Unlocking Sustainable Finance Brilliance with ESG Knowledge

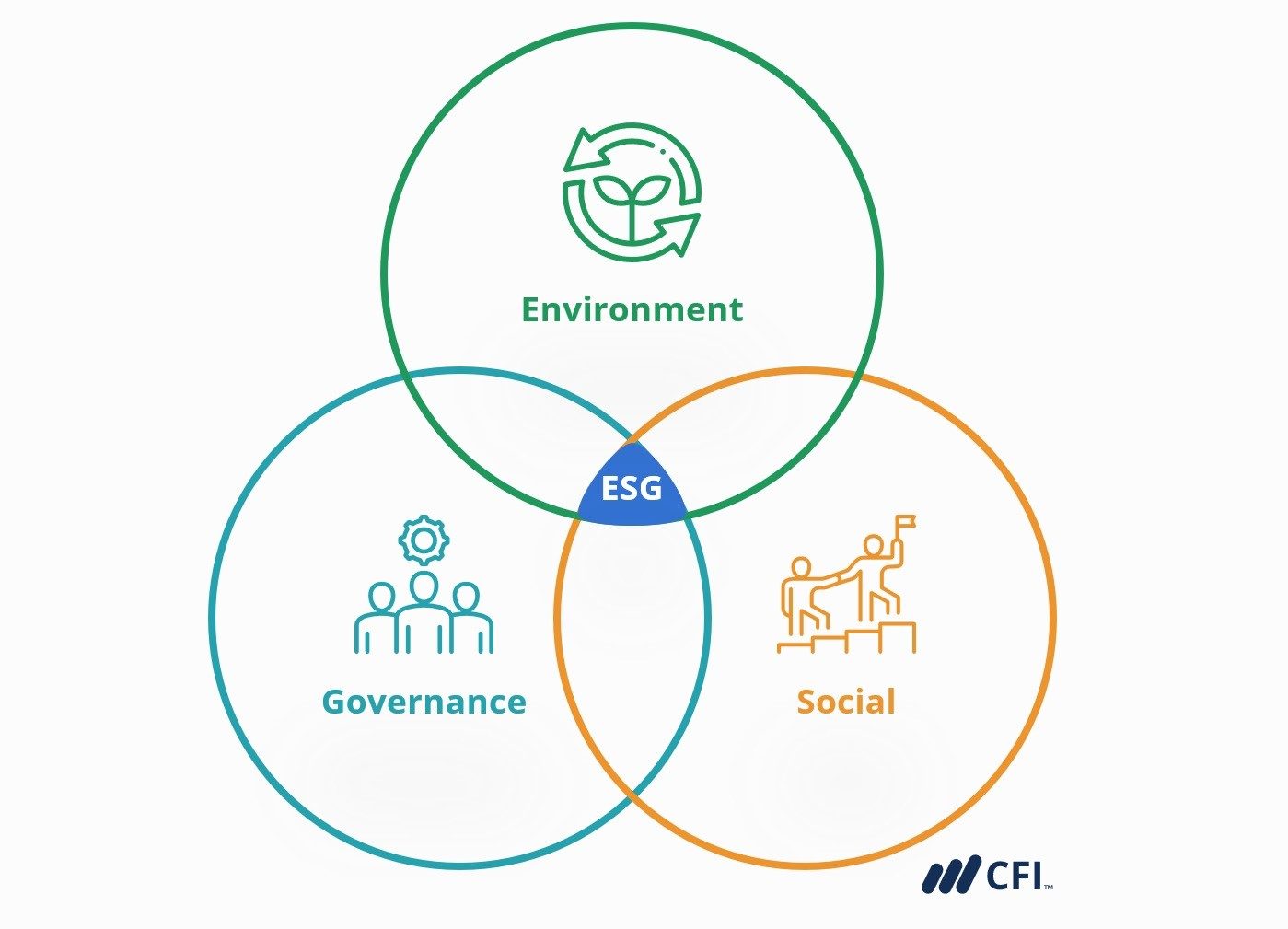

In today’s world, sustainable finance is becoming increasingly important as businesses and investors are realizing the impact they have on the environment and society. Environmental, Social, and Governance (ESG) criteria have emerged as a key factor in assessing the sustainability and ethical impact of investments. By incorporating ESG knowledge into financial decision-making, companies and investors can unlock a world of opportunities for sustainable finance brilliance.

ESG knowledge refers to the understanding of how environmental, social, and governance factors can affect the performance and risk of investments. It involves analyzing a company’s policies and practices in areas such as climate change, human rights, diversity, and executive pay. By considering these factors, investors can make more informed decisions about where to allocate their capital and drive positive change in the world.

Image Source: corporatefinanceinstitute.com

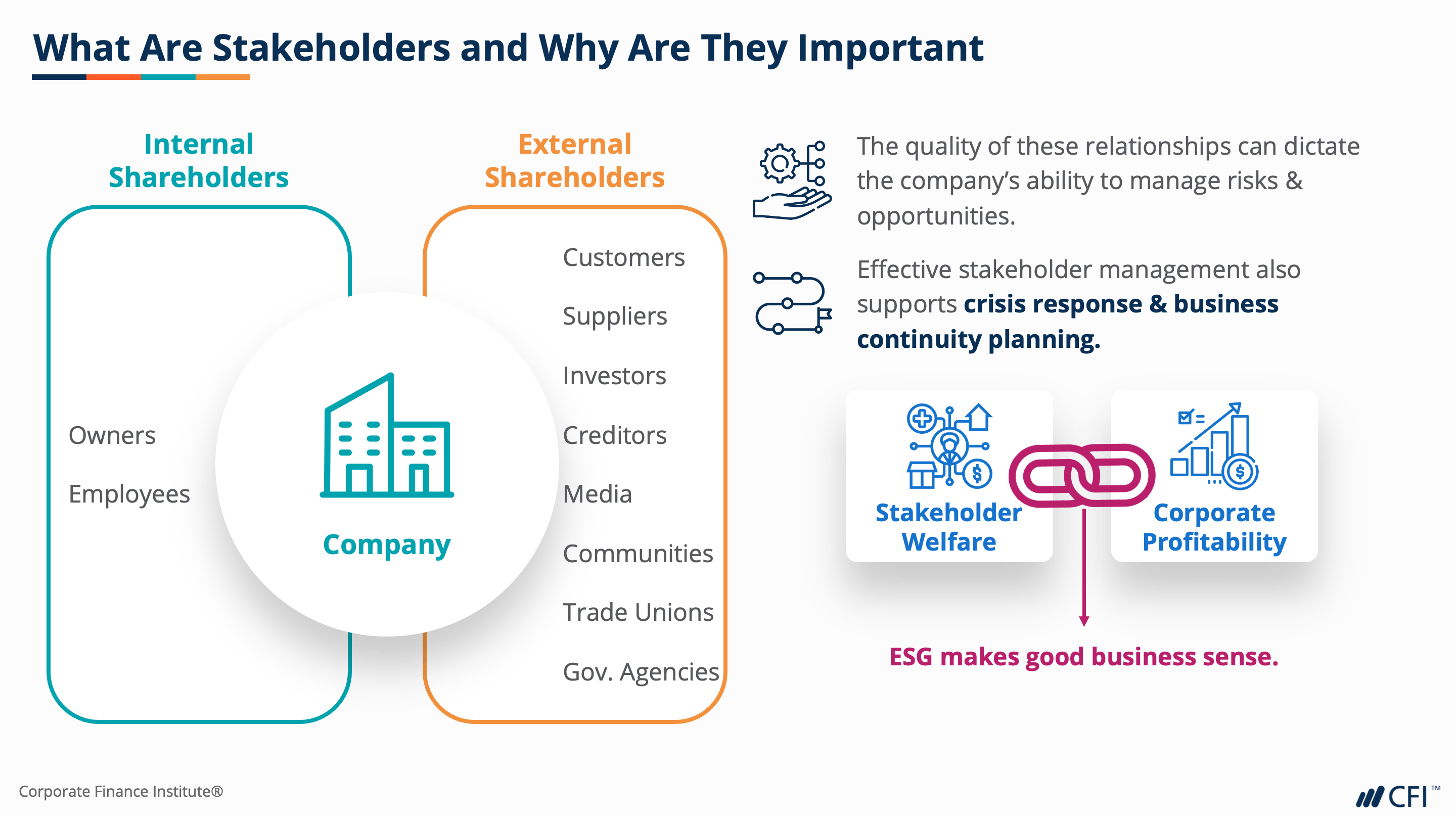

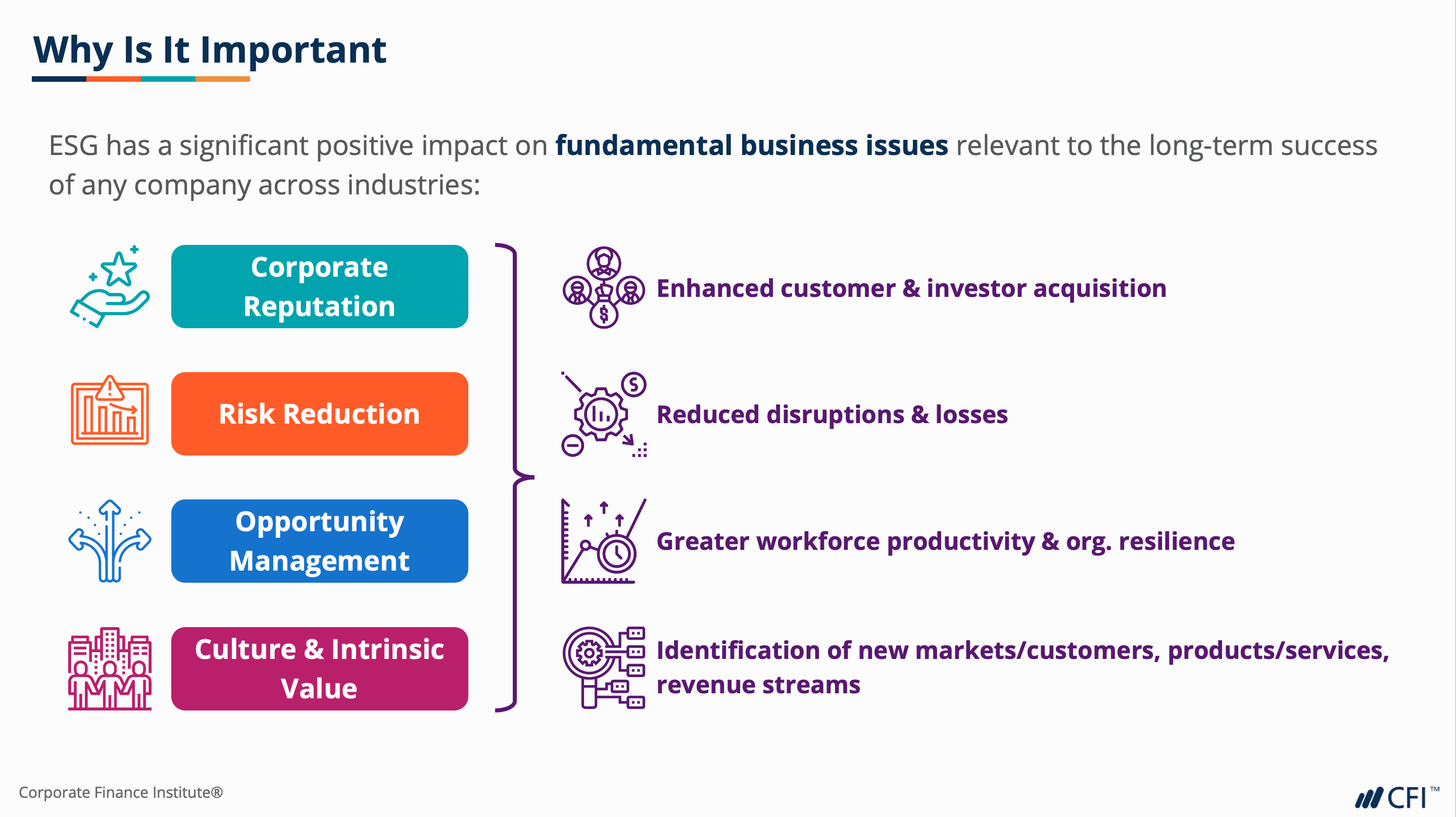

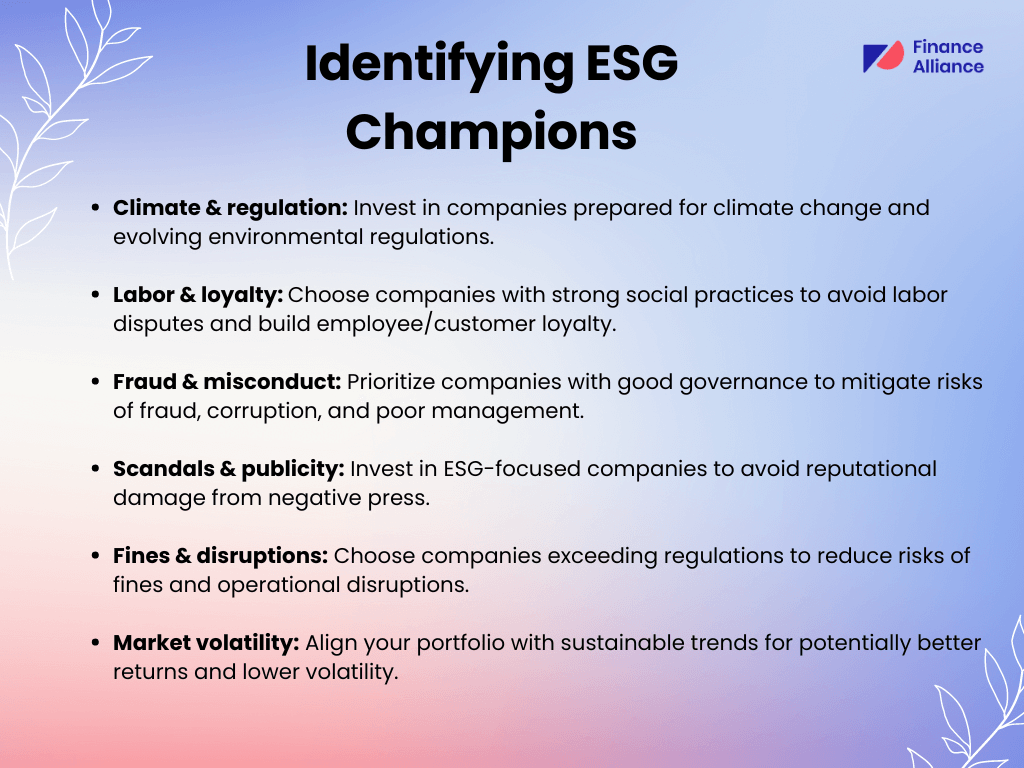

One of the key benefits of incorporating ESG knowledge into financial decision-making is the ability to identify and mitigate risks. Companies that do not have strong ESG practices are more vulnerable to environmental disasters, regulatory fines, and reputational damage. By conducting thorough ESG analysis, investors can avoid these risks and protect their investments in the long term.

Furthermore, ESG knowledge can also lead to improved financial performance. Studies have shown that companies with strong ESG practices tend to outperform their peers in terms of stock price performance, profitability, and risk management. By investing in companies with high ESG ratings, investors can potentially achieve better returns while supporting sustainable and responsible business practices.

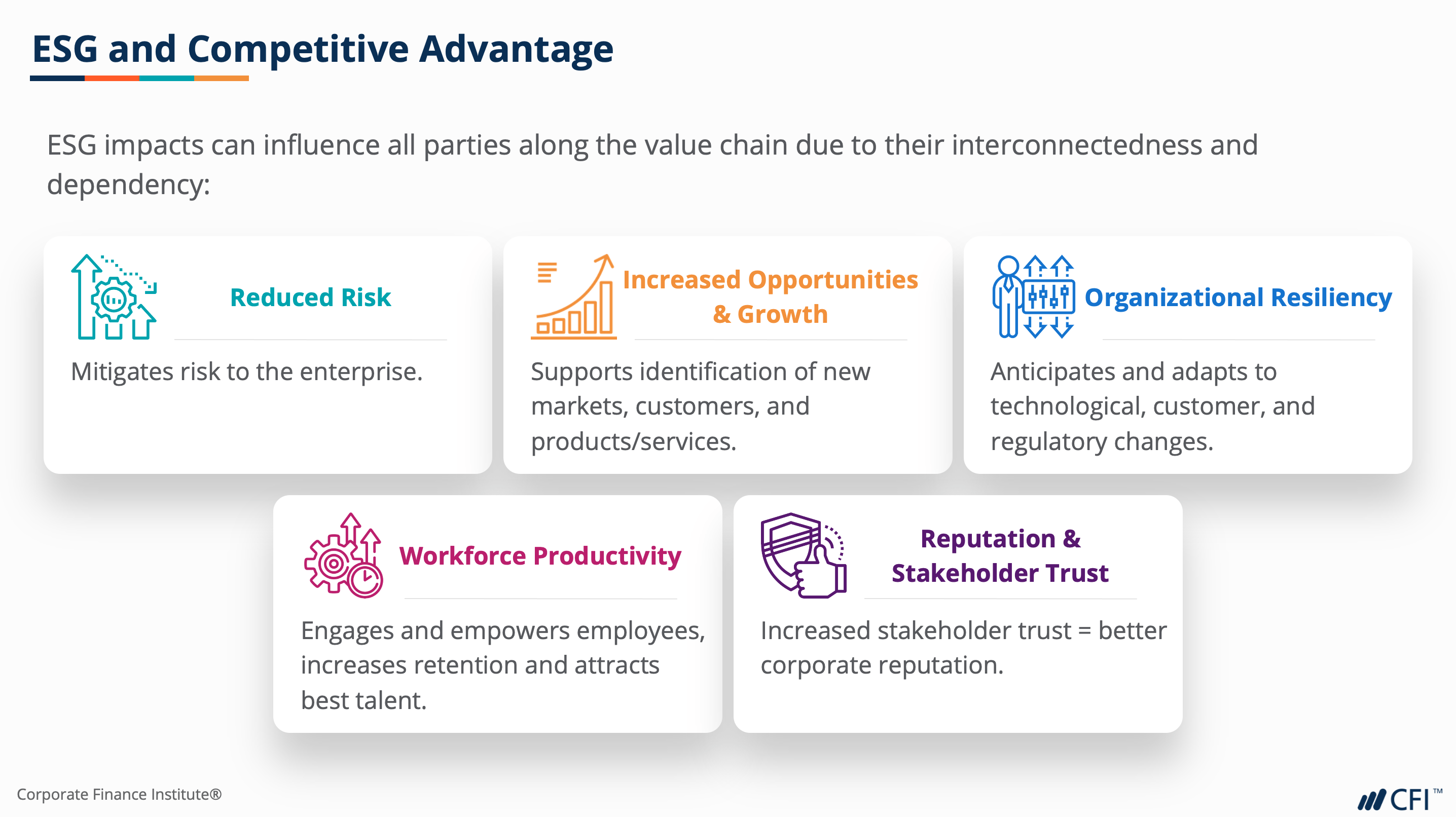

In addition to risk mitigation and financial performance, ESG knowledge can also drive innovation and growth. Companies that prioritize sustainability and social responsibility are more likely to attract and retain top talent, enhance their brand reputation, and foster long-term relationships with customers and stakeholders. By incorporating ESG criteria into their business strategies, companies can gain a competitive advantage in the marketplace and create value for all stakeholders.

Image Source: corporatefinanceinstitute.com

ESG knowledge is not just important for investors and companies – it is also crucial for policymakers and regulators. As the demand for sustainable finance continues to grow, governments around the world are implementing ESG disclosure requirements and sustainability standards to promote transparency and accountability in the financial industry. By staying informed about ESG trends and developments, policymakers can create a more sustainable and resilient financial system that benefits society as a whole.

Overall, unlocking sustainable finance brilliance with ESG knowledge is essential for building a more sustainable and equitable future. By understanding the impact of environmental, social, and governance factors on investments, companies and investors can make more informed decisions that drive positive change in the world. ESG knowledge is not just a tool for risk mitigation and financial performance – it is a key driver of innovation, growth, and long-term value creation. By incorporating ESG criteria into financial decision-making, we can pave the way for a more sustainable and prosperous future for generations to come.

Dive into the World of ESG: Your Path to Financial Sustainability

In today’s ever-evolving financial landscape, sustainable investing has become increasingly important. As investors seek to align their financial goals with their values, the concept of Environmental, Social, and Governance (ESG) factors has gained traction. ESG knowledge has now become the key to sustainable finance success, and diving into this world can pave the way for a more financially sustainable future.

Image Source: corporatefinanceinstitute.com

ESG factors encompass a wide range of criteria that are used to evaluate a company’s sustainability and ethical impact. Environmental factors focus on a company’s impact on the environment, such as carbon emissions, waste management, and resource conservation. Social factors consider how a company interacts with its employees, customers, and the communities in which it operates. Governance factors assess the company’s leadership, executive pay, shareholder rights, and transparency.

By incorporating ESG criteria into investment decisions, investors can not only create positive social and environmental impact but also potentially generate long-term financial returns. Companies that prioritize ESG factors tend to be more resilient and better equipped to navigate risks and capitalize on opportunities in a rapidly changing world. In fact, studies have shown that companies with strong ESG performance often outperform their peers in terms of financial performance.

Diving into the world of ESG involves gaining a deep understanding of these factors and how they can impact investment decisions. It requires a shift in mindset from purely financial metrics to a more holistic view of a company’s sustainability. This shift is crucial for investors looking to build a more resilient and sustainable investment portfolio.

Image Source: googleusercontent.com

One way to dive into the world of ESG is by conducting thorough research on companies and industries that align with your values and sustainability goals. Look for companies that have a strong track record in environmental stewardship, social responsibility, and good governance practices. Consider how these factors can impact the company’s long-term success and financial performance.

Another way to explore the world of ESG is by engaging with companies directly through shareholder advocacy and proxy voting. By exercising your rights as a shareholder, you can influence corporate policies and practices to align with ESG principles. This can help drive positive change within companies and industries, ultimately leading to a more sustainable future.

Furthermore, there are a growing number of ESG-focused investment products and services that can help investors incorporate these factors into their portfolios. From ESG mutual funds to green bonds, there are a variety of options available for investors looking to build a more sustainable investment strategy. By working with financial advisors and asset managers who specialize in ESG investing, investors can gain valuable insights and guidance on how to integrate these factors into their investment decisions.

Image Source: zelleducation.com

In conclusion, diving into the world of ESG is your path to financial sustainability. By understanding and incorporating ESG factors into your investment decisions, you can create positive impact while potentially generating long-term financial returns. With the growing importance of sustainable finance, ESG knowledge has become the key to success in today’s financial landscape. So, take the plunge into the world of ESG and pave the way for a more financially sustainable future.

ESG Knowledge: The Next Big Finance Skill

Image Source: fsdc.org.hk

Image Source: corporatefinanceinstitute.com

Image Source: financealliance.io