Dive into Success with These Finance Exam Flashcards!

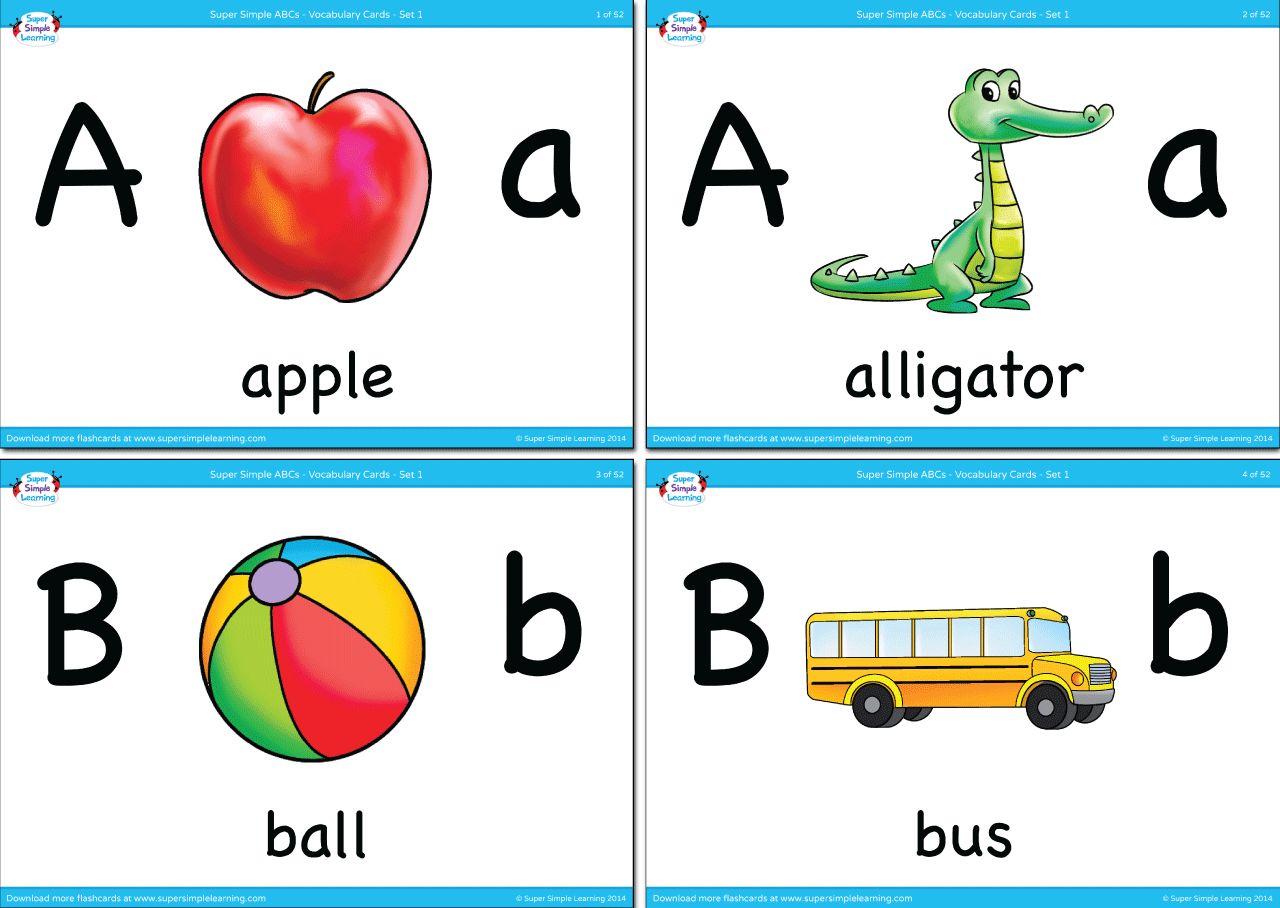

Are you ready to ace your upcoming finance exams? Look no further than these amazing finance exam flashcards to help you dive into success! Flashcards are a fantastic study tool that can help you memorize key concepts, terms, and formulas in a fun and engaging way. With the right flashcards, you can elevate your study game and boost your chances of acing those exams.

One of the best things about finance exam flashcards is their convenience. You can easily carry them with you wherever you go, whether you’re on the bus, waiting in line, or relaxing at home. This means you can sneak in some valuable study time whenever you have a spare moment, making the most of your busy schedule.

Image Source: imgix.net

These flashcards are designed specifically for finance students, covering a wide range of topics from financial accounting to corporate finance. They are expertly crafted to ensure that you are learning the most important information in a clear and concise manner. Whether you’re a visual learner, an auditory learner, or a hands-on learner, there are flashcards that cater to your preferred study style.

Not only are finance exam flashcards practical and effective, but they are also incredibly fun to use. You can challenge yourself with quizzes, games, and memory exercises that will keep you engaged and motivated throughout your study sessions. Say goodbye to boring, monotonous study sessions and hello to an exciting and interactive learning experience!

In addition to helping you memorize important information, finance exam flashcards can also improve your critical thinking and problem-solving skills. By testing your knowledge and understanding of key concepts, you can identify areas where you need to focus more attention and review. This targeted approach to studying will ensure that you are fully prepared for your finance exams and can tackle any question that comes your way.

Image Source: elitemedicalprep.com

So, what are you waiting for? Dive into success with these incredible finance exam flashcards and watch your grades soar to new heights. With the right study tools in your hands, you can achieve academic excellence and pave the way for a successful career in the world of finance. Happy studying!

Elevate Your Study Game with Top Finance Exam Apps!

Are you looking to ace your finance exams and boost your grades? Look no further! In today’s digital age, there are countless resources available to help you study smarter, not harder. One of the best tools at your disposal are finance exam apps, designed to make learning more interactive, engaging, and efficient. Let’s take a look at some of the top finance exam apps that will help you elevate your study game and achieve academic success.

1. Quizlet

Quizlet is a popular study app that offers a wide range of study materials, including flashcards, practice quizzes, and study games. With Quizlet, you can create your own study sets or choose from millions of pre-made sets on various finance topics such as accounting, investment, and financial management. The app also allows you to track your progress, set study reminders, and collaborate with classmates. Quizlet’s interactive features make studying fun and effective, helping you retain information and ace your finance exams.

Image Source: media-amazon.com

2. CFA Exam App

For those studying for the Chartered Financial Analyst (CFA) exams, the CFA Exam App is a must-have resource. This app provides access to thousands of practice questions, mock exams, and study materials to help you prepare for all three levels of the CFA exam. The app also offers detailed explanations for each question, performance tracking tools, and a customizable study schedule to keep you on track. With the CFA Exam App, you can confidently approach your CFA exams and demonstrate your knowledge and skills in finance.

3. Bloomberg Exam Prep

Bloomberg Exam Prep is another top finance exam app that offers comprehensive study materials for finance students. This app provides access to practice questions, video lectures, and study guides on various finance topics, such as corporate finance, investment banking, and financial modeling. Bloomberg Exam Prep also features adaptive learning technology, which personalizes your study plan based on your strengths and weaknesses. With Bloomberg Exam Prep, you can focus on areas where you need the most improvement and maximize your study time for optimal results on your finance exams.

4. Investopedia

Investopedia is a trusted source of financial information and education, and their app is no exception. The Investopedia app offers a wide range of resources for finance students, including articles, videos, and tutorials on finance concepts, market trends, and investment strategies. The app also features a dictionary of financial terms, calculators, and quizzes to test your knowledge. With the Investopedia app, you can deepen your understanding of finance topics, stay updated on industry news, and enhance your exam preparation.

Image Source: totcards.com

5. Wall Street Prep

Wall Street Prep is a leading provider of financial training programs, and their app is designed to help finance students excel in their exams. The Wall Street Prep app offers interactive courses, study guides, and practice questions on topics such as financial modeling, valuation, and equity research. The app also provides access to webinars, case studies, and networking opportunities with industry professionals. With Wall Street Prep, you can gain valuable skills and insights that will set you apart in your finance exams and future career in finance.

In conclusion, finance exam apps are invaluable resources that can help you study more effectively, understand complex concepts, and achieve academic success. Whether you’re studying for a general finance exam or a specialized certification like the CFA, these top finance exam apps will elevate your study game and help you ace your exams with confidence. So why wait? Download these apps today and take your finance studies to the next level!

Image Source: canva.com

Flashcards & Apps to Help You Study for Finance Exams

Image Source: media-amazon.com

Image Source: supersimple.com