Boost Your Money Smarts with These Fun Quizzes!

Are you ready to challenge your financial IQ and test your money smarts? Look no further because we have compiled a list of the top 10 finance quizzes that will put your knowledge to the test in a fun and engaging way. These quizzes cover a range of topics from budgeting and saving to investing and retirement planning. So grab a pen and paper, or better yet, your favorite device, and let’s get started!

1. Budgeting Basics: This quiz will test your knowledge of the fundamental principles of budgeting. Questions may cover topics such as setting financial goals, tracking expenses, and creating a budget that works for you. By taking this quiz, you will not only gauge your understanding of budgeting basics but also pick up some valuable tips on how to improve your financial management skills.

Image Source: goalsetter.co

2. Investment Options: Do you know the difference between stocks, bonds, and mutual funds? Can you explain the concept of diversification and its importance in building a strong investment portfolio? This quiz will challenge your knowledge of various investment options and help you determine the best strategies for achieving your financial goals.

3. Credit Score Savvy: Your credit score plays a crucial role in your financial health. This quiz will test your understanding of what factors influence your credit score, how to improve it, and why maintaining a good credit score is essential for achieving your financial goals. By the end of this quiz, you will be better equipped to make informed decisions about borrowing and managing credit.

4. Retirement Planning: Are you on track to retire comfortably? This quiz will assess your knowledge of retirement planning essentials, such as calculating your retirement savings goal, understanding different retirement account options, and developing a retirement income strategy. By taking this quiz, you will gain valuable insights into preparing for a financially secure retirement.

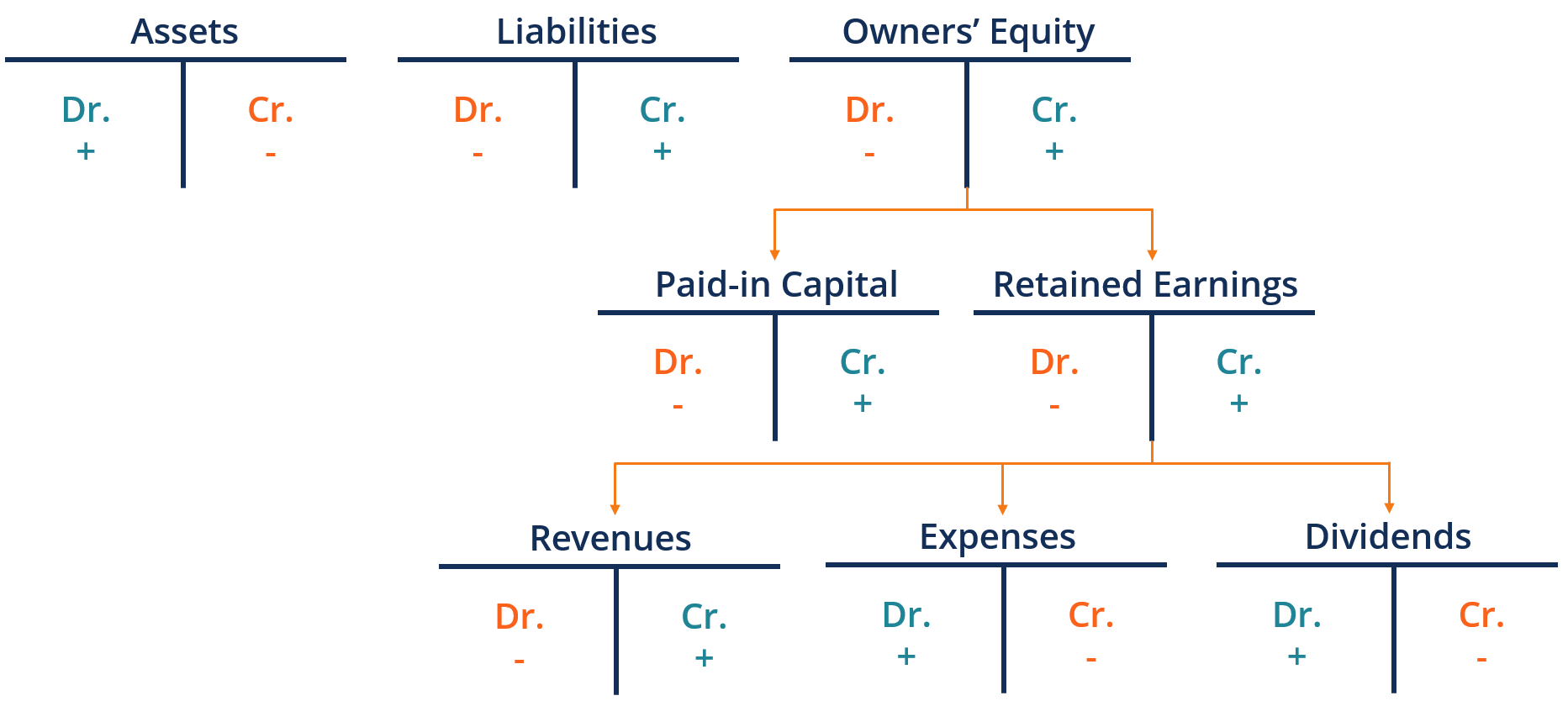

Image Source: corporatefinanceinstitute.com

5. Tax Time Trivia: Taxes can be a daunting topic for many people, but this quiz will help demystify the tax-filing process and test your knowledge of common tax deductions, credits, and deadlines. By understanding the basics of taxation, you can maximize your tax savings and avoid costly mistakes when filing your taxes.

6. Debt Management Dilemmas: Debt can be a significant obstacle to achieving your financial goals. This quiz will challenge your knowledge of effective debt management strategies, such as prioritizing high-interest debt, negotiating with creditors, and avoiding common debt traps. By mastering the art of debt management, you can take control of your finances and build a solid foundation for future financial success.

7. Financial Planning Fundamentals: This quiz will cover a broad range of financial planning topics, including goal setting, risk management, estate planning, and insurance. By testing your knowledge of these fundamental concepts, you can develop a comprehensive financial plan that aligns with your values, priorities, and long-term objectives.

Image Source: tiktok.com

8. Savings Smarts: Saving money is a key component of financial success, but it’s not always easy to maintain a consistent saving habit. This quiz will challenge your understanding of the importance of saving, different types of savings accounts, and strategies for increasing your savings rate. By mastering the art of saving, you can build a financial cushion for emergencies, investments, and long-term financial goals.

9. Investment Risk Assessment: Investing always involves some level of risk, but do you know how to assess and manage that risk effectively? This quiz will test your knowledge of different types of investment risks, risk tolerance, and strategies for mitigating risk in your investment portfolio. By understanding the dynamics of investment risk, you can make informed decisions that align with your financial objectives and risk tolerance.

10. Financial Literacy Facts: This quiz will challenge your knowledge of key financial literacy concepts, such as compound interest, inflation, diversification, and the time value of money. By mastering these fundamental principles, you can enhance your financial literacy skills and make smarter financial decisions that lead to long-term wealth accumulation and financial security.

Image Source: tiktok.com

So there you have it – the top 10 finance quizzes to boost your money smarts and challenge your financial IQ. Whether you’re a financial novice looking to learn the basics or a seasoned investor seeking to test your knowledge, these quizzes offer something for everyone. So why wait? Take the plunge, test your knowledge, and embark on a journey to financial empowerment and success!

Put Your Financial Knowledge to the Test – Are You Ready?

Are you ready to challenge your financial IQ? If you think you have a solid grasp on all things finance, it’s time to put your knowledge to the test with some fun and informative quizzes. Whether you’re a financial whiz or just looking to learn more about managing your money, these quizzes will help you sharpen your skills and expand your knowledge.

1. The Budgeting Challenge

Image Source: goalsetter.co

Do you know how to create a budget and stick to it? Test your budgeting skills with this quiz that will challenge you to allocate your money wisely and make smart financial decisions. From setting financial goals to tracking your expenses, this quiz will help you understand the importance of budgeting and how it can lead to financial success.

2. The Credit Score Quiz

Your credit score plays a crucial role in your financial health. Do you know what factors affect your credit score and how to improve it? Take this quiz to test your knowledge on credit scores, credit reports, and how to maintain a good credit standing. By understanding the ins and outs of credit scores, you can make better financial decisions and achieve your long-term financial goals.

Image Source: getsmarteraboutmoney.ca

3. The Investment IQ Test

Are you familiar with the different types of investments and how they work? Test your investment IQ with this quiz that covers topics such as stocks, bonds, mutual funds, and retirement accounts. By understanding the basics of investing, you can make informed decisions about where to put your money and how to grow your wealth over time.

4. The Debt Management Challenge

Debt can be a major obstacle to achieving financial stability. Do you know how to manage your debt effectively and avoid falling into a debt trap? Take this quiz to test your knowledge on debt management strategies, including how to prioritize your debts, negotiate with creditors, and avoid common debt pitfalls. By mastering the art of debt management, you can take control of your finances and pave the way to a debt-free future.

5. The Savings Quiz

Saving money is an essential part of building a strong financial foundation. Do you know the best ways to save money and reach your savings goals? Test your knowledge with this quiz that covers topics such as saving strategies, emergency funds, and retirement savings. By understanding the importance of saving and how to make it a priority in your financial plan, you can set yourself up for long-term financial success.

6. The Tax Knowledge Test

Taxes can be a complex and confusing aspect of personal finance. Do you know how to navigate the tax system and maximize your tax savings? Take this quiz to test your knowledge on tax deductions, credits, and strategies for minimizing your tax bill. By understanding the basics of taxation, you can make sure you’re not paying more in taxes than necessary and keep more of your hard-earned money in your pocket.

7. The Financial Literacy Quiz

How well do you understand the fundamentals of personal finance? Test your overall financial literacy with this quiz that covers a wide range of topics, including budgeting, saving, investing, debt management, and more. By assessing your financial knowledge across various areas, you can identify any gaps in your understanding and work towards improving your overall financial literacy.

8. The Retirement Planning Challenge

Are you prepared for retirement? Test your knowledge on retirement planning with this quiz that covers topics such as retirement savings accounts, Social Security benefits, and strategies for retiring comfortably. By understanding the key components of retirement planning, you can make sure you’re on track to achieve your retirement goals and enjoy a financially secure future.

9. The Financial Goal-Setting Quiz

Setting financial goals is an important step towards achieving financial success. Do you know how to set realistic and achievable goals that align with your values and priorities? Take this quiz to test your knowledge on goal-setting techniques, including how to create SMART goals and track your progress over time. By setting clear financial goals and developing a plan to achieve them, you can stay motivated and focused on your path to financial success.

10. The Personal Finance Master Quiz

Ready to put your financial knowledge to the ultimate test? Take this master quiz that combines questions from all the previous quizzes to challenge your overall financial IQ. From budgeting and saving to investing and retirement planning, this quiz will put your knowledge to the test and help you identify areas where you can continue to grow and improve your financial skills.

So, are you ready to challenge your financial IQ? Take these quizzes to test your knowledge, learn new skills, and improve your understanding of personal finance. Whether you’re a finance guru or just starting your financial journey, these quizzes will help you become more confident and capable in managing your money and achieving your financial goals.

Top 10 Finance Quizzes to Test Your Knowledge