Elevate Your Career with these Top Finance Certifications!

Are you looking to make a career transition into the finance industry, but don’t know where to start? One of the best ways to boost your credentials and set yourself apart from the competition is by obtaining a finance certification. Whether you are coming from a completely different industry or looking to advance your current finance career, these certifications can help you make a smooth transition and elevate your career to new heights.

1. Chartered Financial Analyst (CFA)

Image Source: shoonya.com

The Chartered Financial Analyst (CFA) certification is one of the most prestigious and globally recognized credentials in the finance industry. It is ideal for professionals who are looking to specialize in investment management and financial analysis. The CFA program covers a wide range of topics, including ethics, quantitative methods, economics, financial reporting and analysis, corporate finance, equity investments, fixed income, derivatives, alternative investments, and portfolio management.

By earning the CFA certification, you demonstrate to employers and clients that you have a deep understanding of financial markets and investment strategies. This certification can open up a wide range of career opportunities in areas such as portfolio management, research analysis, risk management, and investment banking. It can also significantly increase your earning potential and help you advance to senior positions within your organization.

To become a CFA charterholder, you must pass three levels of exams, have four years of qualified work experience in the investment industry, and adhere to a strict code of ethics and professional conduct. While the CFA program is rigorous and requires a significant time commitment, the benefits of earning this certification are well worth the effort.

Image Source: ctfassets.net

If you are looking to transition into a finance career from any industry, obtaining the CFA certification can give you the knowledge, skills, and credibility you need to succeed in the competitive world of finance.

In conclusion, the CFA certification is a valuable asset for professionals looking to transition into the finance industry and advance their careers. By earning this prestigious credential, you can demonstrate your expertise in investment management and financial analysis, open up new career opportunities, and increase your earning potential. So why wait? Elevate your career with the CFA certification today!

Make a Smooth Transition into Finance with These Certifications!

Are you looking to make a career transition into the finance industry? Perhaps you come from a completely different background, but have always been intrigued by the world of finance. Well, you’re in luck! There are several certifications that can help you make a smooth transition into finance from any industry. These certifications will not only provide you with the necessary knowledge and skills, but also give you a competitive edge in the job market.

Image Source: ollusa.edu

1. Certified Financial Planner (CFP)

The Certified Financial Planner (CFP) certification is one of the most recognized and respected certifications in the finance industry. It is designed for individuals who want to become financial planners and help clients with their financial goals. The CFP certification covers a wide range of topics including financial planning, retirement planning, estate planning, and investment management. By obtaining this certification, you will demonstrate your expertise in financial planning and increase your credibility as a finance professional.

2. Chartered Financial Analyst (CFA)

Image Source: zelleducation.com

The Chartered Financial Analyst (CFA) certification is another prestigious certification that is highly regarded in the finance industry. It is ideal for individuals who are interested in investment management and financial analysis. The CFA program covers a wide range of topics including ethics, investment tools, asset valuation, and portfolio management. By earning the CFA designation, you will show potential employers that you have a deep understanding of investment concepts and are capable of making sound financial decisions.

3. Financial Risk Manager (FRM)

If you are interested in risk management and want to pursue a career in this field, the Financial Risk Manager (FRM) certification is the perfect choice for you. The FRM certification is designed for individuals who want to specialize in managing risk in financial institutions. The program covers topics such as risk management tools, quantitative analysis, and financial markets. By obtaining the FRM designation, you will demonstrate your knowledge and expertise in risk management and enhance your career opportunities in the finance industry.

Image Source: shoonya.com

4. Certified Public Accountant (CPA)

The Certified Public Accountant (CPA) certification is essential for individuals who are interested in accounting and finance. While the CPA exam is challenging, obtaining this certification will open up a wide range of career opportunities in finance, accounting, and auditing. The CPA designation is highly respected in the industry and demonstrates your expertise in financial reporting, taxation, and auditing. If you want to pursue a career in finance with a focus on accounting, the CPA certification is a must-have.

5. Certified Management Accountant (CMA)

Image Source: ytimg.com

The Certified Management Accountant (CMA) certification is perfect for individuals who are interested in management accounting and want to advance their career in finance. The CMA program covers topics such as financial planning, analysis, and control. By earning the CMA designation, you will demonstrate your expertise in management accounting and increase your chances of landing a high-paying job in finance. The CMA certification is recognized globally and will give you a competitive edge in the job market.

In conclusion, these certifications are excellent options for individuals who want to make a smooth transition into finance from any industry. Whether you are interested in financial planning, investment management, risk management, accounting, or management accounting, there is a certification that will suit your interests and career goals. By obtaining one of these certifications, you will enhance your knowledge and skills, increase your credibility as a finance professional, and open up new career opportunities in the finance industry. So why wait? Take the first step towards a successful career in finance by earning one of these prestigious certifications today!

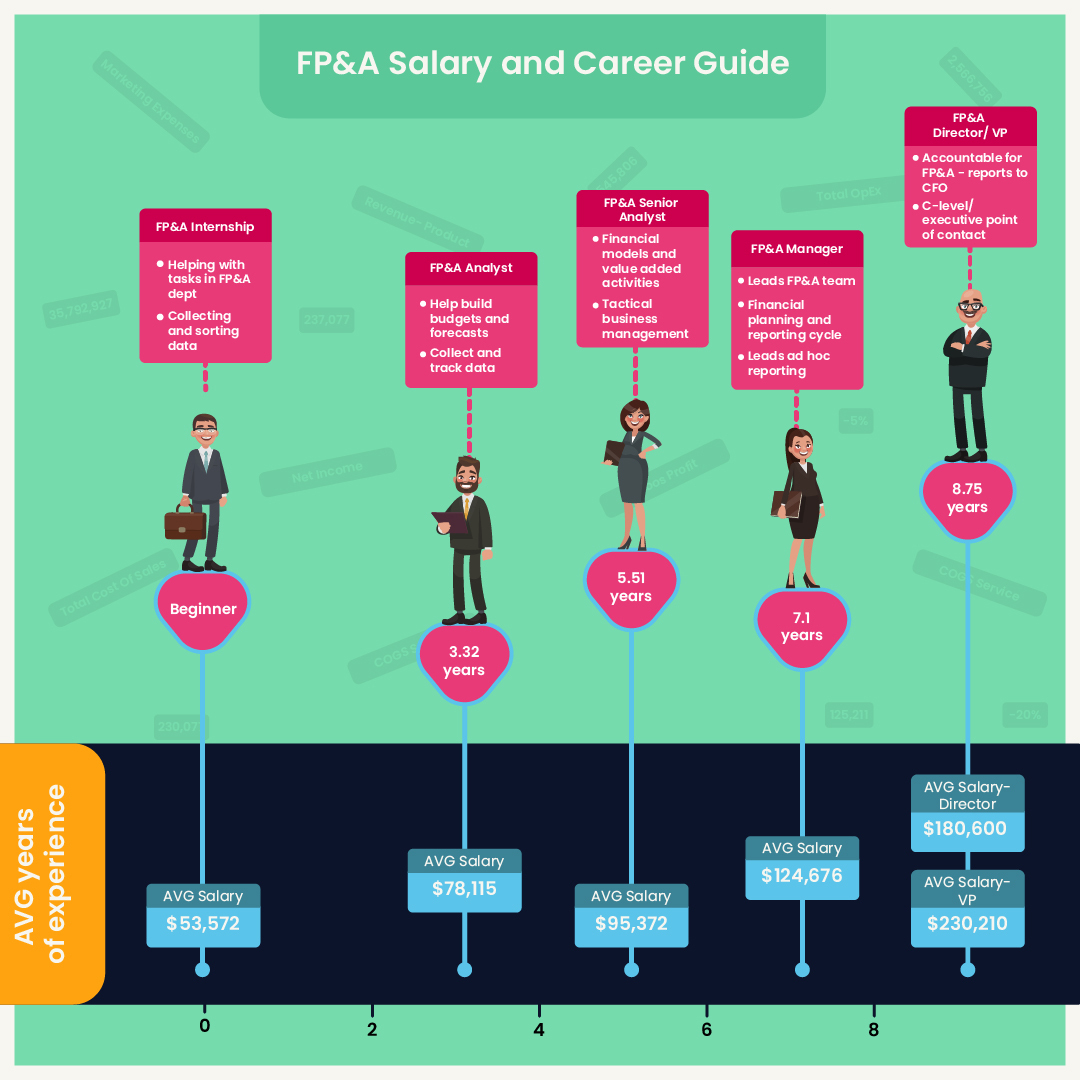

Image Source: datarails.com

Certifications That Help You Switch to Finance from Other Fields

:max_bytes(150000):strip_icc()/bigfour-0e7f1f82c9294d788286e4a66b7f06ee.jpg?w=400&resize=400,400&ssl=1)