Show Me the Money: Finance Internships in 2025

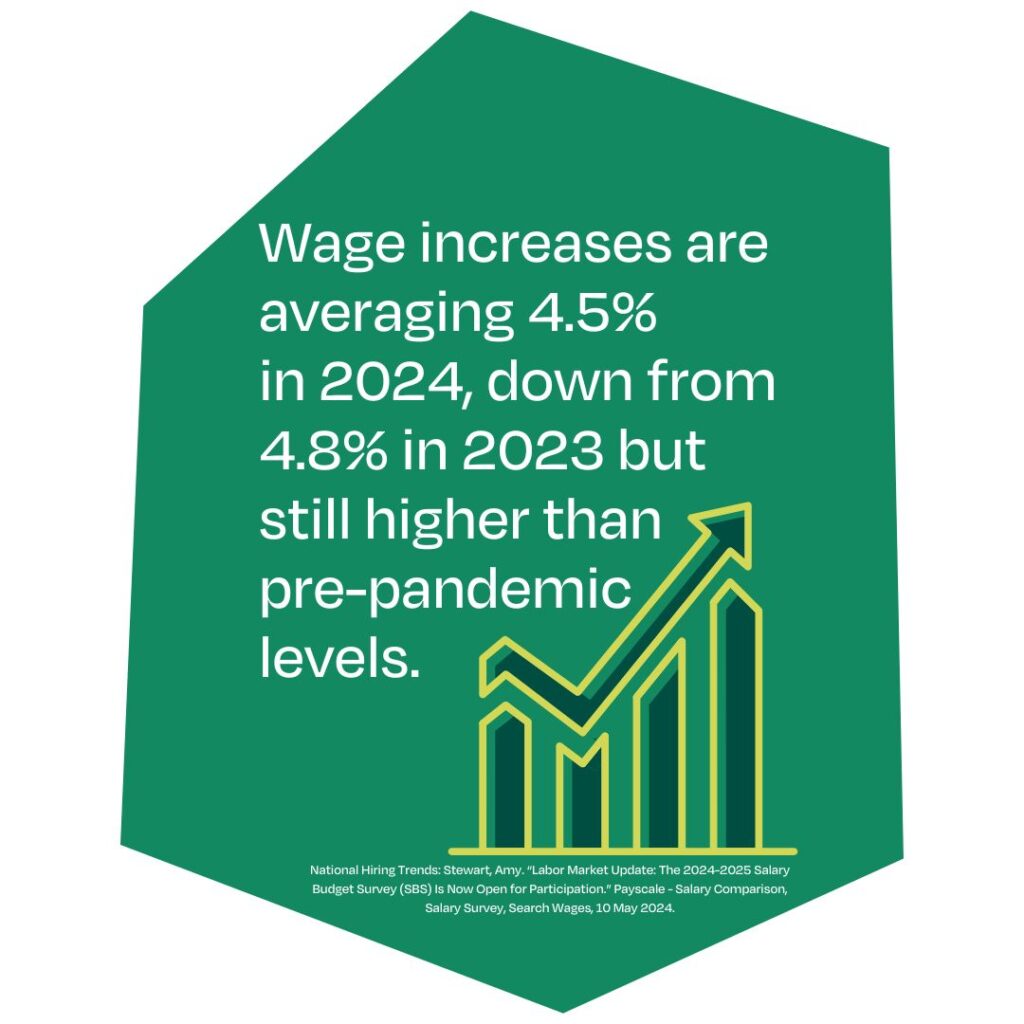

As we look towards the future of finance internships in 2025, one thing is for certain – salary expectations are going to play a major role in navigating the landscape of the industry. With the ever-evolving nature of finance and the increasing demand for skilled professionals, it’s important for interns to have a clear understanding of what to expect in terms of compensation.

Gone are the days of low-paying internships that barely cover living expenses. In 2025, finance interns can look forward to competitive salaries that reflect the value they bring to the table. Companies are recognizing the importance of attracting top talent early on, and are willing to invest in their interns to ensure they stay on board long-term.

Image Source: research.com

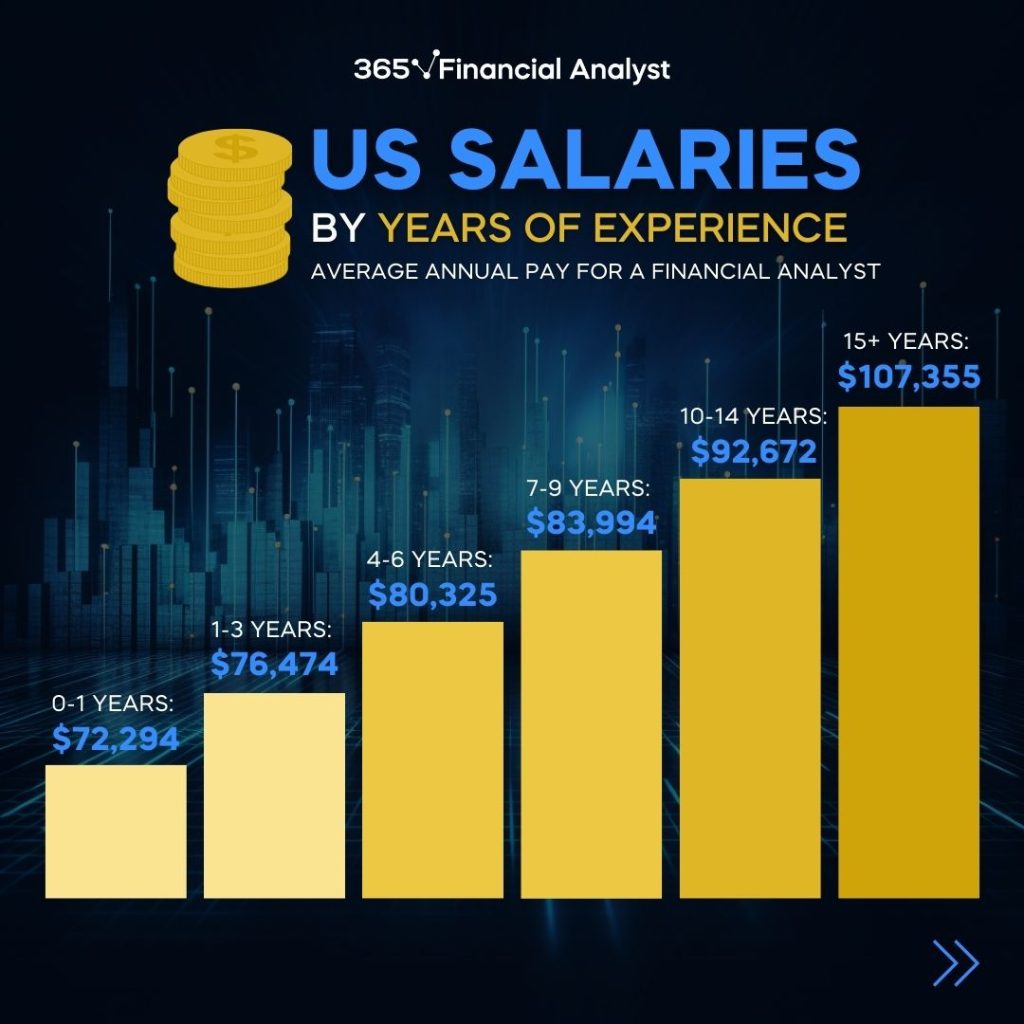

One of the key factors that will determine salary expectations in 2025 is the level of education and experience that interns bring to the table. With the rise of specialized finance programs and certifications, interns who have undergone rigorous training will be able to command higher salaries than their counterparts. Employers are looking for candidates who not only have a strong academic background, but also practical skills that they can apply in a real-world setting.

Another factor that will impact salary expectations in 2025 is the location of the internship. As major financial hubs continue to grow and expand, interns who work in cities like New York, London, and Hong Kong can expect higher salaries to offset the higher cost of living. On the other hand, interns who choose to work in smaller cities or regions may receive lower salaries, but may also benefit from a lower cost of living and a higher quality of life.

In addition to education and location, the specific role and responsibilities of the internship will also play a role in determining salary expectations. Interns who are tasked with high-level projects and responsibilities will be compensated accordingly, while those who are in more entry-level positions may receive a lower salary. It’s important for interns to have a clear understanding of what is expected of them in their role, so they can negotiate a fair salary that reflects their contributions.

Image Source: 365financialanalyst.com

In 2025, finance interns can also look forward to a range of benefits and perks that go beyond just salary. Companies are increasingly offering flexible work arrangements, professional development opportunities, and even bonuses and incentives to attract and retain top talent. Interns who are able to demonstrate their value to the company may also have the opportunity to secure a full-time position upon graduation, with a salary that reflects their experience and contributions.

Overall, the future of finance internships in 2025 is bright for those who are willing to put in the effort and dedication to succeed. By understanding the factors that impact salary expectations, interns can navigate the landscape of the industry with confidence and ensure that they are fairly compensated for their work. With the right education, experience, and skills, the sky is the limit for finance interns in 2025.

Mapping Out Your Salary Journey for Success

As the finance industry continues to evolve and adapt to new technologies and trends, the landscape for internships is also changing. In 2025, finance interns will have to navigate a complex web of salary expectations in order to succeed in their careers.

Image Source: hubspotusercontent-na1.net

The future of finance internships is bright, with opportunities for growth and advancement. However, in order to make the most of these opportunities, interns will need to map out their salary journey for success. This involves setting realistic salary expectations, negotiating effectively, and continuously seeking opportunities for advancement.

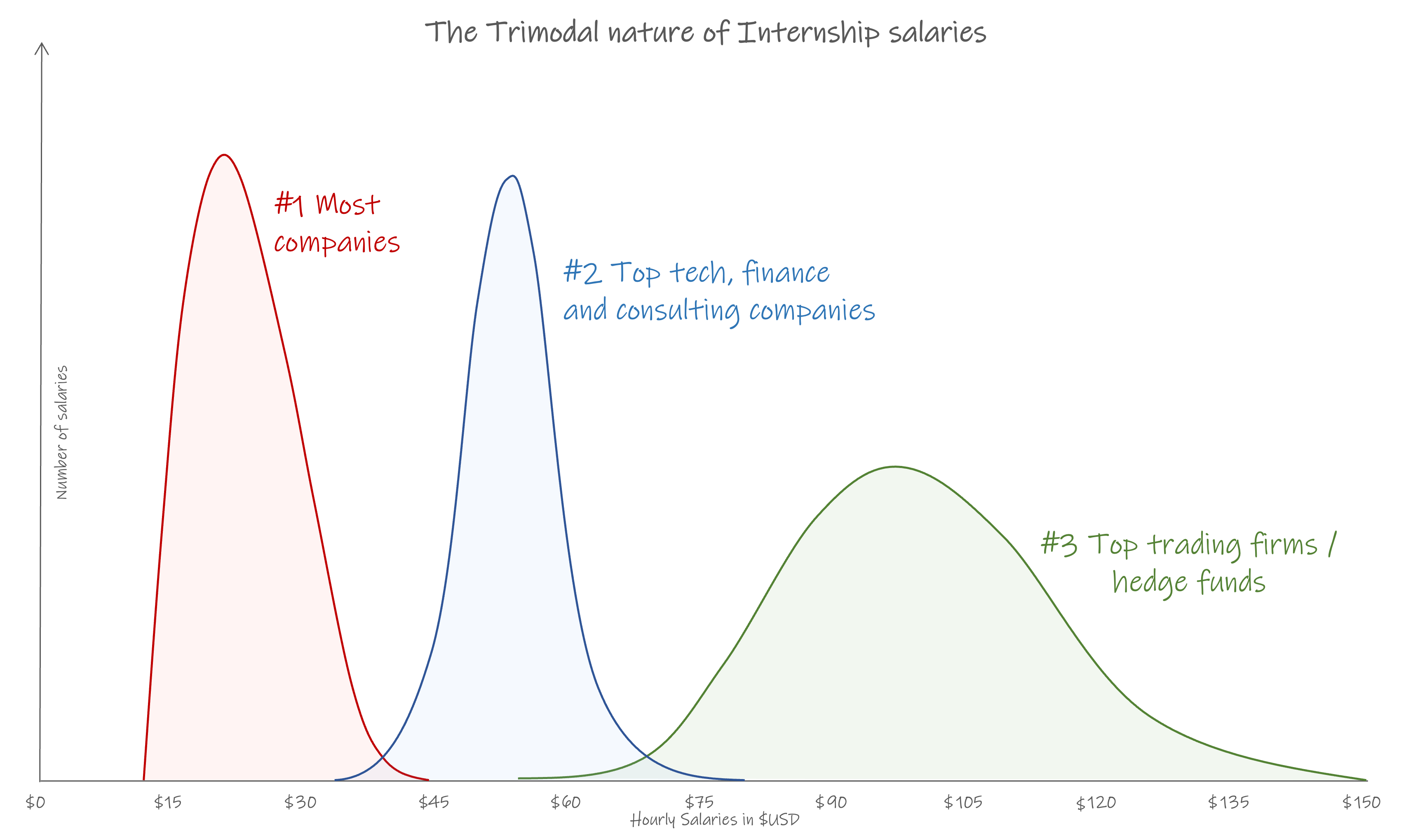

Setting realistic salary expectations is the first step in mapping out your salary journey. In 2025, finance interns will need to consider factors such as their level of experience, the industry they are working in, and the location of their internship. By researching average salaries for interns in their field, interns can set realistic goals for their own salary expectations.

Negotiating effectively is another key component of mapping out your salary journey for success. In 2025, finance interns will need to be confident in their skills and abilities, and be willing to advocate for themselves in negotiations. By highlighting their accomplishments and demonstrating their value to the company, interns can negotiate for a salary that reflects their contributions.

Image Source: tiktok.com

Continuously seeking opportunities for advancement is also crucial for success in the world of finance internships. In 2025, interns will need to be proactive in seeking out new challenges and responsibilities in order to increase their earning potential. By taking on new projects, acquiring new skills, and networking with industry professionals, interns can position themselves for salary increases and promotions.

Overall, mapping out your salary journey for success in finance internships in 2025 requires a combination of research, negotiation skills, and a proactive mindset. By setting realistic salary expectations, negotiating effectively, and continuously seeking opportunities for advancement, finance interns can navigate the ever-changing landscape of the industry and achieve their career goals.

Image Source: levels.fyi

Salary Expectations for Finance Internships in 2025

Image Source: addisongroup.com

Image Source: googleusercontent.com

Image Source: tiktok.com