Unlocking the Power of Budgeting Tools

Budgeting is a crucial aspect of financial management that allows individuals and businesses to plan, track, and control their spending. By setting clear financial goals and creating a budget, you can ensure that you are making informed decisions about your money and working towards achieving your financial objectives. In today’s fast-paced world, there are a plethora of budgeting tools available to help you streamline the budgeting process and make it more efficient and effective.

One of the key benefits of using budgeting tools is the ability to track your expenses in real-time. Gone are the days of manually recording every penny spent – with budgeting tools, you can link your bank accounts and credit cards to automatically categorize and track your expenses. This not only saves you time but also provides you with a clear picture of where your money is going, allowing you to identify areas where you can cut back and save.

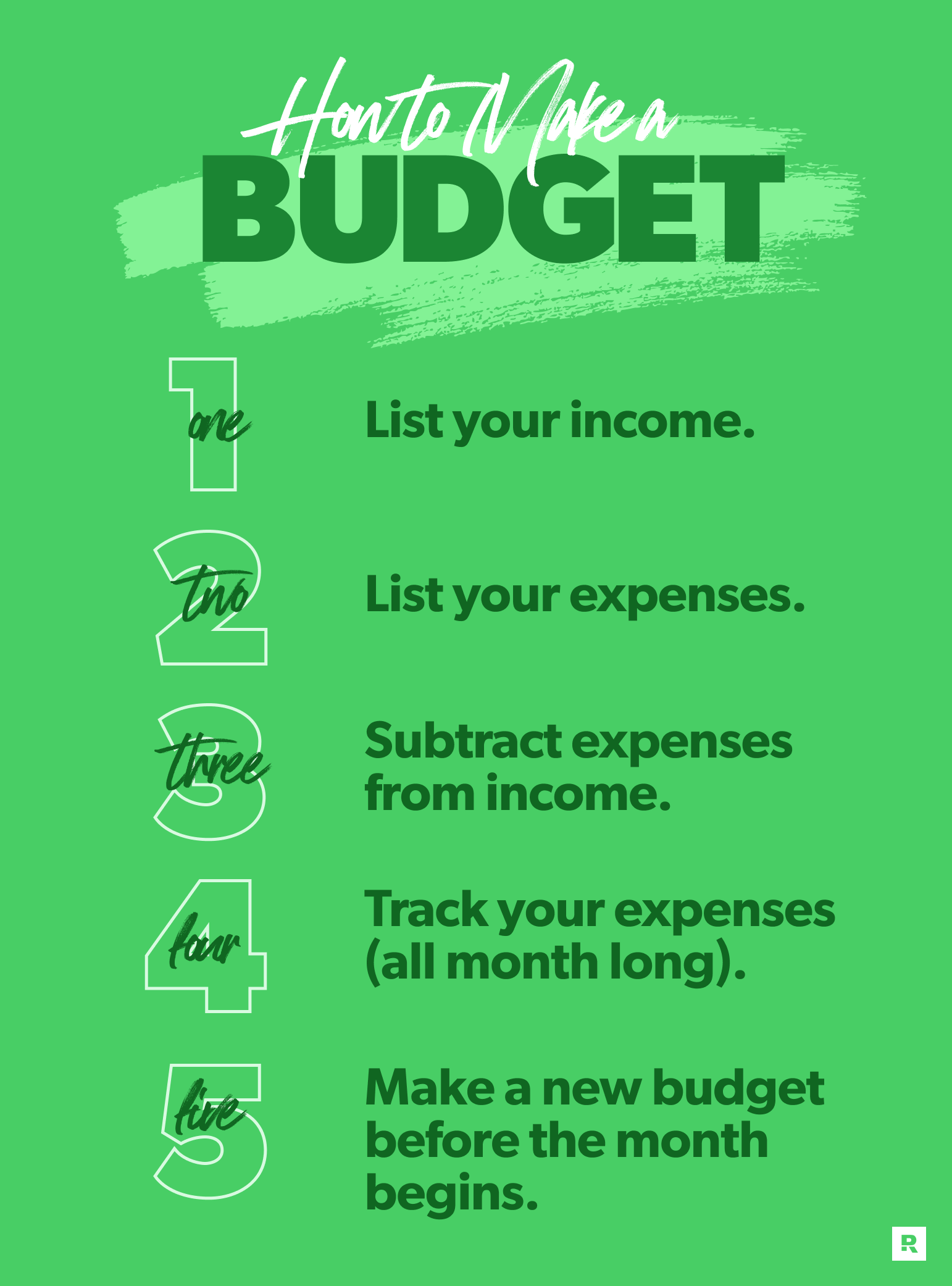

Image Source: ramseysolutions.net

Budgeting tools also offer various features that make budget creation and management easier and more personalized. For example, many budgeting tools allow you to set specific financial goals, such as saving for a vacation or paying off debt, and track your progress towards achieving them. Some tools even offer customized recommendations based on your spending habits and financial goals, helping you make more informed decisions about your money.

Additionally, budgeting tools can help you create a realistic budget that aligns with your financial goals and lifestyle. By analyzing your spending patterns and income, these tools can generate a personalized budget that takes into account your unique financial situation. This can help you avoid overspending, build savings, and achieve financial stability in the long run.

Another valuable feature of budgeting tools is the ability to forecast your financial future. By inputting your income, expenses, and financial goals, these tools can generate projections of your financial situation over time. This can help you anticipate potential challenges, such as cash flow shortages or increased expenses, and make proactive decisions to mitigate them.

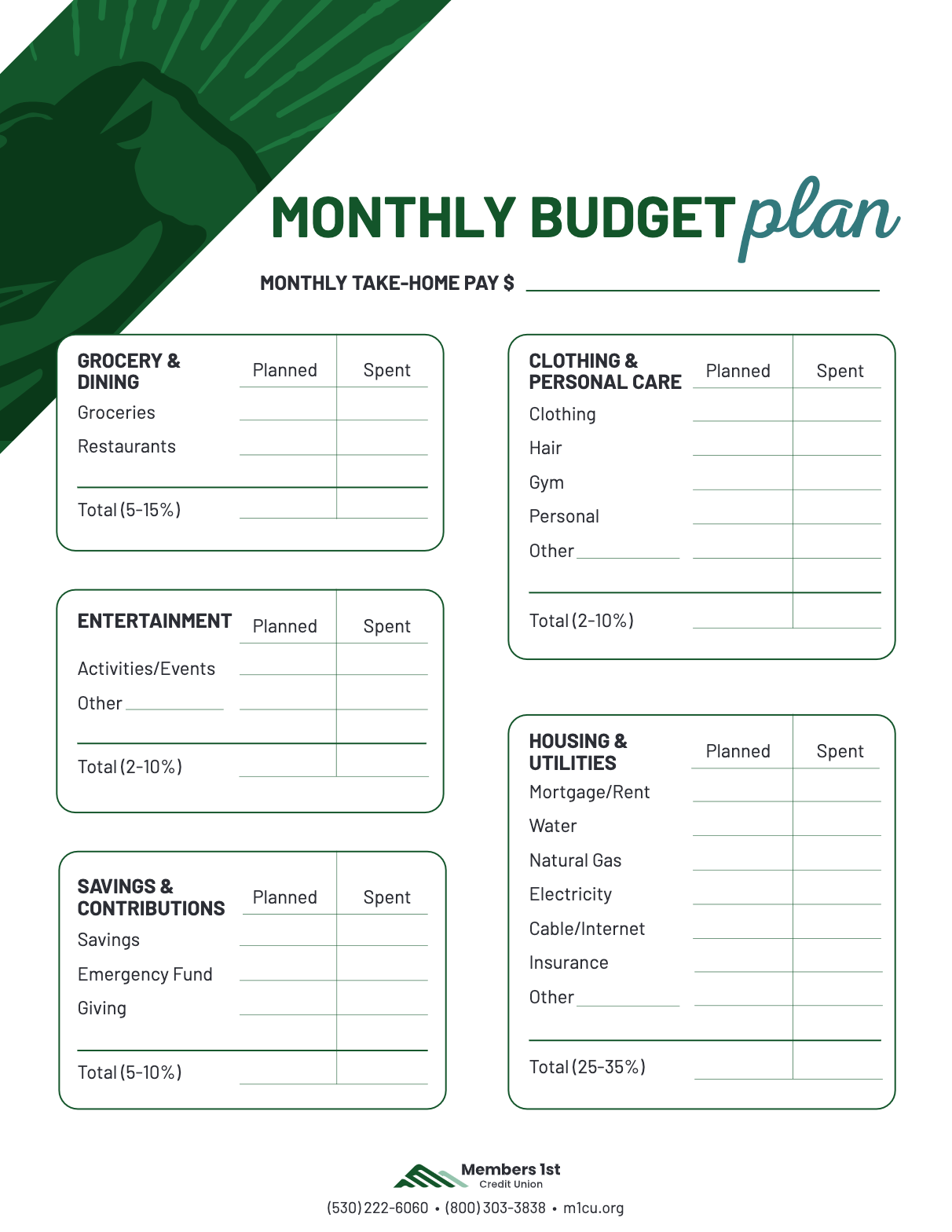

Image Source: 3riversfcu.org

Furthermore, budgeting tools can help you track your progress towards your financial goals and make adjustments as needed. By regularly reviewing your budget and comparing it to your actual spending, you can identify areas where you are overspending or falling short of your goals. This allows you to make changes to your budget and spending habits to stay on track and achieve financial success.

In conclusion, budgeting tools are powerful resources that can help you take control of your finances and work towards achieving your financial goals. By unlocking the power of budgeting tools, you can streamline the budgeting process, track your expenses in real-time, create a personalized budget, forecast your financial future, and track your progress towards your goals. So why wait? Start exploring budgeting tools today and take the first step towards mastering budgeting and forecasting tools for a brighter financial future.

Forecasting Success: Your Ultimate Guide

Forecasting is a crucial aspect of budgeting that allows businesses to predict future financial outcomes based on past data and trends. By mastering forecasting tools, you can make informed decisions, plan for the future, and ensure the financial stability of your organization. In this comprehensive guide, we will explore the key principles of forecasting and provide you with the tools and techniques you need to succeed.

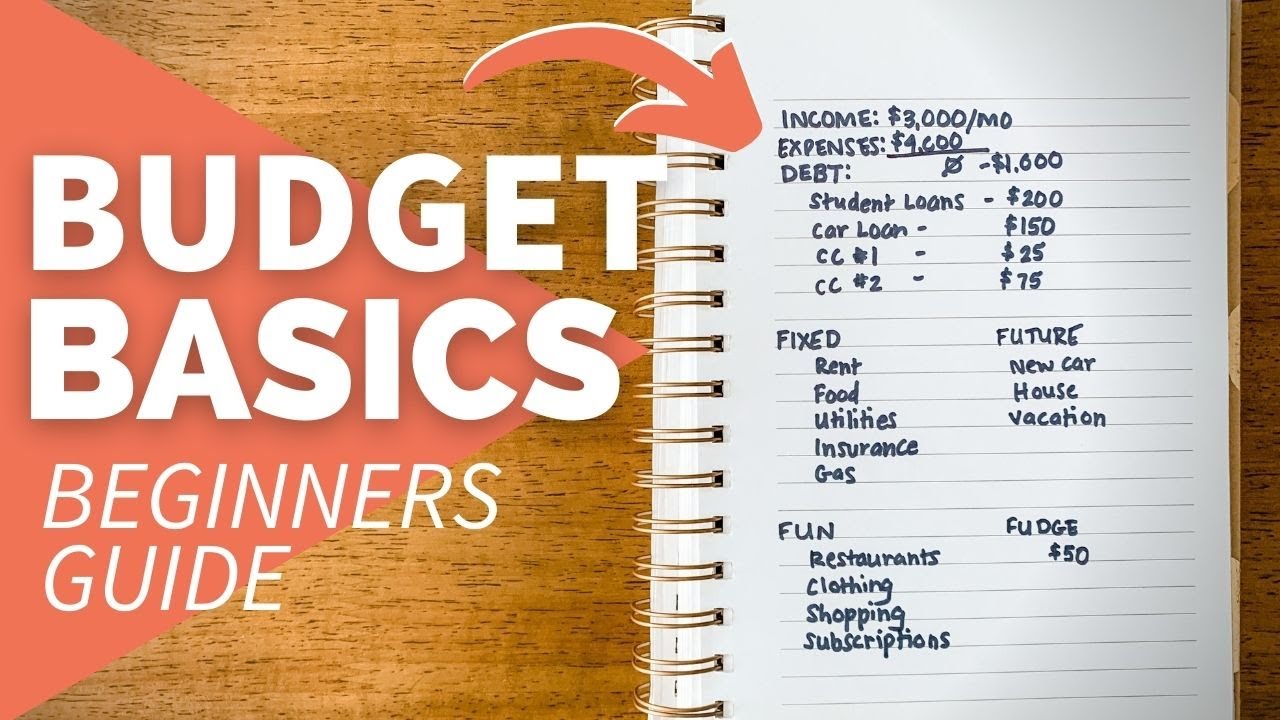

Image Source: coastal24.com

One of the most important steps in forecasting is understanding the different types of forecasting methods available. Some common methods include qualitative forecasting, which relies on expert opinions and judgment, and quantitative forecasting, which uses historical data and mathematical models to make predictions. By utilizing a combination of these methods, you can create more accurate forecasts that take into account both subjective and objective factors.

When it comes to forecasting tools, there are a variety of options available to help you analyze data and make predictions. Excel is a popular choice for many businesses, as it allows you to create sophisticated models and perform complex calculations with ease. Other tools, such as forecasting software and business intelligence platforms, offer advanced features that can help you streamline the forecasting process and improve accuracy.

In addition to choosing the right tools, it’s important to develop a solid understanding of key forecasting concepts, such as trend analysis, seasonality, and regression analysis. Trend analysis involves identifying patterns in data over time, while seasonality refers to recurring patterns that occur at regular intervals. Regression analysis, on the other hand, allows you to identify relationships between different variables and make predictions based on these relationships.

Image Source: m1cu.org

Another important aspect of forecasting is data quality and accuracy. Garbage in, garbage out – if your data is inaccurate or incomplete, your forecasts will be unreliable. To ensure the accuracy of your forecasts, it’s crucial to regularly review and clean your data, look for outliers and anomalies, and use statistical techniques to validate your models.

When it comes to creating forecasts, it’s important to be realistic and conservative in your projections. While it’s tempting to aim for high growth and profitability, it’s important to consider factors such as market volatility, economic conditions, and competition. By setting realistic goals and expectations, you can avoid overestimating revenue and underestimating expenses, which can lead to financial problems down the line.

In addition to creating forecasts, it’s important to continuously monitor and update your forecasts as new data becomes available. By regularly reviewing your forecasts and comparing them to actual results, you can identify trends, adjust your projections, and make informed decisions to ensure the financial health of your organization.

Image Source: ytimg.com

In conclusion, mastering forecasting tools is essential for effective budgeting and financial planning. By understanding the principles of forecasting, choosing the right tools, and following best practices, you can make accurate predictions, plan for the future, and achieve long-term financial success. So don’t wait any longer – start mastering forecasting tools today and take your budgeting skills to the next level!

How to Learn Budgeting & Forecasting Tools

Image Source: mathgiraffe.com

Image Source: desertfinancial.com