Smooth Sailing: Navigating Workplace Challenges

Ah, the workplace. A bustling hub of productivity, collaboration, and sometimes, challenges. Navigating workplace challenges can be like sailing through stormy seas – but fear not, with the right strategies in place, you can steer your ship towards smoother waters.

One of the most common challenges faced in the workplace is dealing with difficult coworkers. Whether it’s a colleague who constantly criticizes your work, a teammate who takes credit for your ideas, or a boss who micromanages every task, handling difficult coworkers can be a daunting task. But fret not, for there are strategies you can employ to handle these challenges professionally and effectively.

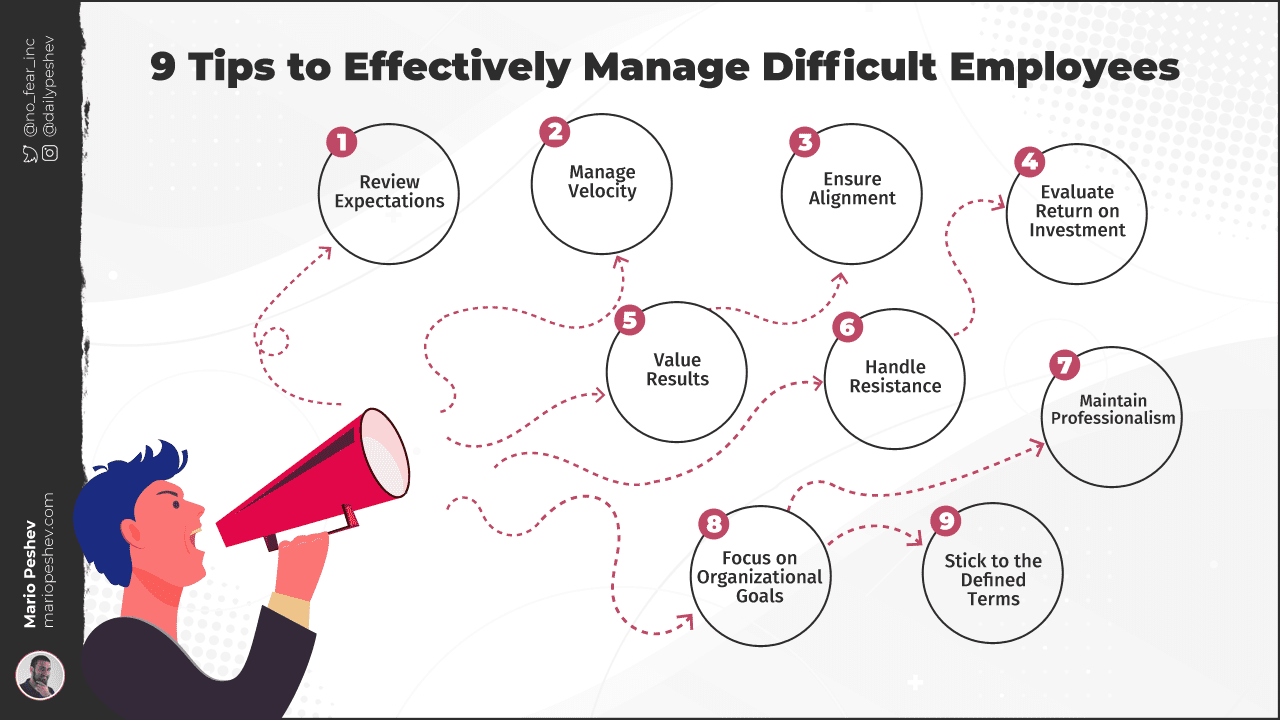

Image Source: squarespace-cdn.com

First and foremost, it’s important to maintain a positive attitude and approach when dealing with difficult coworkers. Remember, everyone has their own reasons for behaving the way they do, and it’s crucial to approach the situation with empathy and understanding. Instead of reacting impulsively or getting defensive, take a step back and try to see things from their perspective. By approaching the situation with a positive mindset, you can foster better communication and collaboration with your difficult coworker.

Communication is key when it comes to navigating workplace challenges. Instead of avoiding the issue or engaging in passive-aggressive behavior, address the problem head-on in a calm and respectful manner. Schedule a one-on-one meeting with your difficult coworker to discuss your concerns and find a mutually beneficial solution. Be honest, but also be open to listening to their perspective. By fostering open and honest communication, you can create a more collaborative and harmonious work environment.

Another important strategy for handling difficult coworkers is setting boundaries. If a coworker’s behavior is consistently affecting your work performance or well-being, it’s crucial to establish clear boundaries to protect yourself. Communicate your boundaries assertively and respectfully, and be firm in enforcing them. Whether it’s setting limits on how much time you spend collaborating with a difficult coworker or establishing guidelines for communication, setting boundaries can help you maintain your professional integrity and sanity in the workplace.

Image Source: nitrocdn.com

In addition to setting boundaries, it’s also important to practice self-care when dealing with difficult coworkers. Workplace challenges can be emotionally draining, so it’s essential to prioritize your mental and emotional well-being. Take breaks when needed, engage in stress-relieving activities outside of work, and seek support from friends, family, or a therapist if necessary. By taking care of yourself, you can better handle workplace challenges and maintain a positive outlook in the face of adversity.

Ultimately, navigating workplace challenges requires a combination of positivity, communication, boundary-setting, and self-care. By approaching difficult coworkers with empathy and understanding, addressing issues through open and honest communication, establishing boundaries to protect yourself, and prioritizing self-care, you can navigate workplace challenges with grace and professionalism. Remember, smooth sailing is possible – even in the face of stormy seas.

Navigating Workplace Challenges: Strategies for Handling Difficult Coworkers Professionally

In every workplace, there are bound to be challenges that employees face on a day-to-day basis. Whether it’s meeting deadlines, dealing with difficult clients, or managing office politics, navigating through these obstacles can be tricky. One of the most common challenges that employees encounter is dealing with difficult coworkers. It’s not always easy to work alongside someone who has a different work style, personality, or attitude. However, learning how to handle difficult coworkers with diplomacy and professionalism can help create a more harmonious work environment for everyone.

Image Source: licdn.com

Diplomacy in Action: Handling Difficult Coworkers

Dealing with difficult coworkers requires a delicate balance of assertiveness, empathy, and conflict resolution skills. It’s important to approach these situations with a level head and a positive attitude, as reacting emotionally or defensively can escalate the conflict further. By adopting a diplomatic approach, you can address the issue at hand while maintaining a sense of professionalism and respect for your coworker.

One strategy for handling difficult coworkers is to practice active listening. When your coworker is expressing their concerns or grievances, make sure to give them your full attention and show that you understand their perspective. This can help diffuse tension and demonstrate that you are willing to engage in constructive dialogue to resolve the issue.

Image Source: licdn.com

Another important aspect of handling difficult coworkers is setting boundaries. It’s crucial to establish clear boundaries with your coworkers, especially if they exhibit disrespectful or inappropriate behavior. By communicating your expectations and asserting your boundaries in a calm and assertive manner, you can establish a professional working relationship with your difficult coworker while maintaining your own well-being.

Furthermore, it’s essential to remain solution-focused when dealing with difficult coworkers. Instead of dwelling on the negative aspects of the situation, focus on finding practical and constructive solutions to resolve the conflict. By approaching the issue with a proactive mindset, you can work towards a mutually beneficial resolution that addresses the concerns of both parties.

In addition to these strategies, it’s also important to practice self-care when dealing with difficult coworkers. It’s natural to feel stressed or frustrated when faced with challenging situations at work, but taking care of your mental and emotional well-being is crucial for maintaining a positive outlook and a professional demeanor. Make sure to prioritize self-care activities such as exercise, meditation, or spending time with loved ones to recharge and rejuvenate after dealing with difficult coworkers.

Image Source: defensestudies.net

Overall, handling difficult coworkers with diplomacy and professionalism requires a combination of communication skills, emotional intelligence, and conflict resolution techniques. By approaching these situations with a positive attitude and a willingness to collaborate, you can navigate workplace challenges with grace and poise. Remember that difficult coworkers are a part of every workplace, but by practicing effective communication and conflict resolution strategies, you can create a more harmonious and productive work environment for yourself and your colleagues.

How to Handle Difficult Coworkers Professionally

Image Source: licdn.com