Money Matters: Crafting Your Personal Finance Plan

Welcome to the exciting world of personal finance! Whether you’re a seasoned pro or just starting out, crafting a personal finance plan is crucial to your financial success. From budgeting and saving to investing and planning for the future, having a solid financial plan in place can help you achieve your money goals and live the life you’ve always dreamed of.

But where do you start? How do you go about creating a personal finance plan that works for you? Don’t worry, we’ve got you covered. In this step-by-step guide, we’ll walk you through the process of crafting a personalized financial plan that will set you on the path to financial freedom.

Image Source: kajabi-cdn.com

Step 1: Set Your Financial Goals

The first step in creating a personal finance plan is to set your financial goals. What do you want to achieve with your money? Do you want to buy a house, travel the world, or retire early? By setting clear, specific goals, you’ll have something to work towards and keep you motivated along the way.

Step 2: Assess Your Current Financial Situation

Next, take a look at your current financial situation. How much money do you earn each month? What are your expenses? Are you carrying any debt? By understanding where you stand financially, you can start to make informed decisions about how to move forward with your financial plan.

Step 3: Create a Budget

Now that you know your financial goals and have a clear picture of your current financial situation, it’s time to create a budget. A budget is a spending plan that outlines how much money you have coming in and how much you have going out. By creating a budget, you can track your spending, identify areas where you can cut back, and ensure you’re on track to meet your financial goals.

Image Source: website-files.com

Step 4: Save and Invest

Once you have a budget in place, it’s time to start saving and investing. Saving money is crucial for building an emergency fund and achieving your short-term goals, while investing is essential for building wealth over the long term. Whether you’re saving for a rainy day or investing for retirement, make sure to regularly contribute to your savings and investment accounts.

Step 5: Plan for the Future

Finally, it’s important to plan for the future. This includes setting up an emergency fund, securing insurance coverage, and creating a retirement plan. By planning for the unexpected and preparing for the future, you can protect yourself and your loved ones from financial hardship and ensure a secure financial future.

In conclusion, crafting a personal finance plan is an essential step in mastering your money and achieving your financial goals. By setting clear goals, assessing your current financial situation, creating a budget, saving and investing, and planning for the future, you can take control of your finances and build a secure financial future for yourself and your loved ones. So what are you waiting for? Start crafting your personal finance plan today and take the first step towards financial freedom!

Get Organized: Create a Study Schedule Today!

Image Source: powerslides.com

Are you ready to take control of your finances and start building a successful personal finance plan? One of the key steps to mastering your money is creating a study schedule that will help you stay organized and on track with your financial goals. In this article, we will guide you through the process of creating a study schedule that works for you.

The first step in creating a study schedule is to assess your current financial situation. Take some time to gather all of your financial documents, such as bank statements, bills, and credit card statements. Once you have a clear understanding of your income and expenses, you can start to identify areas where you may need to make changes.

Next, set specific financial goals for yourself. Whether you want to pay off debt, save for a big purchase, or build an emergency fund, having clear goals will help you stay motivated and focused. Write down your goals and break them down into smaller, achievable steps.

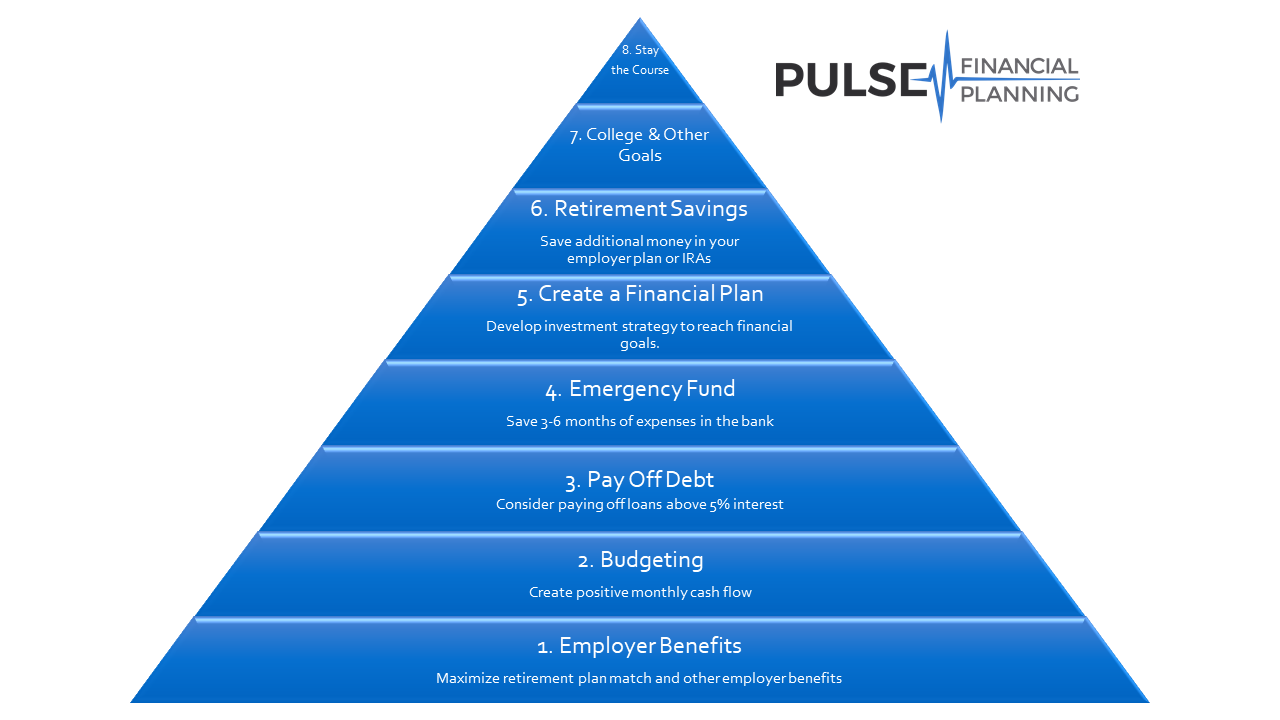

Image Source: pulsefinancialplanning.com

Now that you have a clear understanding of your finances and set specific goals, it’s time to create a study schedule. Start by identifying how much time you can realistically dedicate to studying each week. This could be as little as 30 minutes a day or a few hours on the weekend. Whatever time you choose, make sure it’s consistent and manageable for you.

When creating your study schedule, consider the best time of day for you to focus. Some people are more productive in the morning, while others prefer studying in the evening. Choose a time that works best for you and stick to it as much as possible.

Divide your study time into different categories based on your financial goals. For example, if you want to learn more about budgeting, saving, and investing, allocate specific time for each topic. This will help you stay organized and ensure you cover all aspects of personal finance.

Image Source: westernsouthern.com

In addition to allocating time for different topics, it’s important to incorporate regular reviews into your study schedule. Set aside time each week to review your progress, track your spending, and adjust your goals if necessary. Regular reviews will help you stay on track and make any necessary changes to your plan.

Another key aspect of creating a successful study schedule is to stay motivated and accountable. Find a study buddy or join a personal finance group to share your progress, ask questions, and stay motivated. Having someone to hold you accountable will help you stay on track with your study schedule.

As you follow your study schedule and work towards your financial goals, don’t forget to celebrate your achievements along the way. Whether you reach a milestone, pay off a debt, or increase your savings, take the time to acknowledge your hard work and progress. Celebrating your achievements will help you stay motivated and inspired to continue working towards your financial goals.

Image Source: kajabi-cdn.com

In conclusion, creating a study schedule is a crucial step in mastering your money and building a successful personal finance plan. By assessing your current financial situation, setting specific goals, and creating a study schedule that works for you, you can take control of your finances and work towards a brighter financial future. So, get organized, create a study schedule today, and start your journey towards financial success!

How to Build Your Own Finance Study Schedule