Busting the Myth: MBA Essential in Finance?

When it comes to pursuing a career in finance, there is a common misconception that obtaining a Master of Business Administration (MBA) is essential. However, this belief is actually a myth that has been perpetuated for years. In reality, there are various alternatives to an MBA that can pave the way to a successful career in finance.

One of the main reasons why people believe that an MBA is necessary for a career in finance is because of the prestige and reputation associated with this degree. Many top executives and financial professionals hold MBAs, leading to the assumption that it is a requirement for success in the field. However, this is simply not the case.

Image Source: googleusercontent.com

In fact, there are plenty of successful finance professionals who have achieved their goals without obtaining an MBA. For example, Warren Buffett, one of the most successful investors of all time, does not have an MBA. Instead, he focused on gaining practical experience and honing his skills through hands-on work in the industry.

Another reason why the myth of the MBA being essential in finance persists is because of the networking opportunities that come with obtaining this degree. While it is true that an MBA program can provide valuable networking connections, it is not the only way to build a strong professional network.

There are plenty of other ways to connect with industry professionals and build relationships that can help advance your career in finance. Attending industry events, joining professional organizations, and reaching out to mentors are all effective ways to expand your network without pursuing an MBA.

Image Source: googleusercontent.com

Furthermore, the cost of obtaining an MBA can be a major deterrent for many aspiring finance professionals. The tuition fees for MBA programs can be exorbitant, and the return on investment is not always guaranteed. Many people are hesitant to take on significant student loan debt in pursuit of a degree that may not be necessary for their career goals.

Instead of automatically assuming that an MBA is the only path to success in finance, it is important to consider alternative options that may be more cost-effective and efficient. For example, pursuing professional certifications such as the Chartered Financial Analyst (CFA) designation can be a valuable alternative to an MBA.

The CFA program covers a wide range of topics related to finance and investments, and earning this designation demonstrates a high level of expertise in the field. Many employers in the finance industry value the CFA designation as much as, if not more than, an MBA.

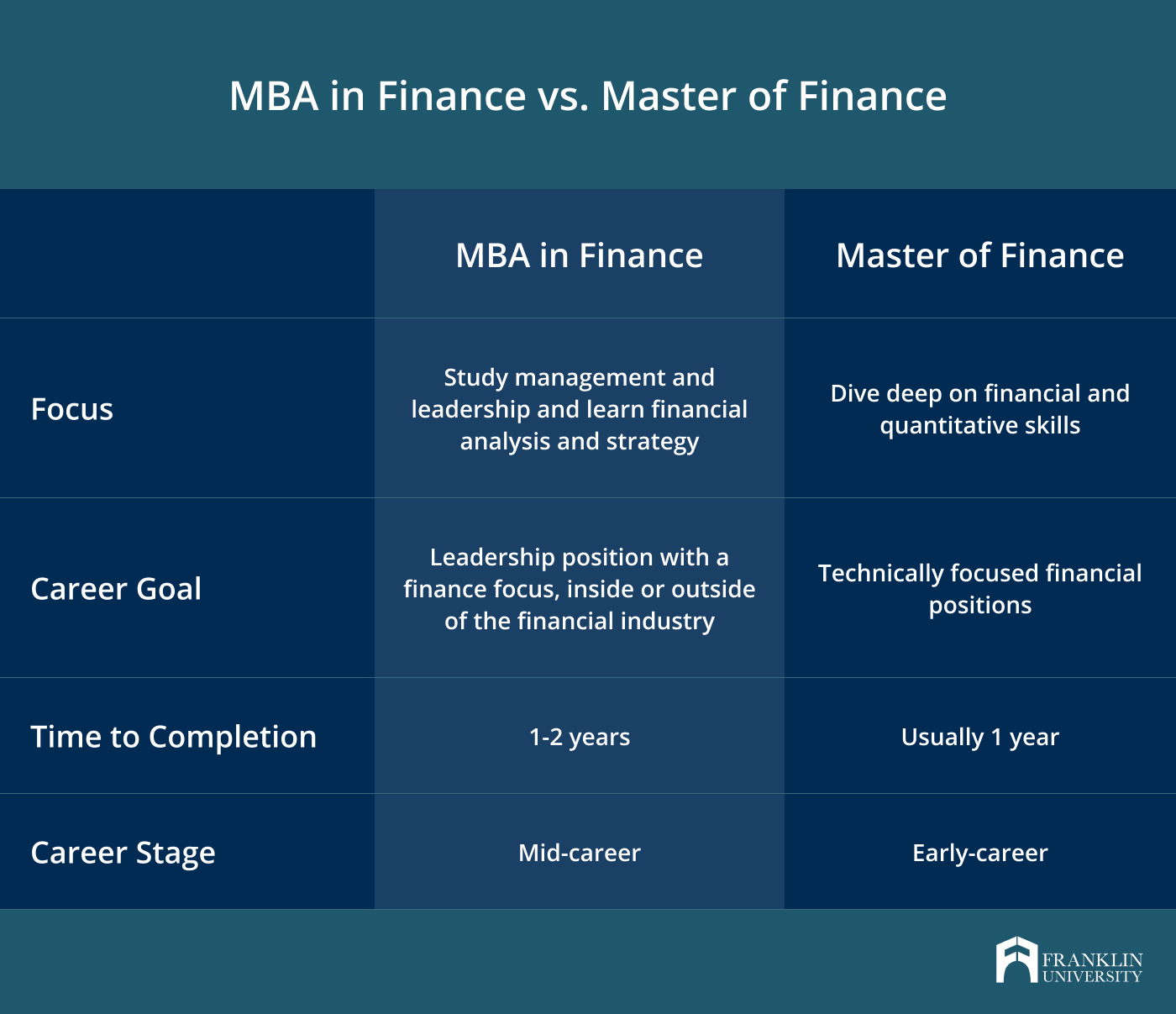

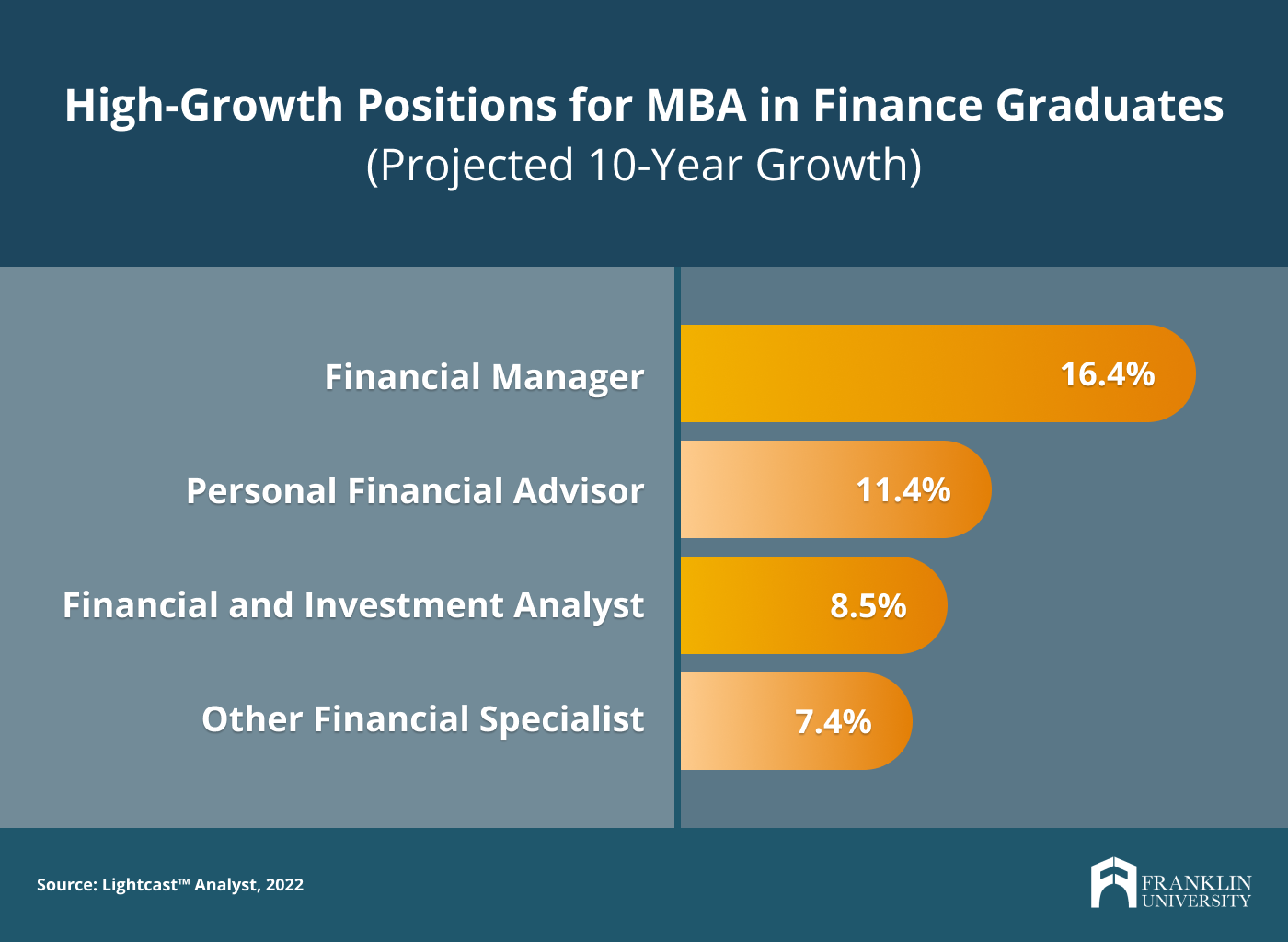

Image Source: franklin.edu

Another alternative to an MBA in finance is gaining practical experience through internships, entry-level positions, and on-the-job training. Hands-on experience in the finance industry can be just as valuable, if not more so, than classroom learning. Many employers value real-world experience and skills over formal education.

Overall, the belief that an MBA is essential for a career in finance is a myth that needs to be debunked. There are plenty of alternative paths to success in the finance industry that do not require obtaining this degree. By exploring other options such as professional certifications, networking opportunities, and practical experience, aspiring finance professionals can achieve their career goals without breaking the bank on an MBA.

Exploring Alternatives to an MBA in Finance

When it comes to pursuing a career in finance, many people believe that obtaining a Master of Business Administration (MBA) is essential. However, this myth can often deter individuals who may not have the time or resources to commit to a full-time MBA program. The good news is that there are several alternative paths to a successful career in finance that do not necessarily require an MBA.

Image Source: medium.com

One alternative to obtaining an MBA in finance is pursuing a Chartered Financial Analyst (CFA) designation. The CFA program is a globally recognized certification that demonstrates expertise in investment management and financial analysis. While obtaining a CFA designation may require a significant amount of time and dedication, it is a valuable credential that can open doors to a variety of career opportunities in finance.

Another alternative to an MBA in finance is pursuing a Master of Science in Finance (MSF) degree. An MSF program typically focuses on specialized topics in finance, such as corporate finance, investment management, and financial modeling. While an MSF degree may not provide the same broad business knowledge as an MBA, it can be a more focused and efficient way to gain the skills and knowledge needed for a career in finance.

In addition to traditional graduate programs, there are also online courses and certifications that can help individuals develop their skills and knowledge in finance. Platforms like Coursera, Udemy, and Khan Academy offer a wide range of finance courses that cover topics such as financial modeling, investment analysis, and risk management. While online courses may not provide the same level of depth as a formal degree program, they can be a cost-effective way to enhance your skills and knowledge in finance.

Image Source: franklin.edu

Networking and gaining practical experience can also be valuable alternatives to obtaining an MBA in finance. Building relationships with professionals in the finance industry through networking events, informational interviews, and internships can help you learn about different career paths and opportunities in finance. Practical experience, such as working in a finance-related role or completing a finance internship, can also help you develop the skills and knowledge needed for a successful career in finance.

Ultimately, the decision of whether or not to pursue an MBA in finance depends on your personal goals, preferences, and circumstances. While an MBA can provide a comprehensive education in business and finance, there are also alternative paths that can lead to a successful career in finance. By exploring these alternatives and considering your own strengths and interests, you can debunk the myth that an MBA is required for a career in finance and find a path that is right for you.

Do You Need an MBA to Work in Finance?