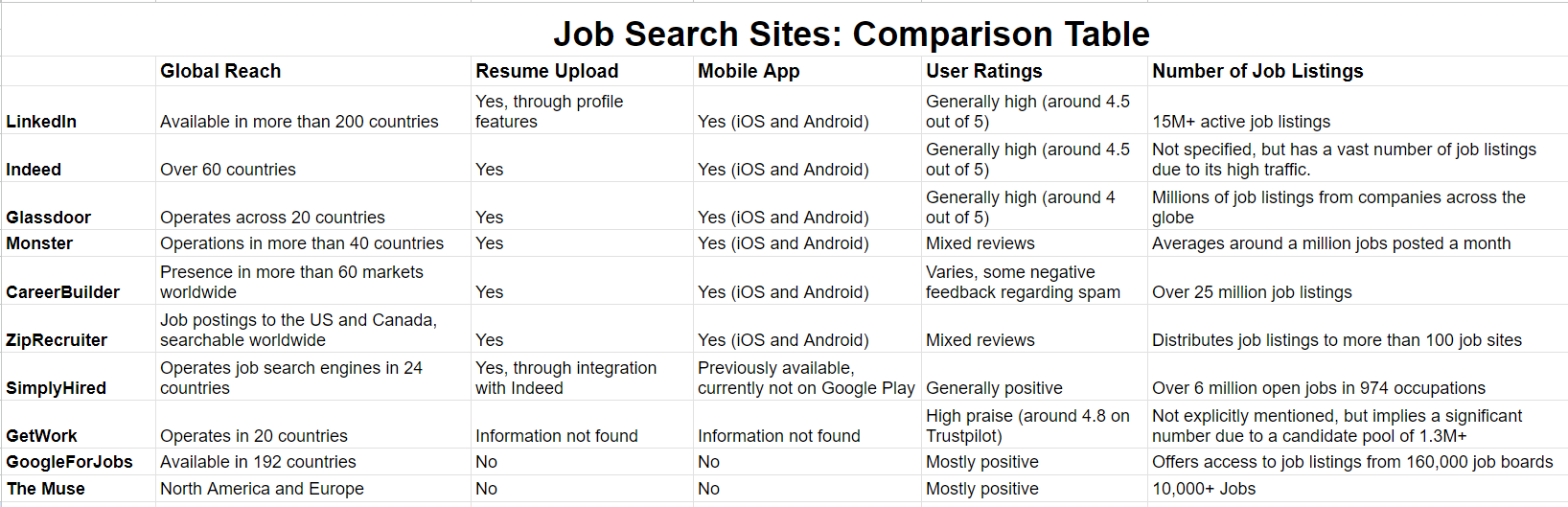

Once you have your resume ready, it’s time to start exploring different job portals. There are a myriad of job portals out there, each catering to different industries and job types. It’s important to do your research and identify which job portals are most relevant to your field. Some popular job portals include Indeed, Glassdoor, LinkedIn, and Monster.

When searching for jobs on these portals, it’s important to use specific keywords related to your desired position. This will help narrow down the search results and ensure that you are only seeing relevant job listings. Additionally, many job portals offer advanced search options that allow you to filter results based on criteria such as location, salary range, and experience level.

Networking is also a crucial component of navigating the jungle of job portals. Many job portals allow you to connect with professionals in your industry, join industry-specific groups, and even reach out to recruiters directly. Building a strong network can open doors to hidden job opportunities and provide valuable insights into the job market.

Image Source: recruiteze.com

Another tip for using job portals effectively is to set up job alerts. Many job portals offer the option to receive email notifications when new job listings that match your criteria are posted. This can save you time and effort by sending relevant job opportunities directly to your inbox.

It’s also important to stay organized while navigating the jungle of job portals. Keep track of the jobs you have applied to, the ones you are interested in, and any follow-up actions you need to take. This will help you stay on top of your job search and ensure that you are not missing out on any potential opportunities.

In conclusion, navigating the jungle of job portals can be a daunting task, but with the right strategies and mindset, you can master the art of using job portals like a pro. By crafting a targeted resume, utilizing specific keywords, networking with professionals in your industry, setting up job alerts, and staying organized, you can streamline your job search and land your dream job. So, put on your explorer hat and start navigating the jungle of job portals with confidence!

Unleash Your Job Search Superpowers

Image Source: ctfassets.net

Are you ready to take your job hunting game to the next level? It’s time to unleash your job search superpowers and conquer the world of job portals like a true pro. In today’s competitive job market, it’s essential to arm yourself with the right tools and strategies to stand out from the crowd and land the job of your dreams. So, let’s dive in and explore how you can unleash your job search superpowers and make the most of job portals.

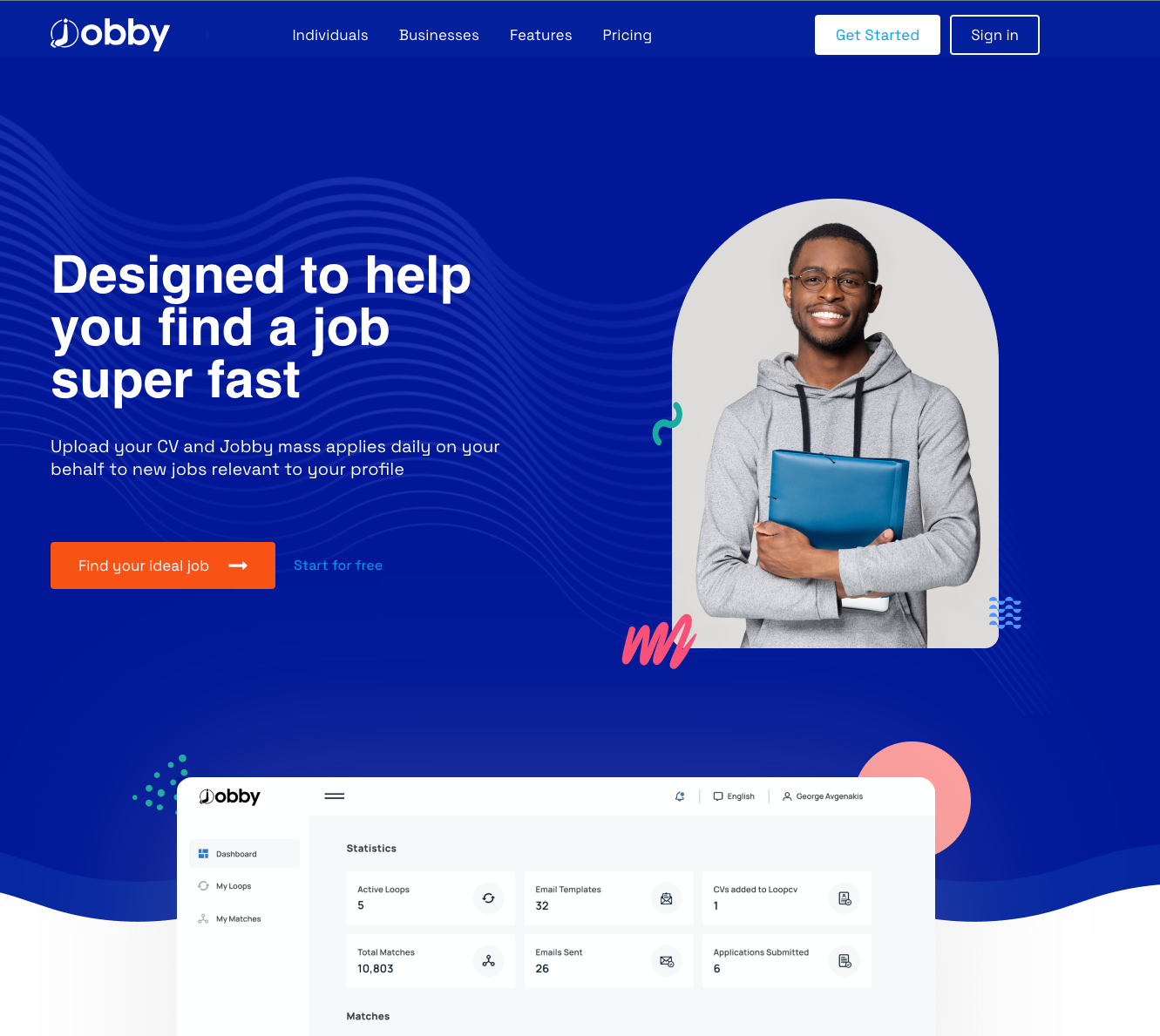

First and foremost, it’s important to understand that job portals are your best friend when it comes to finding new job opportunities. These online platforms connect job seekers with employers, making it easier than ever to search for and apply to jobs in your desired field. However, to truly unleash your job search superpowers, you need to know how to use job portals effectively.

One of the key strategies for mastering job portals is to create a strong and compelling profile. Your profile is essentially your online resume, so make sure it is complete, up-to-date, and showcases your skills and experience in the best light possible. Use keywords related to your industry and job title to increase your visibility to potential employers and make sure to include a professional photo to make a good first impression.

Image Source: wondershare.com

Another important aspect of using job portals like a pro is to set up job alerts. By setting up job alerts based on your preferences, you can receive notifications about new job postings that match your criteria. This will save you time and effort scrolling through hundreds of job listings and ensure you never miss out on a great opportunity.

In addition to setting up job alerts, it’s also crucial to regularly check job portals for new postings. New jobs are added daily, so make it a habit to log in and browse through the latest listings. You never know when your dream job might pop up, so staying proactive and consistent in your job search is key to success.

Networking is another powerful tool in your job search arsenal. Many job portals allow you to connect with recruiters and hiring managers, so don’t be afraid to reach out and make connections. Building relationships with professionals in your industry can lead to valuable job opportunities and insider knowledge about companies you’re interested in.

Image Source: loopcv.pro

When applying to jobs on job portals, make sure to tailor your resume and cover letter to each position you’re interested in. Generic applications are easily overlooked, so take the time to customize your materials and highlight how your skills and experience align with the job requirements. This extra effort will show employers that you are serious about the position and increase your chances of getting noticed.

Lastly, don’t forget to follow up on your applications. After submitting your materials, send a polite email or make a phone call to inquire about the status of your application. This demonstrates your enthusiasm for the job and can set you apart from other candidates who don’t take the extra step to follow up.

In conclusion, mastering the art of job hunting through job portals is all about harnessing your job search superpowers and using them to your advantage. By creating a strong profile, setting up job alerts, networking, customizing your applications, and following up on opportunities, you can navigate the world of job portals like a pro and land the job of your dreams. So, unleash your job search superpowers and watch the job offers start rolling in.

Image Source: youtestme.com

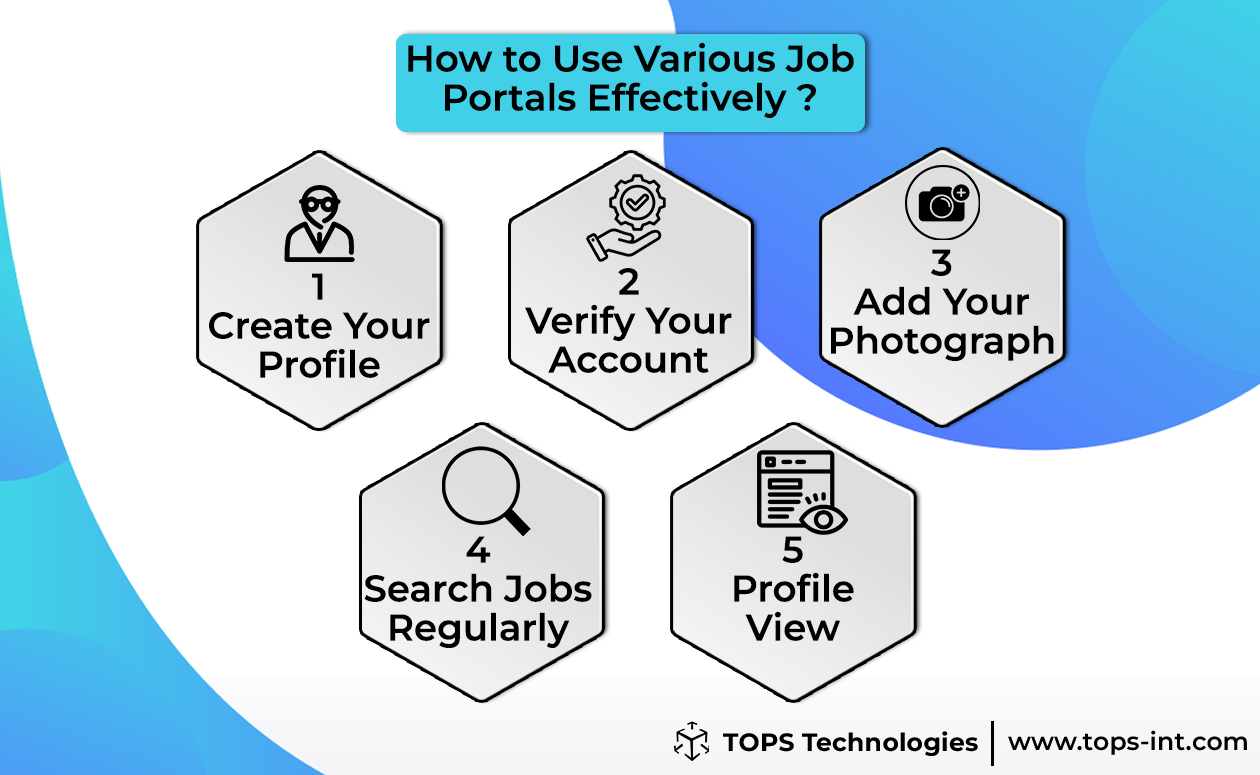

How to Use Job Portals Like a Pro

Image Source: tops-int.com

Image Source: careerhigher.co